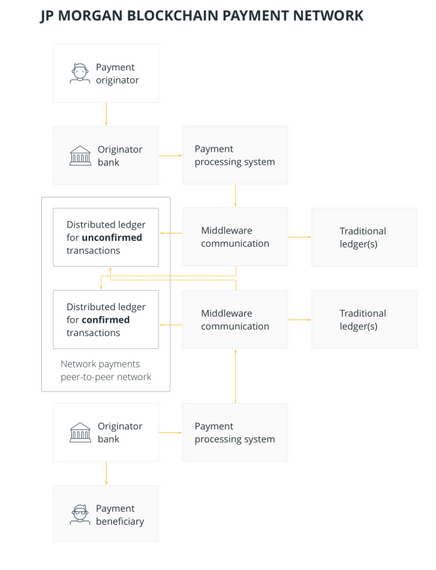

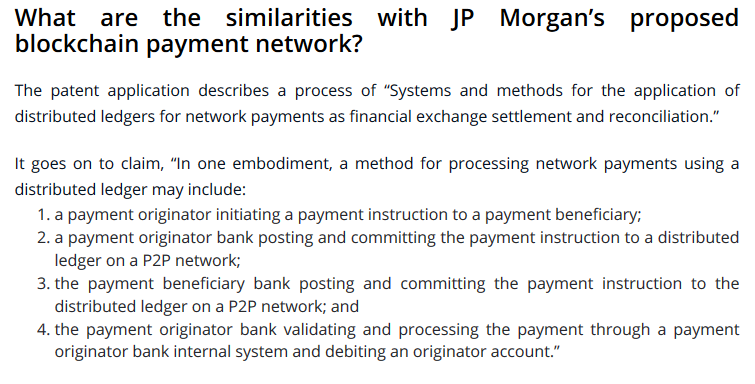

Ripple will face competition from JP Morgan following the latter's blockchain patent application for a P2P method of processing network payments using a distributed ledger, similar to Ripple's model of cross-border payments.

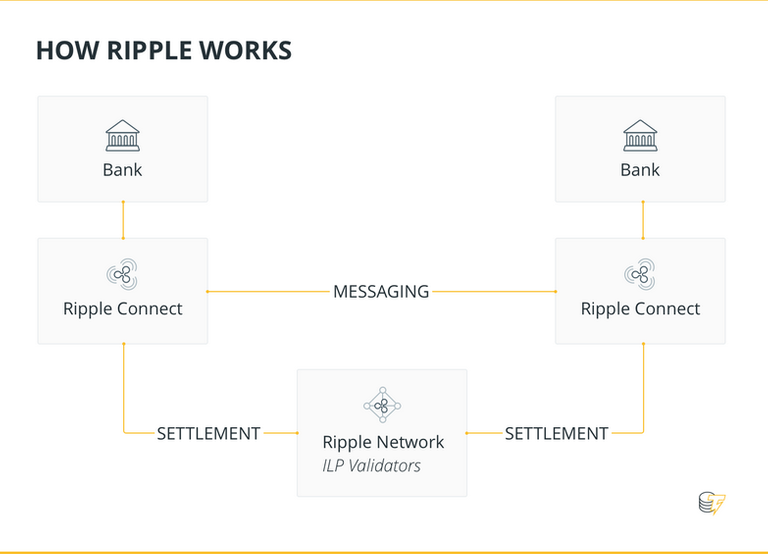

Ripple's model works by avoiding the traditional intermediaries required to execute cross-border payments, as in the Swift payments system, which takes a number of days to complete and is slower than getting on a plane and physically taking the money to the required destination, compared to Ripple's 5-step-process of payment, validation, followed by a cryptographic holding of funds, and lastly settlement and confirmation, which currently costs 0.00001 XRP for a typical transaction and takes seconds to complete;

The proposed JP Morgan method of P2P cross-border payments would also use messaging across a distributed ledger technology to eliminate the traditional intermediaries;

https://cointelegraph.com/news/why-jp-morgans-blockchain-patent-application-is-not-that-surprising

This move by JP Morgan has surprised many, who well remember Jamie Dimon's comments about Bitcoin being a fraud that would eventually collapse, but whilst JP Morgan may not be enthused by Bitcoin, they have been a part of the Ethereum Enterprise Alliance for some time and it is the obvious benefits of blockchain technology that appeals to JP Morgan.

In a recent JP Morgan publication, "J.P. Morgan Perspectives Decrypting Cryptocurrencies: Technology, Applications and Challenges", it was Ripple that was singled-out for special praise;

https://www.docdroid.net/6rtUfVX/jpm-decrypting-cryptocurrencies.pdf (Page 15)

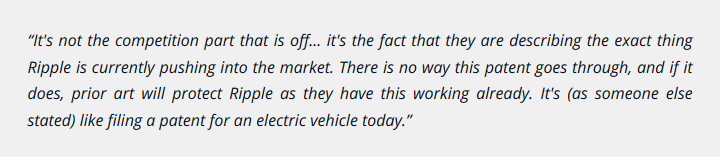

Should Ripple be worried that this fearsome competitor will walk over it, rather than around it? Some in the Ripple community seem unconcerned;

Bittorrent was a threat to Hollywood, but it resulted in Netflix because they made it easier. Bitcoin is a threat to the banks and the criminal central bankers, but now they will make things the way they should be or they will die like Blockbuster.

Lol they try to steal the plans of ripple >_< wont work there way too far ahead they have a product already.

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly & Featured Posts are voted every 2.4hrs

Join the Curation Team Here | Vote Resteemable for Witness