There are conspiracies going around that Ripple has been taken on by the banking community as a vehicle to unseat BTC in terms of marketing/branding and overall market cap.

As we saw, all of the banker controlled mainstream media were peddling the Ripple brand, and a lot of money was spent on fake videos of Coinbase back end, as well as hundreds of shills commenting on youtube with positive stuff about Ripple.

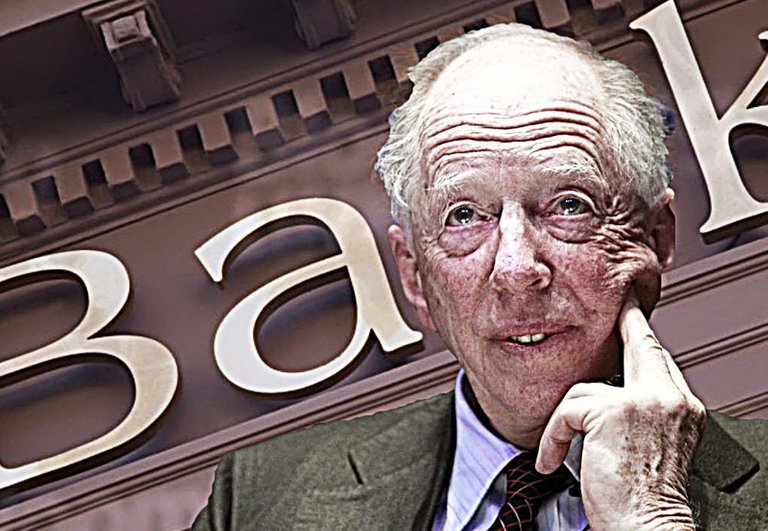

How many crypto investors are actually aware of how dangerous BTC (and other legitimate cryptocurrencies) is to the banking system? I see there are a lot of very naive guys who don't seem to understand the real ramifications of what crypto can do to the fiat banking system, and just how much power the Rothchilds have in the game. The Ripple fiasco is far from over and I imagine there will be plenty more similar occurrences over the next few months.

I'd love to hear your thoughts guys!

ps. China are scaling back their BTC mining meaning it's going to be more profitable for those mining in the US and Europe. How many of you guys are thinking about getting into mining or scaling up your current mining enterprises?

I can't speak for the other countries but if the large banking industries lose to much money and or wall street by huge amounts of money not going through their systems. The banks and wall street will lobby, and if the usa says no more cryptocoin to be traded in the usa well there will be a huge hit to the market actually any large country would cause huge spikes if they banned it.

I think the GOVs are watching and learning from it all and then once they have it down pack will convert to a block type currency and throw the hammer down on the competition.

It's a concern for sure. Personally I believe as independent creation of content within the digital domain grows (internet 3), world population will become more and more atomised and less dependent on being part of the herd. (notice how many of the alt media consumers have branched away from FB and moved to minds, steemit, etc) There will be a scenario in the future where more and more of our transactions are payments for digital services and often services will have been made to take advantage of decentralisation and the associated freedoms that come with it. So even if Bitcoin were banned, it may lose value in terms of trading for fiat, but once fiat crumbles completely (expected massive crash in 2018), many people will simply bypass the banks all together. Without taxes, governments cannot impose their laws and entire systems will flip (probably for the worse in the short term, but we'll have more freedom in the long run once we adjust and setting into the new system). At that point solid dependable currencies like BTC will thrive (if they can be scaled as we all hope it can be). As the ICO bubble bursts - too much money in it, too many opportunities for scams now so people will become caution nce the first huge scams start to happen in the coming months.

I see it as if any chain is connected to a fiat currency then the GOVs that own that currency be it whatever country, owns the chain. They can inflate it, crash it, make it volatile, all the while creating their own and pumping it slowly and making sure it does not crash.

If the chains stayed a barter chain and fiat currency was not attached it would work. Link it to fiat currency and the one with the most wins and that is the GOVs and bankers of the world in their respective currencies