Hello distinguished ladies and gentlemen, my name remain @Princessebi and as an insurance student, I will like to bring to your knowledge what credit insurance policy is.

Credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export creditagencues(Nigeria Export and Import Bank) to business entities wishing to protracted default(delay or failure in paymeny/delivery of goods by suppiers/customers due to insolvency or bankruptcy). This policy is purchased by businesses only to insure payment of cr sit extend by the business.

Credit insurance is a risk management tool that compensate policyholder when their clients fails to pay for goods and services as at when due.

Trade credit insurance Protects a seller business from the risk of buyer nonpayment, which may occur due to commercial or political risks. The commercial risk cover buyer insolvency and extended late payment and failure to pay within a fixed days of the fixed date.

Extended late payment is protracted default. Political risk involved the nonpayment on all export contract or project due to the government's actions. It includes intervention to prevent the transfer of payment, cancellation of license, acts of war or civil conflict or the government's enactment of laws or other measures(import duties; tarriffs, contraband - on importation and exportation of certain goods by government).

Methods Of Operation.

Credit insurance companies control their exposures through limited management as they provide cover for 60-120 days.

They gain better with the use of information technology for credit quality of policyholder and risks accumulation.

Reinsurance companies over 50% of the credit.

Premium rate is set at the inception of the policy.

It covers all the Commercial trade receivable under comprehensive policy.

It's policy are usually renewable.

The renewable policy is issued at a discount or 10-20% in non-claim.

Types Of Credit Insurance.

Single account policy.

This cover a size gle named account(commercial bank).Catastrophe policy.

This policy inures risk from catastrophic trade credit default. It carries larger premium(political risk).

Functions Of Credit Insurance.

The credit insurance gets the right of collection directly from the buyer who failed to pay the seller.

The credit insurer pays the amount of trade to seller if buyer fails to pay to the seller.

THANKS FOR READING AND GOD BLESS YOU ALL. PLEASE DO WELL TO UPVOTE, COMMENT AND RESTEEM.

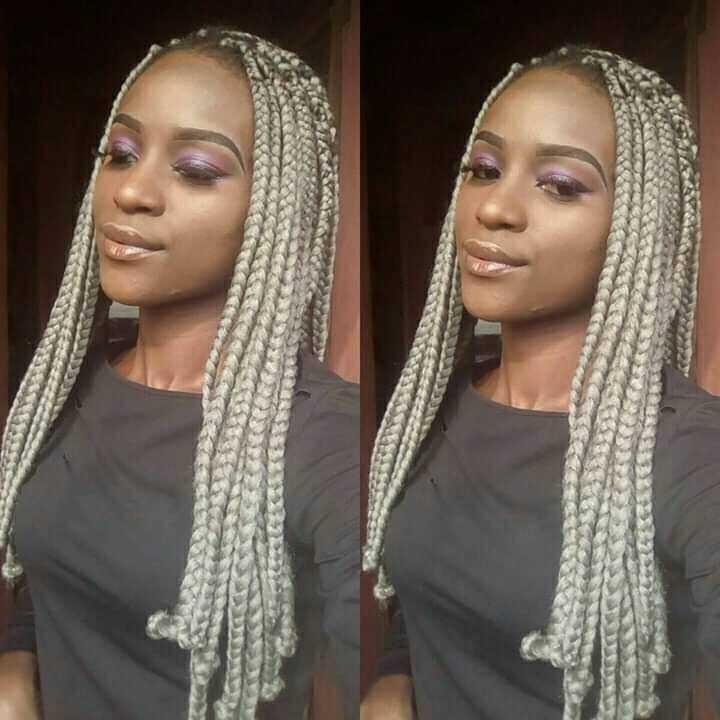

Thanks for the info. You look beautiful.