Is there ever a situation where a housing bubble can be beneficial to some citizens? Why or why not? @mackenziejones

An idea that I have recently been exposed to is the act of buying options in the market. This idea has really elucidated how large of a system the markets are, and how large scale profits can be with accurate predictions and a little bit of luck even while the market is tanking. I am still far from being an expert on these matters so rather than explaining these concepts for those who haven't been exposed to options, here are a few resources to check out:

Trillionaire Mindset

These guys explain options in a very entertaining, non-technical way starting at approx 14:40

Applying These Concepts to the Housing Market

Similar to the stock market, one can hedge themselves in positions that are betting on the housing market going down through put options.

In an account of housing futures and options, Dr. Elliot F. Eisenberg of the National Association of Home Builders writes, "investors (like builders described earlier) who expect residential real estate prices to decline will be able to sell futures or buy put options." This is a common maneuver by heavy investors and the home building industry to protect themselves against market bubbles and crashes.

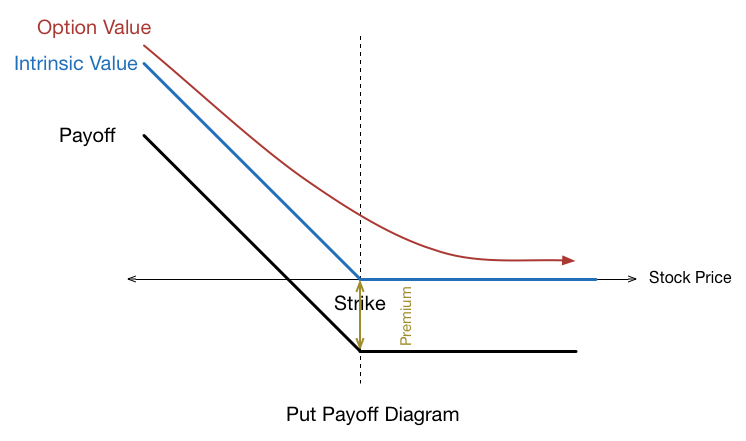

So what does this really mean that they are doing... Said investors are purchasing contracts that allow them the option or right to sell their their investments to protect them against buying at the peak of the market. The value of this option itself increases as the market value of the stock decreases (See Graph at the Bottom). For example, if an put option was written for a stock that is currently trading at $100 for the stock to be sold at $90, then an investor could sell said stock at $90 at anytime in which the contract was valid... even if the stock were to drop all the way down to say $50. In such a circumstance, the option would be worth $40 though it was purchased for a small premium. These options can be sold freely too, so one must not even own the stock to buy these options initially. Thus they can just buy the option, and then sell it to someone at the $40 price after the market downturn. This amounts to potentially huge amounts of profit when one is able to make accurate, time-bound predictions on the movement of the markets. I am far from an expert on these matters but I am sure there are a number of more mechanisms that one would be able to profit in times where the bubble pops. But, these put options, and shorting housing stocks, or the market by large are a couple ways that individuals may profit off of a housing bubble in a collapsing economy.