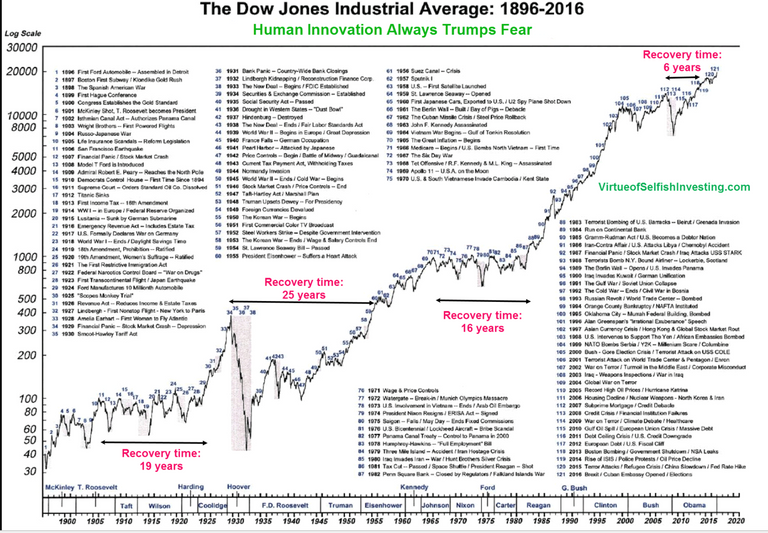

The thing to remember is that the stock market always rebounds and keeps on trucking.

This graph is well done and illustrates the example well.

I vividly remember the 2007ish crash and how my parents just stuck it out and kept their savings in the market. I wish they threw more money at it, but I lost that battle. They were back to even in a matter of years and have done well since then. So this little blip from the last couple days in both crypto and the stock market can cause a lot of anxiety. Seeing red (my +10.75% over the last 3 months turned to nothing in a big hurry) is no fun, but it just means there will be more green in the future.

This is just a perfect example of why you need to have diverse investments and plan it out so you don't lose your safety net if the market takes a dive. I assume a worst case scenario of losing 1/4 of my invested money before I get wise and either pull some out (only to be reinvested when I think it has reached the nadir of the dip) or reallocate to more stable investments.

On that note, please excuse me while I go transfer some more funds into Robinhood :)

Which you should be aware of. Free trades are awesome, especially for active traders who don't have a ton of money to throw at trade fees and no balance fees got me started with just $25 a while back.

Feel free to use this to sign up if you want a free stock (I get one too!): http://share.robinhood.com/chasek8

As usual, I'm not a financial advisor but this was all spelled out very clearly to me when I started working with my wife's years ago. He made me read a few books so I would understand the history and why he was suggesting what he was suggesting. Makes all of the ups and downs bearable.