Introduction

VSC is a complex project, with a vast reach encompassing a variety of topics within Hive. Our goal with these blog posts is to break down some of the different things that make our network work, and how we built it. Sprinkled throughout our weekly blog posts, you will find development updates, relevant topics, and other interesting topics within the blockchain space.

If you use Hive already, you may be familiar with its native assets, HIVE and HBD. In this post, we will break down what HBD is, how it works, why it is a superior stablecoin, plus why it is the right choice for VSC.

What is HBD and how does it work?

HBD stands for Hive Backed Dollar, and is the native stablecoin on the Hive blockchain. Unlike more well-known stablecoins, HBD is very unique in the way it functions, maintains its peg, and is distributed. Instead of being backed by a reserve of fiat currency or centralized authority, HBD is backed by HIVE tokens. It is kept the near-peg to 1 USD by Hive’s internal conversion mechanism, which allows 1 HBD to be converted to $1 worth of HIVE over 3.5 days, and vice versa. This is called the Hive Conversion mechanism. Not being backed by reserve fiat currencies comes with numerous advantages, such as being more transparent and easy to audit by anyone. The actual backing is locked HIVE cryptocurrency, and it has been stable for 8 years.

HBD is completely permission-less, meaning anyone can use it anywhere in the world without fear of their assets being frozen or seized. This means KYC (Know Your Customer) is not required for you to access this stablecoin, because it is fully decentralized. Unlike other algorithmic stablecoins that we have seen experience a “death spiral” (Terra Luna UST), HBD has substantial prevention mechanisms in place to prevent such an event from occurring, as explained below.

How is HBD created?

There are a few unique ways that HBD is created and distributed as a stablecoin. This makes its distribution more accessible to any user worldwide, not just those who can afford to buy it or pay expensive transaction fees. One of the distribution mechanisms is through Author rewards from creating content on Hive social media apps. Anyone can earn HBD by creating content, without any investment.

Another way that HBD makes it way into circulation is through interest paid out to users that place their HBD in Hive Savings. Hive Savings interest rate is determined by the Hive Witnesses, and is currently at 15% APR (subject to change). This interest earned can be claimed on monthly intervals, and any withdrawal of HBD is subject to a 3.5 day waiting period.

HBD is also created by the Hive Conversion mechanism, which helps with maintaining the peg around 1 USD. This operation is a collateral-based conversion. After initializing the conversion of the X amount of HIVE to HBD, the user gets Y amount of HBD immediately. The Y is equivalent of the value of X/2 of the HIVE. This conversion has a 5% fee which is burned in the process, as well.

In addition to the above, HBD is also paid out to the DHF (Decentralized Hive Fund) proposals that are approved by voters in the community. Anyone can create a proposal to the DHF and request funding for their project.

Maintaining the Peg

One of the most crucial parts of HBD’s stability lies within its hard-coded mechanisms that prevent any sort of huge price deviation. The Hive Conversion mechanism outlined above, combined with the debt-limitation mechanism, is extremely important when you consider what has happened to other stablecoins without similar measures.

In 2022, we saw the largest implosion of an algorithmic stablecoin in history. HBD is immune to a similar situation. To prevent a catastrophic decline similar to what occurred with Terra Luna’s UST, the blockchain enforces restrictions on the creation of HBD. For example, the HBD market cap must currently remain below 30% of the HIVE market cap and this cannot change.

This debt-limitation mechanism prevents any inflation and maintains the price around 1 USD at all times. When the debt ceiling is reached, no more HBD can be minted by the blockchain. This also works the other way around, ensuring that the HBD price remains as close to 1 USD as possible.

As mentioned above, the Hive Conversion mechanism between HIVE and HBD helps to secure the stability of HBD’s price. When a user converts HIVE to HBD, this happens over a 3.5 day period and has a 5% fee that is burned. When a user converts HBD to hive, it happens over 3.5 days as well, but with no fee.

Decentralization

HBD natively runs on the Hive blockchain, fully denominated and controlled by open source code without any issuer or centralized entity to manage it. Only the blockchain itself can issue HBD, which means that we can always be confident it was issued fairly and in accordance with its code limitations. This completely removes the “trust” factor you have to have when dealing with other stablecoins issued by centralized parties. This decentralized structure also ensures that no single entity has the power to blacklist accounts, freeze funds, or exert undue influence over the stablecoin. It is entirely open-source, meaning anyone can submit contributions to the code base.

HBD vs. other stablecoins

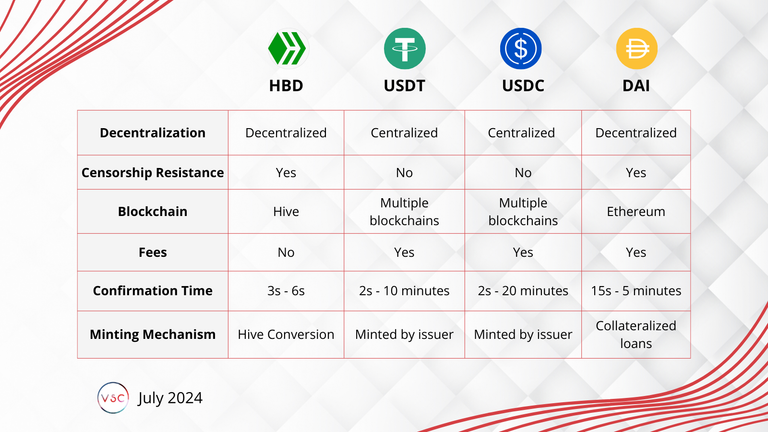

As you can see, in the graphic, HBD is superior in a lot of ways to the other mainstream options. With zero fees, super-fast confirmation times, and a long history of stability, it’s hard to even consider using something else. Stability and security are crucial factors that should always be considered when interacting with any cryptocurrency, as well. Stablecoins are no different, and HBD has those concerns covered.

All HBD transactions have one-block irreversibility in comparison to most other options. USDC and USDT are supported on many different chains, all with different confirmation times creating a very inconsistent experience. DAI is on Ethereum, which can also have very inconsistent confirmation times and high fees dependent upon the state of the blockchain.

HBD’s trust-less nature allows anyone to audit the process in which HBD is kept secure. From the minting mechanism to the debt ratio to HIVE, everything is transparent for the world to see. It’s all on the blockchain, which prevents any kind of fraud or manipulation of the data. The same things couldn’t be said about the majority of stablecoins, because you have to trust that the entity is transparent with their collateral assets.

In most cases, you have to trust that the company behind them has reserves to back their stablecoins. These entities could face regulatory scrutiny that HBD is immune to because of its decentralized structure. Another thing to think about is, who owns the smart contract that is able to mint these assets, because they could have the ability to freeze them all or blacklist your account.

This is not the case with DAI, however, as it functions as an over-collateralized asset backed by cryptocurrencies. DAI uses smart contracts and economic incentives within the MakerDAO system to maintain its peg. While it is decentralized and has a different backing mechanism than USDT or USDC, it is still inferior to HBD in the sense of usability.

Conclusion

As VSC is preparing to pave the way for DeFi on Hive, choosing the right stablecoin is a very important process. We had to take in consideration the most popular stablecoins of the market and the result is clear. HBD is the perfect match for us for a number of reasons outlined above such as:

- Trust-less nature

- Fast + zero fee transactions

- Can be used to create trading pairs similar to USDC/USDT

- Safe and secure to use

- Provides a 15% APR (currently).

- Truly decentralized

All of that being said, there are quite a few different options for stablecoins out there, but it’s clear that HBD is the best option on the market. HBD is the one for us and it will be a key part of the VSC ecosystem. You might now be asking yourself how you’ll be able to use HBD on VSC.

Nice and easy to understand explanation. The comparison of the stablecoins infographic is very helpful in explaining to others the advantages of HBD. The upper limit on the confirmation time alone should be enough to show how good HBD is as a payment option.

We agree as well!

A very interesting and complete explanation about the stablecoin of the chain, I took the opportunity to share it:

Stay !ALIVE

!BBH !PGM

Good idea to use HBD. It has been very stable for years now.

The witnesses did just drop the interest rate to 15% though.

This is interesting and I have learned so much in this piece. HBD has been stable since I knew Hive. The Blockchain is working well to see HBD as a stablecoin not fluctuating as Hive. Thank you for sharing with us.

Congratulations @vsc.network! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 700 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPHive Backed Dollar #feelsgoodman !BBH !DOOK

@vsc.network! @pepetoken likes your content! so I just sent 1 BBH to your account on behalf of @pepetoken. (7/100)

(html comment removed: )

)

This is an explanation I have been waiting for. It's cool.

So glad you're supporting HBD.

Excellent post, however, UST lost courage due to the high offer at a difficult time for the project. If users massively sell HBD to HIVE, what prevents demand from paying less than the parity, creating an imbalance in the 1:1 parity?

The conversion mechanism prevents excess HBD from being in circulation and corrects the price accordingly.

15%

It was 20% at time of writing. We will correct

Hello vsc.network!

It's nice to let you know that your article won 🥇 place.

Your post is among the best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by szejq

You and your curator receive 0.0448 Lu (Lucoin) investment token and a 16.17% share of the reward from Daily Report 386. Additionally, you can also receive a unique LUGOLD token for taking 1st place. All you need to do is reblog this report of the day with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by @szejq

STOPor to resume write a wordSTART