Pump&dump (P&D) schemes are a common occurrence in the cryptocurrency world.

They most often happen in Telegram or Discord (chat programs) groups in which several thousand people buy a specific shitcoin (a crypto token without a value or future) at the same time in an attempt to artificially inflate its value. This value increase is called the pump while the selling of this now expensive token to naïve bystanders is the dump phase.

In this article, we’ll take a look at the anatomy of one such smaller P&D group.

Group

New groups are popping up daily, but they’re rarely legit. Most often they’re actually outer rims of already established groups – a secondary layer more intended for the dumping phase.

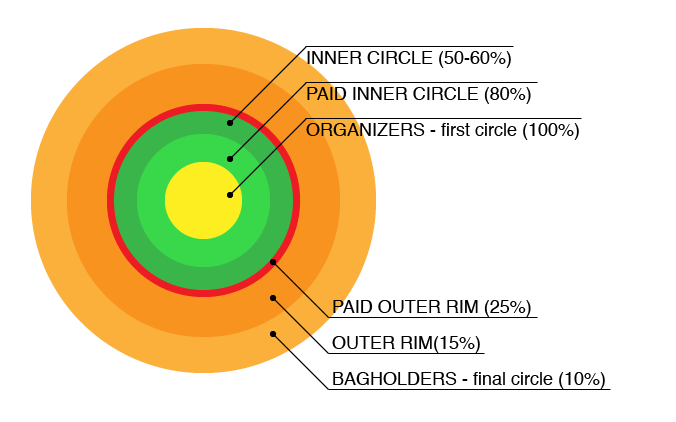

The simplified layout of a P&D group

Members of the core layer agree on a coin and inform the outer rim about it. Even inside the core layer there are often several levels – for example, those who paid entry (averaging 1 – 10 BTC) generally get their information 5-6 seconds before others. That’s plenty of time to buy the coin at a lower price. Others join in afterwards and only 10-30 seconds later do the outer rims find out which coin was picked and go into hardcore shopping.

Quality core layers accepting new members today are hard to find and expensive to join (north of 15 BTC), and the groups people join today are generally second or third layer groups. The percentage of successful trades decreases as the circle you join is further away from the center.

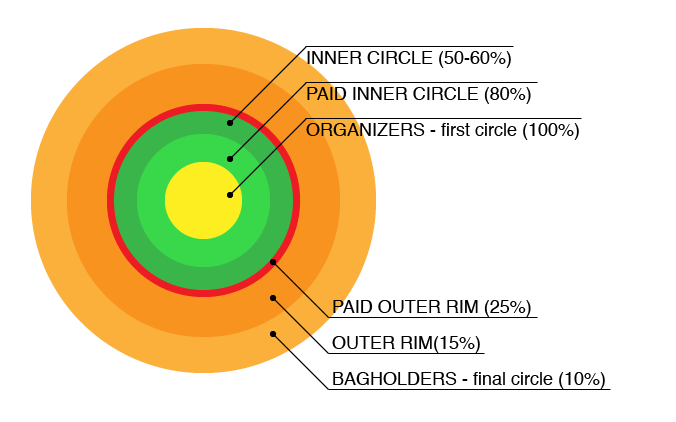

More realistic depiction of a P&D group

Organizers are always successful because they’re the ones who decide which coin is next and can buy it well in advance – sometimes days to hide their trail. The very next layer already has a lower chance of success. Despite the fact that they paid for access to information, technical difficulties can happen and since the information can’t take too long to reach the outer rims otherwise everything falls apart, a simple glitch in the internet connectivity or the site in question can be enough to miss the train. The next layer is even less successful than the one before it – at this point, it can already be obvious which coin is being pumped judging by the graphs, and sometimes these outer rims use such information to buy before those in internal circles do, thereby beating them to a better price. The situation keeps resolving until it reaches the outermost layers.

Phase 1: Announcement

How often the pumps happen depends on the group. There are some who pump several times per day, and others who pump once per week or once per month even. The group we’ve been watching for this post is relatively new and does it once per day on average.

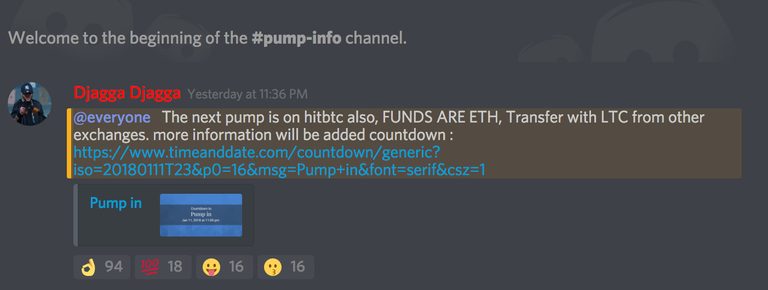

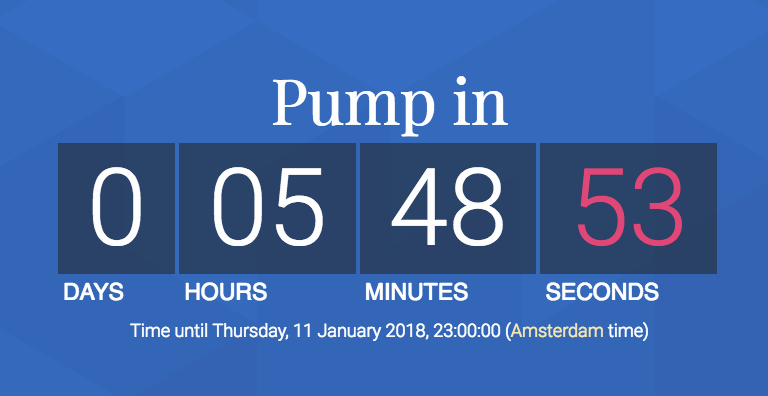

In phase 1, the time of the pump is announced, often with the help of a link which leads to a countdown to accommodate people from different time zones.

The pump time announcement in a Discord chatroom

Pump countdown

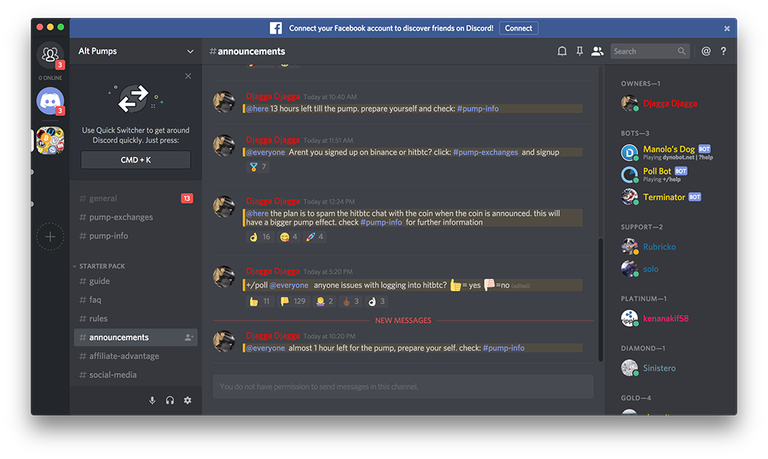

The exchange on which the pump will happen is also selected. Tokens susceptible to P&D are rarely listed on reputable exchanges, so these schemes will usually happen on HitBTC, Cryptopia, Coinexchange, and similar smaller exchanges.

Exchange is selected

Instructions are provided

It’s important to note that no one but the organizers knows which coin is going to be pumped.

Phase 2: Countdown and Preparations

Once the countdown begins, participants prepare their accounts by loading them up. The accounts are often loaded up only with enough funds to click “max” in the UI so the purchase goes through faster at market value.

Reacting quickly is very important so other browsers and programs are generally turned off and the internet connection is freed up as much as possible (no torrents or streaming) to make response times fast. Technical problems can create bagholders.

Those most experienced have trading bots ready (scripts for programmatic purchasing without the need for a browser). Once the coin is known, they type in its symbol and the bot takes over, immediately also setting up a limit sell order for 150% – 200% of the purchase price, all within a single second.

Phase 3: Pump

After the coin has been picked, the organizers buy enough of the coin to take advantage of the price spike, but not so much as to move the price themselves. If they moved the market with their own buys, this would get them accused of a pre-pump, causing them to lose followers. Such a move usually gets executed when the group is at its death throes and most participants have lost trust in the administrators. When only the most naïve remain – those who are unable to recognize pre-pumps – that’s when this last trick is executed to milk the members one last time.

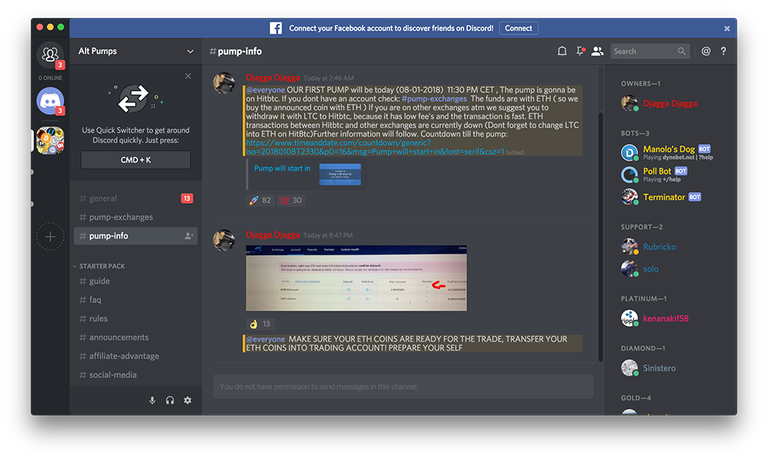

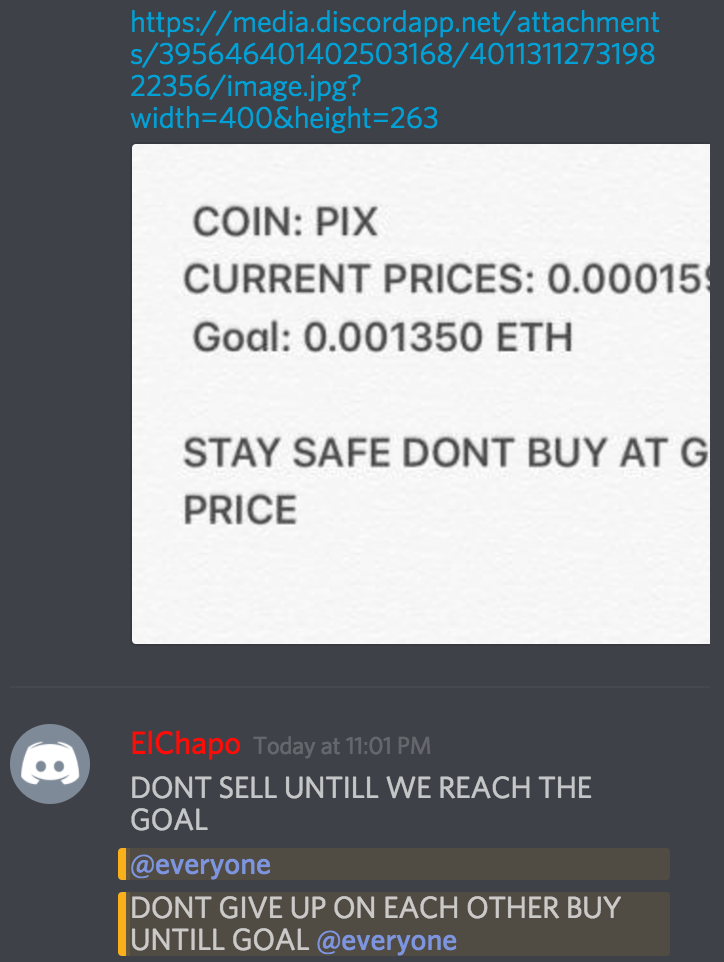

After filling their bags, the admins release the coin’s information to the rest.

The coin is picked

Some use bots, some go manual, but everyone then loads up on the same coin, making it more expensive.

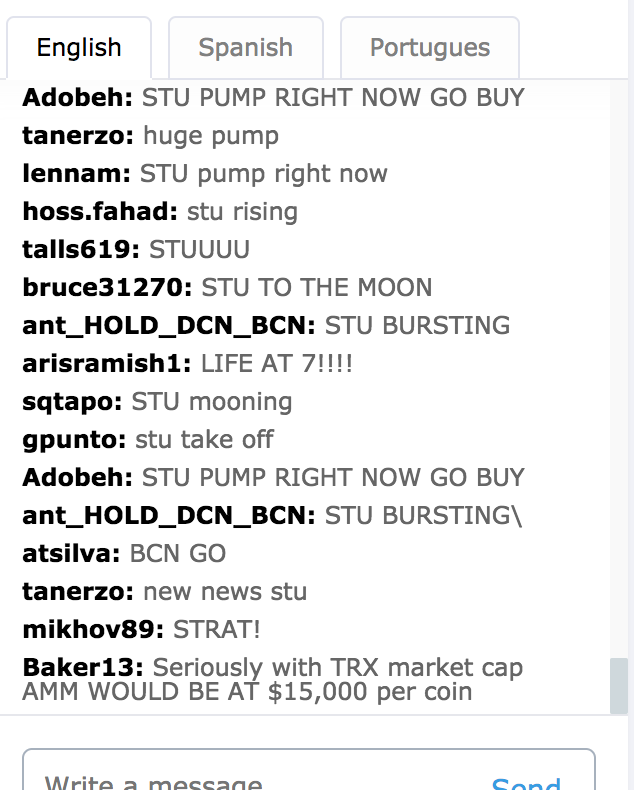

Those who completed a purchase then move into hype phase where all chat channels are spammed with the coin, urging bystanders to buy it as well.

Pumping in the exchange's trollbox

Phase 4: Dump

The purpose of this phase is to get innocent bystanders to buy into the coin because of its rapid rise (which is, by now, visible on the graph).

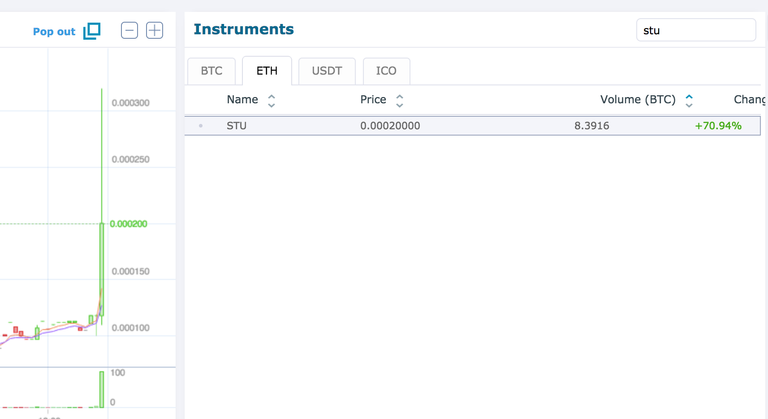

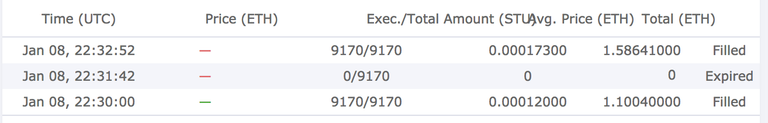

Price spike visible on the graph

Because of a rapid sell-off by the members who bought early, the dump lowers the price of the coin to its initial value, sometimes lower. In rare cases, the pump will actually permanently raise a coin’s price by 10-15%, depending on the coin.

A successfully pumped and dumped coin - sold at a higher than purchase price

Professional Bagholders

When the organizers buy a coin before telling everyone, that’s what’s called a pre-pump. For example, in the group we were watching for this post, the OAX coin was announced with a pump start due at 23:00. But if we look at its graph, the pre-pump is obvious:

Pre-pump

The graph clearly shows the organizers having loaded up on the coin 20 minutes earlier. This allowed them to start dumping on their group’s members immediately on start time at 23:00. The reason they were able to move the market by themselves was because this coin had a total trading volume of 2 Eth on HitBTC, which meant even half an ether could move the needle.

Many people simply don’t know that during a group’s pump phase the organizers are doing their own pump in the group itself in order to get the members to buy the coin from them.

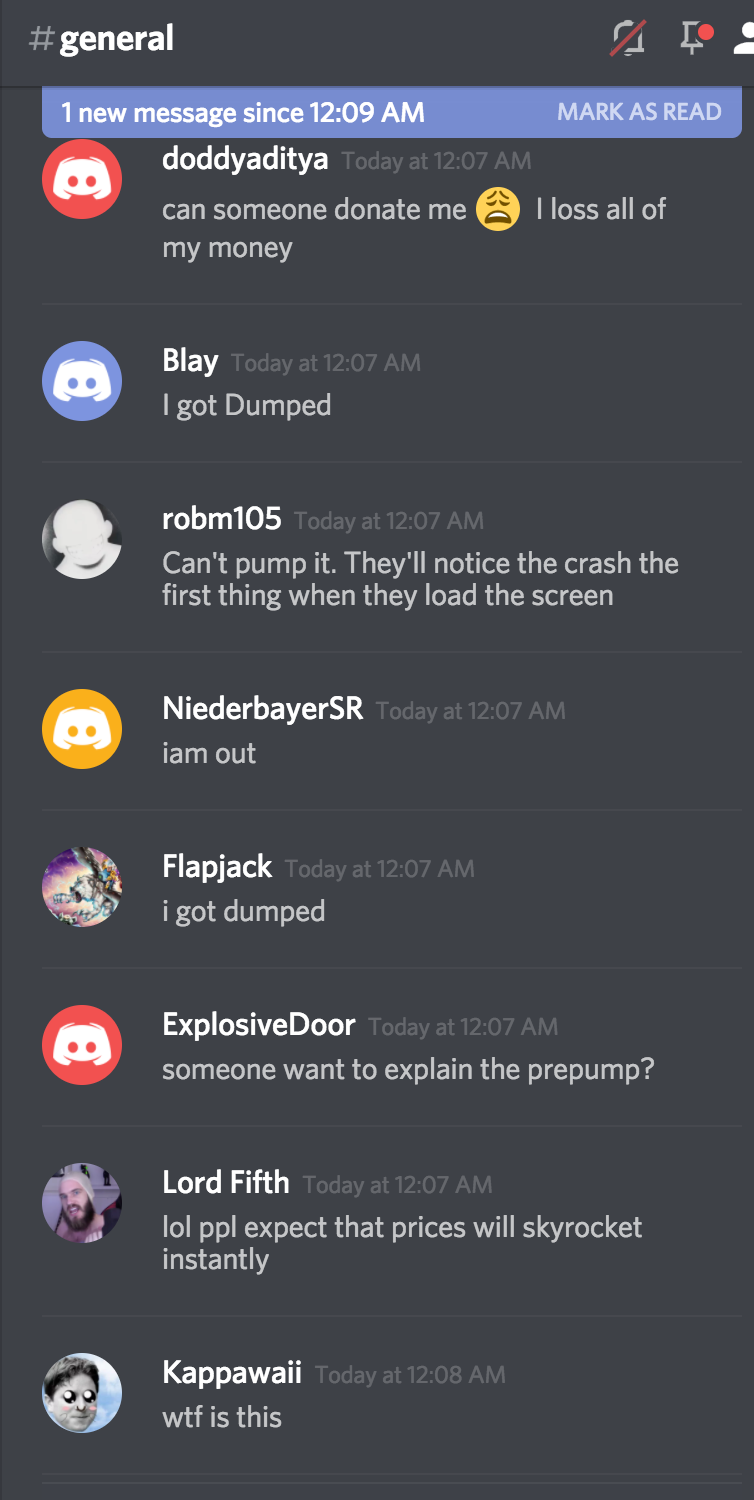

If one of the members gets lucky and sells it forward for even more, that member is successful and has good things to say about the group, bringing in new members. Those who fail usually leave the group (so there is little to no negative feedback in such groups after a while), but only after begging and complaining about losses first:

These participants are called professional bagholders because they enter the market with amounts they cannot afford to lose and only want a quick buck – no research, no effort, no thinking, not even watching the first 4-5 pumps to see what the group is like.

The vast majority of P&D groups you get invited in by someone is of this type – a fraud designed with the express purpose of presenting the first pump as successful and legit and whetting people’s appetites, and then using future pumps to milk the members dry. It is very easy to make new groups – if you’re not the organizer, you’re expendable to the group.

Other P&D Types

Other than these P&D groups, there are other P&D methods out there. One of the more popular ones is celebrity endorsements/pumps. As celebs usually have many hundreds of thousands of followers, celebrities make good “professional bagholder factories”. For example, John McAfee (500k followers on Twitter) is very open to such schemes. Here’s how it works:

Organizers pick a coin and buy lots of it.

McAfee is contacted about it and paid 25 BTC (his current known fee).

McAfee also buys the coin, and then promotes it. The pump begins.

McAfee and the organizers dump the coin on the followers.

This is worth it only when the potential earnings are bigger than the expense – 25 BTC isn’t cheap after all. This is why this is usually done to long-term pumps (like Verge) or bigger coins (like SiaCoin or Stellar) which have enough of a market cap to not be completely obliterated by buy and sell orders from the organizers and McAfee alone. Schemes like these are very risky, but can be very profitable.

Conclusion

In the traditional investment world, P&D schemes are illegal. Because of a lack of regulation in the cryptocurrency space, they’re still a very appealing way of earning a lot of money quickly. There are various opinions about them – those who fail to use them properly and lose money usually label them as immoral or criminal, while those who are in the midst of them and find great success usually claim that they’re a great way of clearing the “dumb money” out of the market, or an awareness mechanism about the crypto bubble, or something else.

Objectively, those schemes are no more immoral than gambling or lottery ads on TV and online – everything involving money has its risks and without a great amount of research (technical investments), patience (HODL investment), or good contacts (P&D), there can be no profit.

Disclaimer: Bitfalls do not participate in P&D schemes other than in a watch-only capacity. We are primarily long-term technical investors. The participation in this group was for public research purposes only.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitfalls.com/2018/01/12/anatomy-pump-dump-group/

Descriptive and informational post, upvoted and followed, vincentb!