Personally, I like to think of bitcoin as an old dog.

Or this...

First movers or fast followers — which has the advantage? When bitcoin was first proposed in 2008 it was revolutionary. For the first time people could trust in a currency without a bank or government behind it.

Fast forward to 2018 and bitcoin is well above 10,000 USD a coin. Over 87% of people have heard of bitcoin. We’ve crossed the chasm.

But bitcoin is almost a decade old. When bitcoin was conceived the app store was only just getting off the ground and portable DVD players were still used on long car trips. The technology of 2018 is leaps and bounds ahead of where it was a decade ago. Crypto technology is no exception.

There are now over 1500 cryptocurrencies newer than bitcoin. These coins are more efficient, faster, and offer features that bitcoin lacks. In the past month bitcoin’s percentage of the market has fallen from 56% to 33%.

This is not the first time first movers have been threatened by newer technologies. Altavista gave way to google. Myspace fell to Facebook. There is a history of first movers losing to innovative fast followers.

Research shows that the first mover in a space is 6 times more likely to fail then the ventures that follow it.

Bitcoin has done the difficult work of trail-blazing, and now the floodgates are open for a slew of modern competitors.

So if bitcoin is just the start of cryptocurrencies, what comes next? To understand what technologies could surpass bitcoin we need to understand where it is currently falling short.

Bitcoin and its blockchain have serious flaws

1.Transaction speed

The bitcoin network can only handle 7 transactions a section. That means only 7 people worldwide can buy or sell using bitcoin every second. For comparison visa handles 24,000 transactions a second. Low transaction speed limits bitcoin’s effectiveness as a currency. It also hurts those who see bitcoin as a store of value. Exchanges go down and funds are stuck waiting hours (or even days) when too many people buy or sell bitcoin.

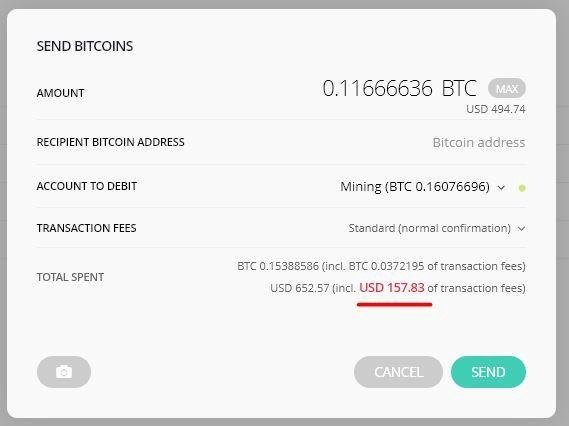

Network congestion leads to extraordinarily high fees. Fees at the end of December were $37 a transaction, more than the cost of a wire transfer.

2.Lack of privacy

Are you comfortable with the whole world knowing the value of your bank account? What about the whole world knowing where you send funds and who you receive them from? Bitcoin wallets are tied to address hashes (random sequences of letters). Once the owner of a wallet is identified all of their previous transactions and all of their future transactions are visible to anyone who downloads bitcoin’s ledger. This history can never be deleted or changed.

3.Programmability

Bitcoin was designed as a digital currency. The technology allows only basic programming. This prevents bitcoin from being used in more complicated situations like for smart automatically executing contracts. Think of it like a calculator compared to a computer. Programmable blockchains (Ethereum being the most widely known example) have the potential to massively disrupt a wide array of sectors.

What do you think of bitcoin?

Leave comment with your opinion.

source and full article at: https://hackernoon.com/bitcoin-is-outdated-tech-these-3-alternatives-should-be-on-your-radar-57cf806d34df

This post has received a 0.39 % upvote from @booster thanks to: @domisun.