Problem

Stable coins have huge value to help grow the crypto universe. There are now many stable coins that are available. Some are backed by onchain crypto reserves e.g. DAI, SBD, bitUSD etc and others are backed by reserves in external places e.g. USDT.

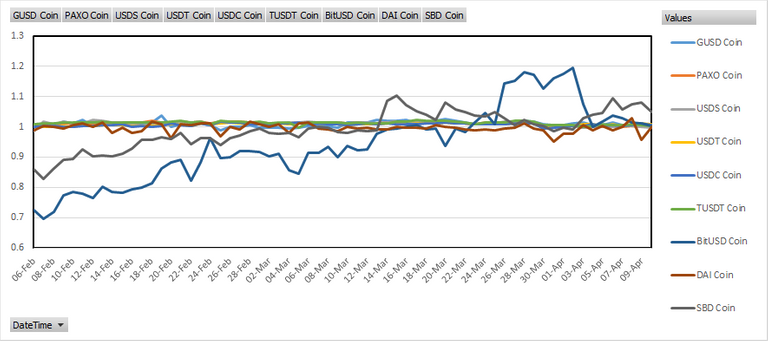

The prices for these stable coins are expected to be stable but do fluctuate as can be seen in below picture:

Crypto backed stable coins e.g. DAI, SBD, and bitUSD have large variations upto 30-50% from their target value of 1 USD. Although, others are stable but do vary between +/-5% and sometimes even upto +/-15%.

Therefore, none of the stable coin project, so far, provides perfect stability. Also by holding these coins holders wealth is continuously eroded due to inflation associated with USD.

USDONE Concept

USDONE will always be pegged at 1 to 1 with USD. In addition to that USDONE holders will receive monthly dividend at the rate of 0.565% which is equal to 7% annual on their holdings. The dividends will be paid out on 1st of each month to USDONE token holders on that date.

Where To Buy and Sell USDONE

USDONE is a token on Steem Engine. Currently you can buy it only against SteemP. SteemP is pegged Steem on Steem Engine Platform. In future we will add other options.

Sell price will always be less than 1.05 and buy price will always be greater than 0.95 from USDONE. Your order will be executed as and when your quote is within these prescribed limits of USDONE. That is equal to 0-5% fee for conversion from SteemP to USDONE and USDONE to SteemP.

The buy/sell spread by USDONE will be continuously adjusted depending on the cost of stabilization, demand, and supply but will always be within 0-10%. This can be considered as stabilization fee similar to maker/dai stability fee which is constant and much higher with current rate of 14.5%.

What We Do To Maintain USDONE Stability

The Steem that you pay to buy USDONE are deployed in below activities to meet the above promised obligations:

- Other stable currencies

- Steem delegations

- On blockchain fixed rate lending

- External fixed rate lending

Obligation Fulfillment

USDONE account on Steem Engine will always remain funded with sufficient SteemP to meet the demands of liquidity requirements.

Why Would You Want To Use It

- One can use SBD/Steem conversion but SBD is not a very stable coin with risk of losing upto 50% wealth

- bitUSD/Steem is also low liquidity market and again bitUSD is not a stable coin with risk of losing upto 50% wealth

- Other stable coin/Steem markets are available on centralized exchanges but there you lose the control of your Steem holdings

- Centralized exchanges charge unreasonable large minimum withdrawal fees. For smaller value transactions this is very painful.

- SteemEngine is DEX and you control your holdings with your Steem Keys all the time.

- In addition to stability it also offers protection against inflation related devaluation of USD

- This is the stability solution for steemians, by steemians, and within Steem ecosystem.

Links

Link to Steem Engine for USDONE

Link to Steem Wallet for USDONE

Link to Ethereum Wallet for USDONE

Link to Tron Wallet for USDONE

We also invite your feedback and comments. The best suggestions will be rewarded with USDONE tokens.

Additional Ideas From Community

Since we launched the token, below is the list of ideas provided by community in comments that will be implemented:

- Audit Report - An audit report with proof for onchain assets holding will be published regularly. The Frequency will be optimized so that it does not increase cost of storing in one place and managing the stability, return, and liquidity obligations.

- Delegator Rewards - Under consideration.

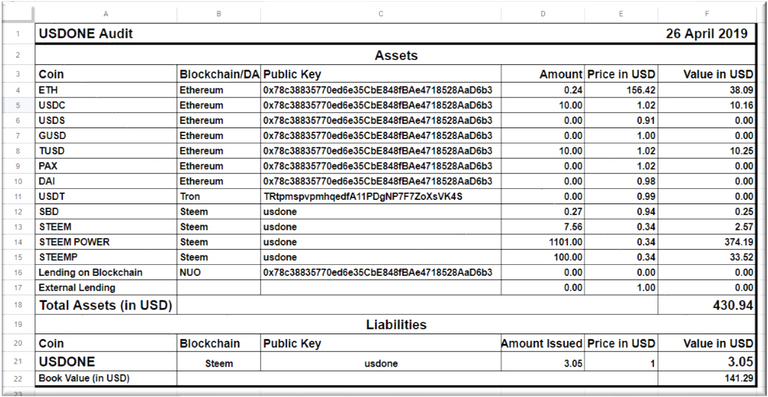

Audit Report

Below is our audit report produced on 26th April and added here on 26th April itself:

If buy price will always be 1.05 and sell price will always be 0.95 on S-engine market how are we expected to trade it as 1 USD to people that aren't you? Or am I missing something here?

These ask/bid spread will be provided and maintained by USDONE on SteemEngine Exchange as buyer and seller of last resort but you all are fee to trade it in between. Hope that makes it clear.

And this max 5% difference is given back in the form of 7% dividend i.e. 5% fee plus 2 percent for inflation.

The spread will be continuously adjusted - so it can be much less on average.

So basically the value will swing between these two right? Well, at least it's kinda guaranteed that the value won't go above 1.05 or below 0.95

#sbi-skip

will be range bound between these two limits. And the spread will be continuously adjusted - so it can be much less on average.

You just planted 0.10 tree(s)!

Thanks to @fuadsm

We have planted already

7997.77 trees

out of 1,000,000

Let's save and restore Abongphen Highland Forest

in Cameroonian village Kedjom-Keku!

Plant trees with @treeplanter and get paid for it!

My Steem Power = 20858.67

Thanks a lot!

@martin.mikes coordinator of @kedjom-keku

protects from usd inflation by always being worth 1USD = the value of 1 dollar no matter what that dollar is worth ?

if the token is 1USD and 1USD is 1.1 euro then it will be worth 1.4 euro and still 1USD if it went back to before lehmanns ?

somewhat ...

?

Good to see more stable coins being made. With how volatile regular cryptos are, stable coins give traders less volatile options.

At some point everybody wants stable coins to protect wealth in volatile times.

This make a good value in steemit blockchain . Wish to get some free.

Posted using Partiko Android

thanx for your gr8 support.

Which economy or what kind of wealth back USDONE?

The Steem deposited with us against the Token -will be invested in below activities to meet the obligations:

Other stable currencies

Steem delegations

External fixed rate lending

Would pretty cool if we can delegate and get the token. I imagine leveraging Smartsteem/Minnowsteem can help you earn from the delegations...

At present receiving delegations is not our priority as we can have enough bandwidth to support our transactions on the blockchain. But may consider in future if there is lot of demand.

Again thanks for your nice advice. You get 0.5 Token again from us.

Was meaning like proxy voting selling ie you sell votes and give delegators stablecoins...

could you please provide more detail about it with examples. seems interesting

You know how some Steem projects offer SMT in exchange for delegations? I was thinking the same for you. But you could leverage Smartsteem/Minnowbooster to sell the votes via the delegations to gain liquid money to back the currency. According to Smart Steem: 200 Steempower 0.085 STEEM(+ curation) which is about 0.04 US daily. Weekly about 28 cent. And you can give the Stable coin weekly as well in turn for delegations. And with the 5% conversion "stability fees" you give delegators 0.014 usdone.

Probably some issues as you might have to cap the delegation number unless your ok with giving less than a penny tokens(which could show of the power of the token use but that iffy).

@usdone, Specially the Dividend system can play the prominent role and will attract more users. Good wishes from my side team.

Thank you to provide positive feedback.

Welcome.

Another Stable Coin crypto dont need stable coins anymore.

This will be useful to the community. Lets work together.

مرحبا ايها الشعب العظيم انا خالد جديد في ستيميت ارجو ان تدعموني

Intersting idea...

How about weekly "audit"/ "proof of reserve of the backing" of the coins.

This is good idea. We have it in our plans. Frequency will be optimized so that it does not increase cost of storing in one place and managing the stability, return, and liquidity obligations.

But you deserve the token from us to provide genuine advice.

Woh cool thanks!

No problem. It a very cool thing to see Steem have now. I would recommend you guys get a domain(which I also assume your working on?) to market the new token. The idea is very good but risky. I'll see after the reports and assume others too before investing into it. Is the team planning on going public? That would bring more trust to the stablecoin. But nonetheless wish you luck :)

We must trust in blockchain.

But honestly the commented I mentioned was done to negate Tether criticisms. Yes you can trust the blockchain but the funds are still mainly controlled by the account holders so still single point of failure...

You are right. Periodic audit of fund holdings on blockchain should help reduce the concern.

And ourselves :P

Thank you for sharing this valuable article. Although convince people to buy new token is hard I believe this project. Good luck USDONE.

Posted using Partiko Android

Thank you. We hope to serve the community. There are risks but we will work hard to manage them.

@usdone purchased a 17.93% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com

Congratulations @usdone! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

You got a 42.59% upvote from @joeparys! Thank you for your support of our services. To continue your support, please follow and delegate Steem power to @joeparys for daily steem and steem dollar payouts!