Real estate prices have skyrocketed in some cities, leaving reality in the dust. There hasn’t been this euphoria in the real estate market since the subprime crisis. Today we witness limited pockets absolutely annihilating any precious assumption of how high prices can go. The only question is, who can afford these prices?

LOOK THROUGH MY BOOKS!: http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

BITCOIN: 1MbAUXsHa8XRFMHjGurd7L5nRDYJYMQQmq

ETHEREUM: 0xece0Dd6D0b4617A8D94cff634C64155bb1cD8C2C

LITECOIN: LWh6fji4WrJT7FAbFvFSZ9jVNCgVM3dHod

DASH: Xj9RXrvhXbaL3prMDvdzAxM8gDB2vDiZrh

MONERO:47q5qDPkDBLRadwcSXDsri3PNniYRYY1HYAhidXWAg8xXHFFZHFi7i9GwwmZN9J5CJd8exT4WARpg2asCzkuoTmd3dfcXr6

STEEMIT: https://steemit.com/@themoneygps

DTUBE:

T-SHIRTS: http://themoneygps.com/store

PROTECT YOUR CRYPTO WITH THE TREZOR: https://goo.gl/keoFei

Sources Used in This Video:

https://goo.gl/UpprQe

salary-need-to-afford-home-2018-8426.png (1188×875)

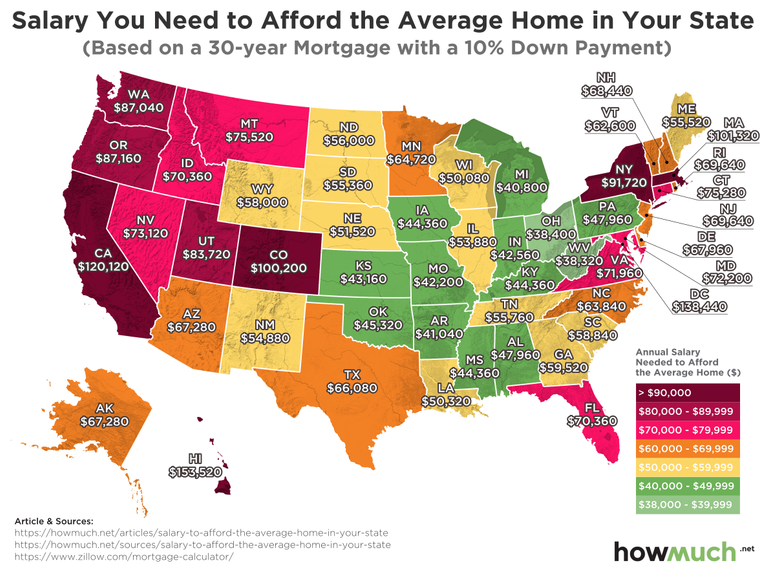

How Much Income You Need to Afford the Average Home in Every State in 2018

https://howmuch.net/articles/salary-to-afford-the-average-home-in-your-state

Average_30-Year_Mortgage-Rates.jpg (835×625)

Housing-Affordability-Trends_SF-Only_bar-chart.jpg (835×625)

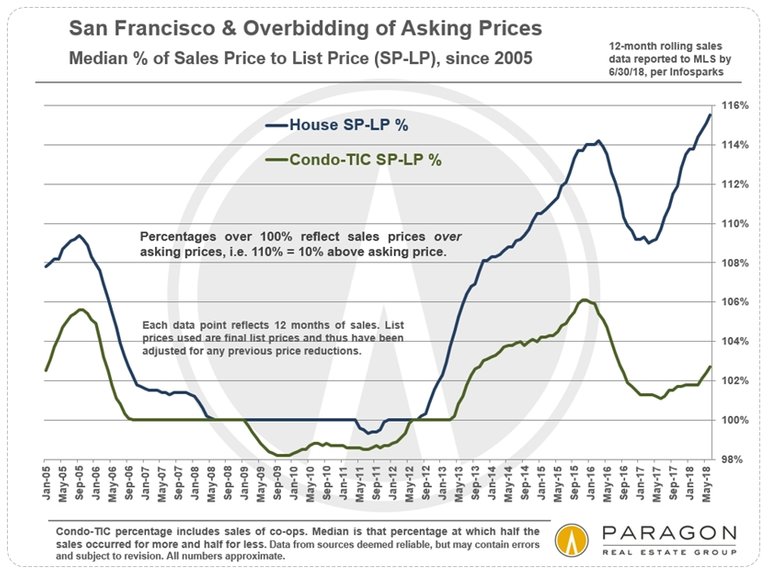

SP-final-LP_Percentage_MEDIAN_12-Month-Rolling_SFD-Condo-sep_since-2005.jpg (835×623)

Employment-Bay-Area_6-Counties_since-2000.jpg (835×626)

Population_SF_METRO-AREA_by_year_since-2010_census.jpg (835×626)

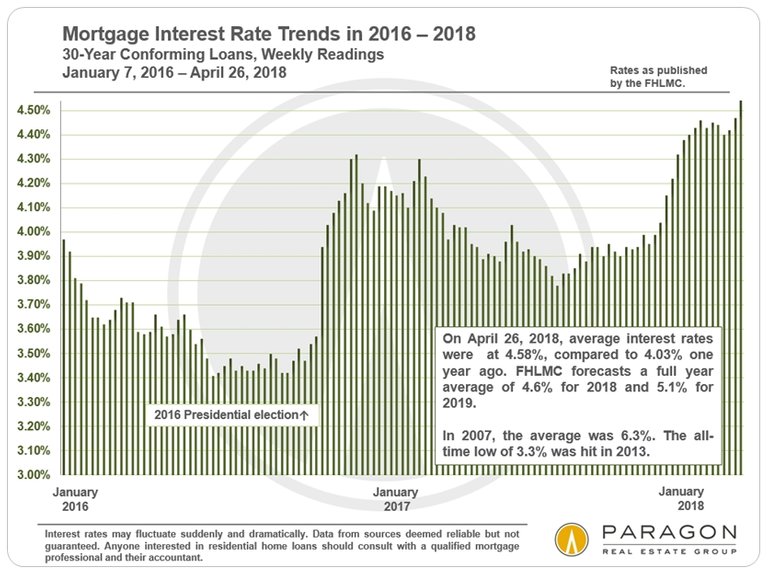

Short-term_30-Year-Rate-Trends.jpg (835×625)

Median-Price_Sep-SFD-Condo_by-Quarter_Short-termV2.jpg (835×625)

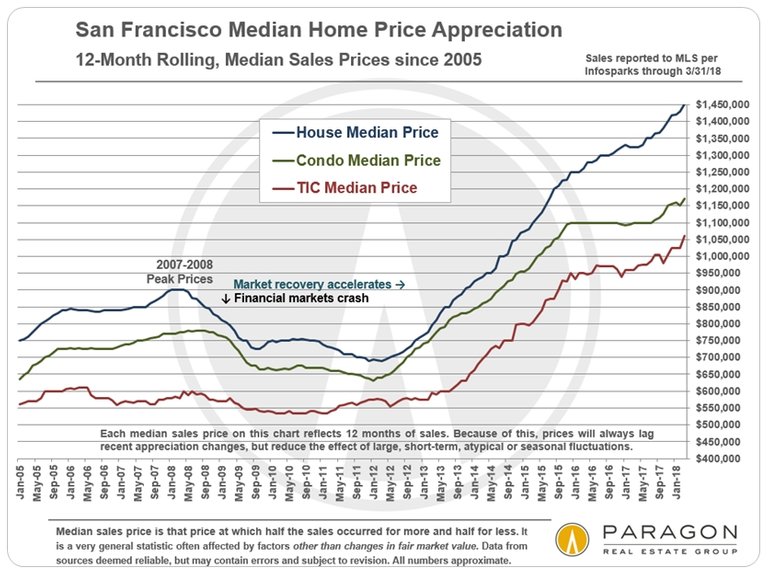

MedianPrices_12-Month-Rolling_SFD-Condo-sep_since-2005.jpg (835×625)

683551_cshomeprice-release-0327.pdf

https://www.spice-indices.com/idpfiles/spice-assets/resources/public/documents/683551_cshomeprice-release-0327.pdf?force_download=true

Mobile home loan delinquencies are a warning sign for the economy - Business Insider

http://www.businessinsider.com/mobile-home-loan-delinquencies-are-a-warning-sign-for-the-economy-2018-4

Average Commute Time in U.S. by State and City

http://www.visualcapitalist.com/wp-content/uploads/2018/04/average-commute-time-by-state.html

https://www.paragon-re.com/trend/san-francisco-home-prices-market-trends-news

▶️ DTube

▶️ IPFS

Real estate isn't supposed to be a speculative asset. Yet we have learned over the years that it absolutely is. People have taken every dollar the banks and lending institutions will give them and bought the maximum they could get. Everything is all good while the market is moving upward. Nothing to worry about. But then one day, something changes. Oops.

You can't have prices escalating so high and people buying into these homes with maximal debt and not have it backfire. It's inevitable. Most people would say it's ok because prices will just come back up. That's most likely true. However, what they haven't thought about it how on the way down, people will be destroyed. Happens every single time.

Do you know anyone who went way overboard on their purchase of real estate?

The Baby Boomer generation was the generation that sunk the progeny going forward. The concept of making shelter an investment is absolutely counter intuitive to acknowledging the rights of future generations to exist. Post WW2 was when the population was lulled to sleep and all the damage was done to the future.

A perfect example of the Winners Curse. Yes, those buying real estate in some of these overinflated markets are able to procure a loan allowing them to get into a home. But at what cost? It is only because they are willing to pay the most, over and above what a reasonable person would be willing the pay.