Ripple and the custom cryptocurrency it created, XRP, are having a moment.

Winning the attention of new investors (so much so that XRP shot up over 1,000 percent earlier this year) as well as new clients (with announcements rolling out at a slow and steady clip), the enterprise blockchain startup has been the talk of crypto in 2018.

Yet, newcomers should note that much of the enthusiasm stems from certain claims by the startup - namely, that its tech could revolutionize international payments, innovating on outdated methods for routing messages and money between financial behemoths.

Not only does Ripple claim its products are cheaper and faster, but it also touts them as generally more efficient than the services in the marketplace today, a claim that hinges primarily on its use of blockchain technology and cryptocurrency.

Still, not all Ripple products are created equal in relation to XRP and its $35 billion market.

In fact, XRP, the asset you can buy and trade, is just one small piece of a suite of products the San Francisco startup offers (some of which don't employ the cryptocurrency at all).

In the following piece, we outline Ripple's three products today - xCurrent, xRapid and xVia - and explain where XRP fits in.

xCurrent

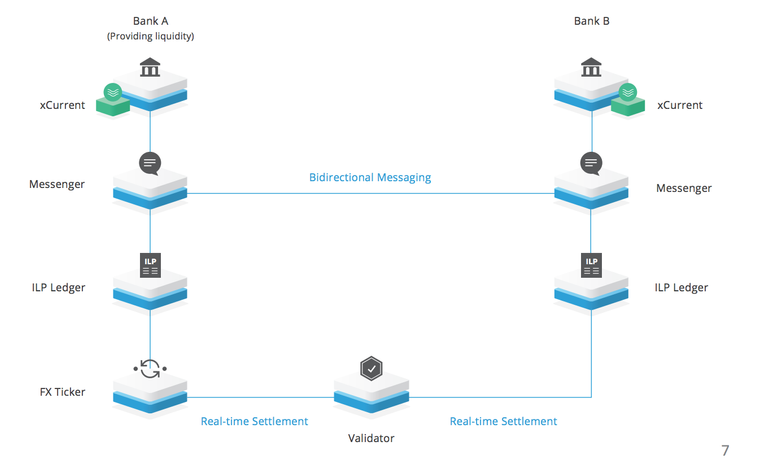

Built on a distributed ledger called Interledger, xCurrent doesn't operate on the same technology as XRP (which uses a separate system called XRP Ledger).

Of note is that, while Interledger was built by Ripple executives, it's not managed by the company - it's incubating in a World Wide Web Consortium (W3C) group, which is managed by a long-standing non-profit dedicated to furthering internet standards.

As such, the main goal of xCurrent is to provide interoperability between any and all currencies, not just cryptocurrencies.

By having connectors that hold value in a number of currencies, xCurrent allows banks to transact with each other, even if the sender wants to pay in U.S. dollars but the recipient wants to receive money in euros.

The product also features a messaging platform "used to coordinate information exchange between the banks," Thomas said, one that lets either bank send data back and forth.

The messaging platform allows for real-time updates so that simple errors, such as mistakes in spelling the recipient's name, don't delay payments from getting facilitated quickly. Another function allows payments to be tracked to their endpoint, all while preserving customer privacy.

As Ripple CTO Stefan Thomas explains:

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.coindesk.com/xrp-fits-ripples-payments-products-explained/

You recieved a 50.0% upvote from @sisygoboom - your post is on fire!

Consider delegating to us and recieve 100% of the earnings! (We're happy just recieving curation)