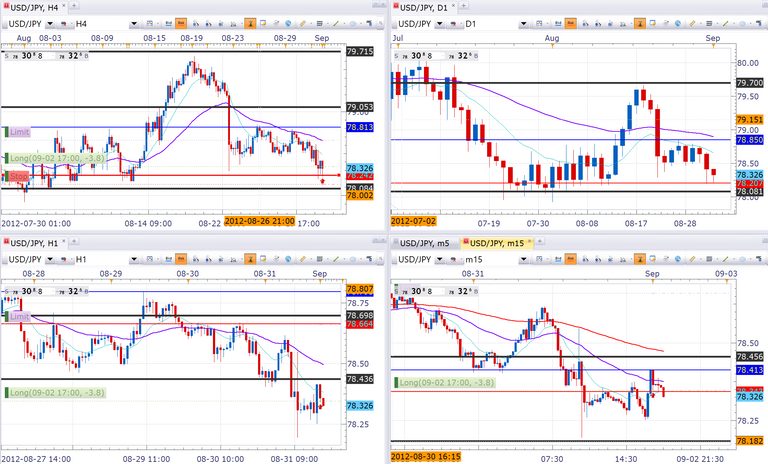

this is a technical analysis of historical data in order to reveal some psychological patterns in the USDJPY ( september 2012)

the analysis uses Simple support and resistance levels and the use of 14 Period and 50 Period EMA's ( Exponential Moving Averages)

- Daily shows prices are at the bottom of the range yet price is below all EMA

- 4hr shows prices testing or tested the bottom of the range

- 1hr shows that price has tested the 14 EMA and support has been found around the 78.25 level

- 15 min shows that EMA’s are offering resistance

- The expectation is that because we are at the bottom of a daily range the lower time frames do not have as much weight so therefore reversal is possible at this area as it has happened in the past. attempting to get 20 to 30 pips for a move to the UPSIDE

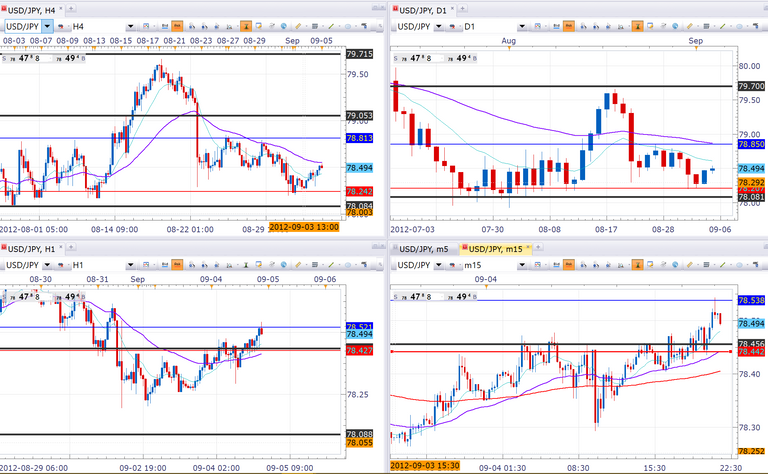

here is the result so far target price was 78.60 price acheived 78.56 profit was taken successful trade