.jpeg)

When you first step into cryptocurrency, it is usually through a user friendly wallet/exchange that makes things as simple as possible. Coinbase has become the go to for ease of use and credit/debit card spot buys. The fact that it is Nasdaq backed and has its KYC/AML in check is another green light to many/red flag to traders who value anonymity. P.S. Don’t be that guy that cashed out tens of thousands in profits and didn’t pay his taxes.

If you’re only buying a few dollars worth of majors like Bitcoin, Litecoin or Ethereum — it is convenient and you don’t take the fees into consideration. This is acceptable as you are buying time in a way and the more you trade, the more you learn to value your time. However, when you start actually trading or buying up real numbers [let’s set this at a four figure range and up] the fees will bite into your profits quicker than you realise. Had I taken this into more serious consideration during the Ethereum rally of 1H2017 after the value of a small initial investment made good on its return, I would be up anywhere between 3,000–5,000 dollars. $5,000 for doing almost nothing. Sure, these may be small numbers for high rollers, but would you rather pickup a new Rolex or donate four figures to your friendly exchange?

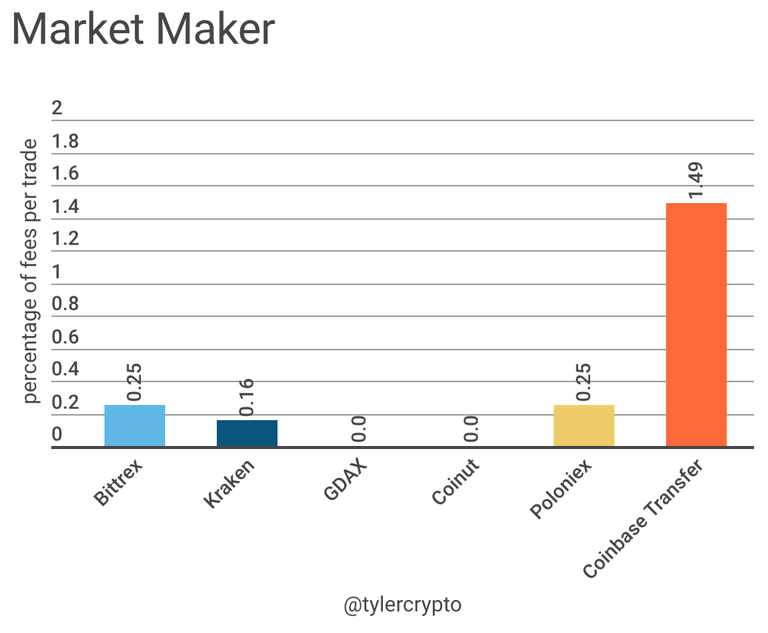

Market maker fees will always be lower than taker because your orders are providing liquidity. Some exchanges have so far as to charge zero fees to the maker — trust me these days are numbered. As a trader in both long and short term positions you want to use this arbitrage to increase your profitability or losses.

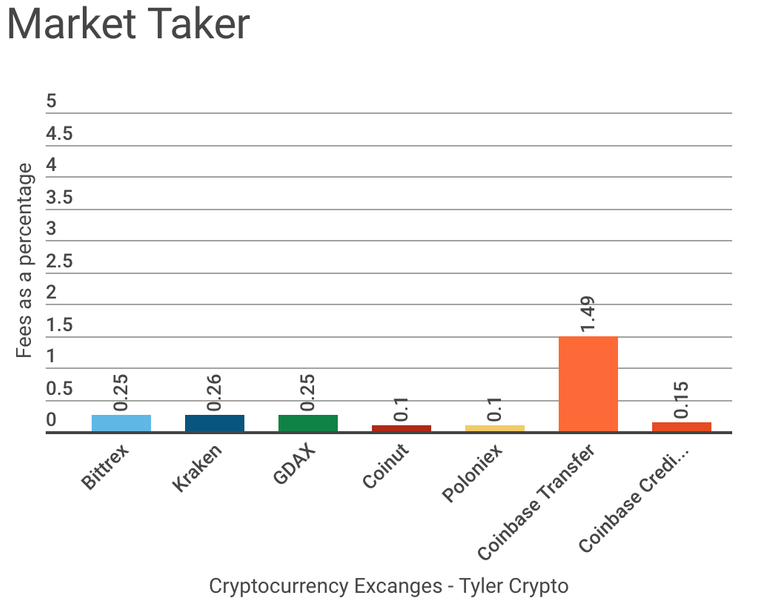

Takers are those who “buy now” at the current market spot price. This is never a good idea and typically a newcomers habit. A little bit of patience pays off. Fees on major exchanges fall between an initial 0.15% a the way up to 0.25% [usually for less than around $50,000 per trading month and they progressively give lower fees are you trade more]. If you include Coinbase as a type of exchange you will get fees as high as 3.99% — this means if you purchase $10,000 worth of Litecoin/Bitcoin/Ethereum you will lose out on $399 worth of cryptocurrency assets.

Takers are those who “buy now” at the current market spot price. This is never a good idea and typically a newcomers habit. A little bit of patience pays off. Fees on major exchanges fall between an initial 0.15% a the way up to 0.25% [usually for less than around $50,000 per trading month and they progressively give lower fees are you trade more]. If you include Coinbase as a type of exchange you will get fees as high as 3.99% — this means if you purchase $10,000 worth of Litecoin/Bitcoin/Ethereum you will lose out on $399 worth of cryptocurrency assets.

Makers are those who set orders usually above or below the market price, can also be called spot price. As they provide liquidity and take the other side of a position as opposed to the taker, they get charged substantially lower fees. Arbitrage opportunities exist for the dedicated — two quick examples are Ethereum Classic on Coinut or Litecoin/Ethereum on GDAX; it goes without saying that you have Bitcoin (or fiat GDAX only) on the exchange and have set your buy or sell targets. The patient traders are rewarded. Never leave too much on an exchange only enough to fill your orders (i.e. I want to buy up 1 Bitcoin worth of Ethereum Classic at the lowest daily price over a number of days — I only leave one bitcoin on the exchange). An upcoming post on security and safety will cover this sufficiently.

My latest plays have been accumulating $ETC on Coinut, this little known in EU/US Singapore based exchange is quick and reliable — it has never been down in a DDoS attack and just happens to be the only exchange offering Ethereum Classic for Bitcoin at zero percent fees. The same applies for Litecoin as well and can be done at GDAX if you are currently accumulating and don’t mind the occasional outage (lost time/lost time imo). Keep a lookout for my upcoming article on why i’m doubling down on $ETC and also an example of how to do it efficiently and cheaply.

Comments on other tested and trusted exchanges offering decent arbitrage opportunities on large cap coins and assets are welcome.

If you found this post useful and want to thank me, send a tip. It’s not the amount, it’s the gesture. Want a pro tip/trading strategy/evaluation on a certain crypto? Tell me.

Litecoin: LPh4MayLMDqYAVSumnoSMyRhVS1EmvEVaS

Bitcoin: 1JfHAGJ2mNrT2FcJkVyiWZfrpGeEiyou6J

Disclaimer: I am not your financial advisor, this is not financial advice.

Great post. I'm annnoyed at all the fees Coinbase have taken from me even for sending crypto to other wallets. I thought sending crypto was supposed to be free?

The fees for sending are rather low if any (i.e. miner fees from GDAX/Coinbase only), it's the buying fees there that aren't. If you want to stay on Coinbase I suggest wiring money (DO NOT PAY 4% credit card buy pls!) and then sending it over to GDAX as it's the same company. Then even if you market buy you'll pay only 0.25%.

Stay safe and stay in profits

By transfer I mean bank transfer in fiat, not sending crypto ;)

Hi friend, very good !!!!!

You would help me with a vote in my post., Thanks !!! ;)

I just checked Bitfinex fees: Maker 0.1% Taker 0.2% if you want to include it in your data.

Very nice information