About a year ago I got into the world of financial markets, and well... Since then it has been a scalloped road full of many lessons. I currently trade some financial instruments in the cryptocurrency market, the stock market, and the foreign exchange market (Forex).

As I mentioned, for my short time as a trader, I have very clear that I have a long way to go, however, I join this community to share that little knowledge, in this way, to all those who want to start trading the financial markets, I will be helping you keep off those mistakes that I have already made.

4 Mistakes you should avoid when start trading the market.

1. Enter without even having basic knowledge about the trading in question.

Financial markets can be a hostile environment; you can get really frustrated if you don't worry about learning the basics before initiating trading, and by basic I mean not just technical analysis but also what the nature of trading includes.

If you are thinking of running the financial markets, I warn you that like any profession from which a person can profit, you must study it, dedicate time, and of course, try your methods before jumping into the real environment.

My recommendations for this mistake are the following:

- Consider the technical analysis and the psychology of trading: briefly, I warn and remind you that the financial markets develop in an environment that moves on the psychology of people trading in real-time, That's why, beyond the technical knowledge of analysis and probabilities, you must acquire both technical and psychological knowledge.

- Run in Demo accounts before jumping into real accounts, so you can put your knowledge into practice, develop a strategy and measure the probability of mathematical success of your strategy.

2. Trading against the trend.

It is common that in the beginning, we are tempted to trade against the trend driven by the idea of

more earnings, thinking that we can "guess" a local bottom (lower price) or a local top (maximum price) before the price changes its direction. The result is that while we are still novices, it will represent a problem since in the long term we will see ourselves losing money.

One of the troubles that come with operating against the trend is that it can become addictive; it may not even be really positive that we accumulate a handful of winning trades since in the long term we could catch a habit of performing this type of trades when the reality is that the highest profitability is found in the decent trends or impulses of the market.

This error is simple, and I clarify that although it is possible to deliver a strategy to take advantage of market movements against the trend (pullbacks or consolidations), the most recommended when we start trading the markets, is always to join large and main movements, instead of pursuing a change in it, all this comes from the principle that the continuation of a movement is more likely than a total change in it.

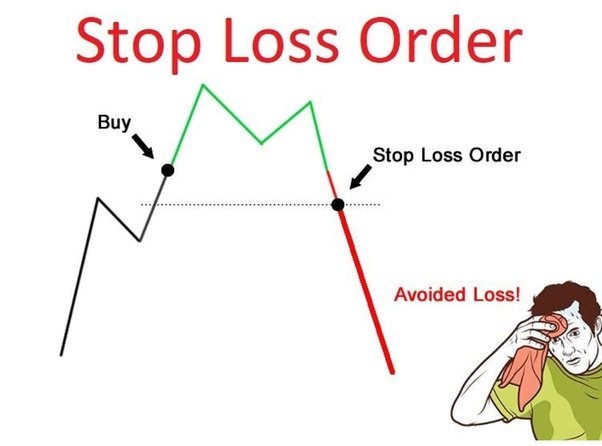

3. Not using Stop Loss in your operation

Although you can be profitable in your trading without using the Stop loss, it is a decision that could take you to disastrous results.

This happens mostly if we have already made the first mistake on the list, and the reason is why, while studying a bit of what trading and the technical analysis of a stock chart are about, we find the irrefutable truth that trading takes place on the uncertainty.

Is known, When we operate the markets, we will earn money if the price moves in the direction of our position (Long or Short) and we will lose if it moves in the opposite direction, but this direction is determined by the psychology of all people who are trading at that time, if those people think the price is too cheap or too expensive, the price will move, and that's why, even if we could identify high probabilities of the next possible price movement, it will never be something accurate.

Recognizing the above, it is evident why we must always include in our operation the use of Stop Loss. In this environment where despite the high probabilities we can identify, there is no certainty, the only thing we can control, is how much we would lose in the worst instance.

4. Abuse the Use of Indicators:

It is very common that when we start to familiarize ourselves with the use of indicators in the price chart, two things could happen: we start a search for the "holy grail of indicators" or we use a lot of indicators in the price chart, with the belief that we would filter the perfect entry signal for a trade.

What ends up passing off is that we have a chart full of indicators where we cannot visualize the price action, and when the multiple indicators begin to contradict each other we lose valuable opportunities to trade.

The recommendation against this is the following:

The indicators should be studied and choose only the necessary ones that fit your strategy and personality in trading, you must likewise accept the truth that the indicators are just a tool, to help us and understand what's going on with the price and give us a resume, just that. Lastly, when trading the markets forget about perfection trying to filter the perfect signal with multiple indicators, There always will be losing trades, is nature in trading, you cannot have 100% success, so just concentrate on improving your success rate.

-------------------------------------------------------------------------------------------------------------------------------Don't forget to share your opinion in the comment box and if you would be interested in me talking about a topic or have any suggestions you can still leave it in the comment box. Thank you, see you next time!

Reminder/Disclaimer:

---All the information found on this blog IS NOT financial advice of any kind, It is just with educational and helping purpose. Investment in financial markets is a risky activity where you can lose a lot of money. Take all your decisions at your own risk--

NOTE: You can find all my content at my social media:

https://trybe.one/user/31072

https://www.uptrennd.com/user/NTIzNjE=

https://steemit.com/@tradingoz

https://www.minds.com/trading0z/

https://www.publish0x.com/the-ever-wanted-trading-tips

You can also find me there with the same username: tradingoz

If a different type of proof is required by admins to prove the ownership I'd be glad to provide it.

Hello tradingoz, welcome to Partiko, an amazing community for crypto lovers! Here, you will find cool people to connect with, and interesting articles to read!

You can also earn Partiko Points by engaging with people and bringing new people in. And you can convert them into crypto! How cool is that!

Hopefully you will have a lot of fun using Partiko! And never hesitate to reach out to me when you have questions!

Cheers,

crypto.talk

Creator of Partiko