Or so I thought...

This is the (short) story of how I lost an awful lot of money because I was an idiot who thought I knew better.

I hadn't been share trading long, this is way back while I was still messing around as a hobby. I was long on a stock that I really liked and thought it was going places. I had a reasonable size position on it, way more than what my account could handle - around 20% of my capital.

Everything was going great, had made a bit of a profit (which I should have took) but I was a little greedy and was holding out for more. Then out of nowhere, the stock started to take a dive. That should have been the first warning sign. It dropped a hundred pips in maybe a minute or two, and I could only watch in disbelief and wait for it to recover.

It did recover 10 pips or so and seemed to be holding for about 30 minutes, but didn't start climbing back to its original level. But I held on for a bit more, even though I was holding a bit of a loss. Then it did it again, and again, and again. All day long.

Every time the price fell, it bounced a little and settled at a higher level, giving the impression that it was bottoming and would soon turn around. It didn't.

By the time I eventually sucked it up and got out I was down 70% of my account. I lost 70% of my money on one single trade. Even looking back now, I was trading on margin and if it wasn't for a margin call I think I would have lost the lot, I was so convinced the price was going to go back up.

I can't even explain now what happened, I think I just couldn't believe what I was seeing, or maybe I was in some kind of shock. The lower the price got, and the more loss I made, the more determined I got not to take the loss. Once it got past a certain point I even went into 'Ah fuck it, I don't care any more' mode.

What I didn't know at the time was the company had declared bankruptcy, this was way before access to instant news feeds and most news was got from physical newspapers so I never knew until it was too late. The stock never recovered.

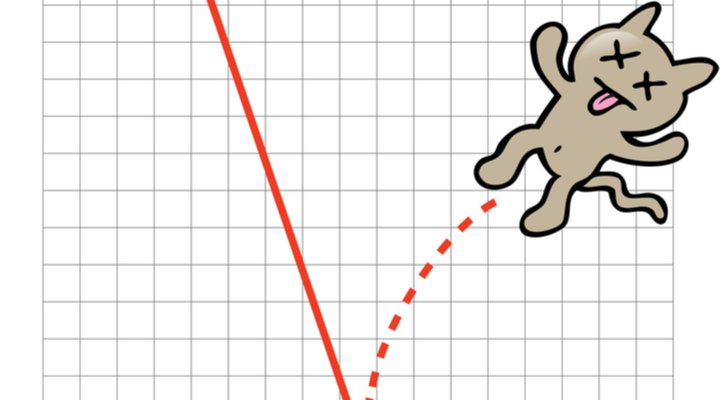

What I had been seeing is known as a 'dead cat bounce'. The idea is that even a dead cat will bounce if dropped from a great enough height. It happens after a big fall when people think the stock can't possible go any lower (like I did) and start to bargain hunt, thinking they're going to be buying in at the lowest possible price.

The fundamentals quickly take over again though, and the stock continues in it's original direction. It's a continuation pattern and it happens a lot, I just didn't know that at the time. The problem is, it's very hard to spot them as they happen, it's only with hindsight that they become obvious, when you look back at the chart.

So here's the lessons I learned from it, hopefully it's of some use.

- Don't have a position size bigger than your account can handle.

- If you have a good profit, take a good profit, don't be greedy.

- At the first sign of serious trouble, get out.

- Never ever hold on to a losing trade in the hope that it'll recover.

- Have a system/rules/trading plan and stick to them, no matter what.

- Be aware of the psychological effects of winning and losing, and how it can affect your behaviour.

The reason why a lot of traders (including me at the time) get in trouble is because they have their trading priorities wrong. Beginners are very patient with losing trades and impatient with winning ones. Beginners will hold onto a dying position for way longer than they should, while a professional will cut it dead the instant it goes wrong.

Beginners will also cut short a trade as soon as it starts to show profit because it's money in the bank and they're fearful of losing it again. A professional will let it run and run to maximise the profit.

You can understand the reason why beginners often fail, they have lots of big losers with a couple small winners. The idea is to have lots of little losers with some very large winners.

So please learn from my mistake, you don't know anything that the market doesn't. Wishful thinking doesn't move stock prices in the direction you want. Learn to accept that your going to be wrong a lot of the time and take the losses on the nose, and concentrate on making those winners bigger.

And so concludes the story of the first time I was an idiot and lost my trading account.

Image credit : Shutterstock, via Google image search.

Disclaimer : If you blindly act on the advice of strangers from the internet then you're an idiot and probably deserve to lose all your money. There's no fast track to success. Do your own research and make informed decisions based on all available evidence. Critical thinking is the key to everything.

hahahaha, your honesty is outstanding. I like your style.

Thanks, I think it's important to be honest and describe how it actually is in the real world. Never trust people who only show winning trades, systems that always win, or the amount of money they've made.. it's complete horseshit.

Like now, thousands of people are getting their crypto accounts decimated due to bad advice, just so others can profit from their stupidity, it makes me sad :-(

Lots of people trying to sell their trading ideas simply because they dont make any money trading,

I've always wondered, even some of the 'famous' traders when they bring out books, if you're so successful then surely the pissy amount you'll earn from a book sale would be a drop in the ocean compared to what you've made trading...

Exacly. They sell book and subscriptions and signals. you name it. that's how they make their money. if i had the winner secret i would not be selling it. Trust me.

same, even though I try to help new traders it's still a zero sum game, everyone is in competition for the same money :-)