TUESDAY

1-OCT

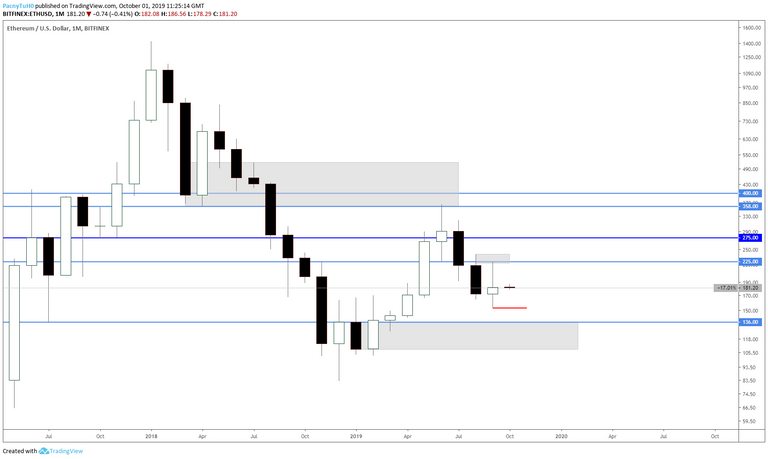

Price looks like dropping further, following the rejection of the $225 resistance level.

LM low seems like the most likely target, with a support level just below it.

The $136 level has provided both support and resistance and it coincides with the MN buy zone that caused this year's rally.

It seems unlikely that price will resume its rally from the current prices without reacting from an S/R level, especially with $136 being so close.

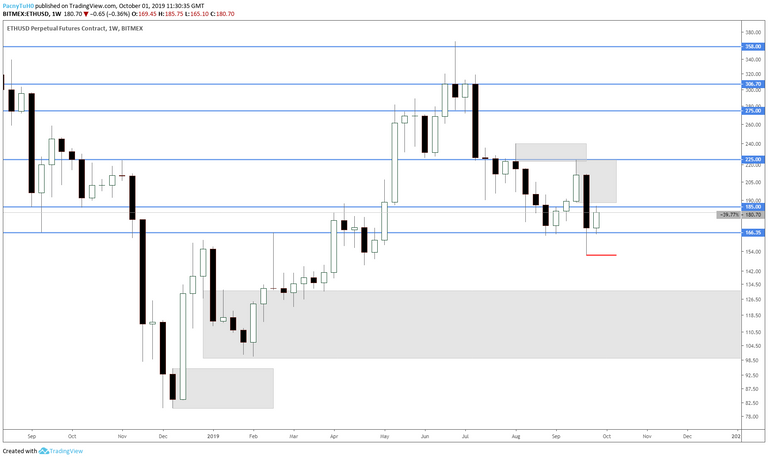

On the Weeky, price is rallying so far this week and it's about the reach the potential W1 sell zone just above the $185 S/R level.

The upside LQ is above LW high which seems far away from current prices and given the bearish momentum it seems unlikely to be targeted.

LW low seems like the most reasonable target right now.

On the Daily, price has found some support around the $166 S/R level and not a single day managed to close close below it last week.

The rally from the last few days has been caused by the W1 buy zone around the S/R level, but it's the second time that price visits the level.

Another drop towards $166 may be a sign that buyers are getting exhausted and further downside could be expected.

What’s happen? It’s so many time you don’t post your analisys

Posted using Partiko iOS