TL:DR; Locally with my Forex trading, a lot of people were wanting to know how its done, but when it came to actually using brokers or autotrading most people said it was just too complicated, so I put together an ebook outlining exactly how I do it. It's free for any Steemit users if you're interested. Enjoy!

Bank withdrawal, late payment, interest or extra charges. Normally, to be able to pay for your everyday household bills, you require a bank account. Then, simply for having money in a bank account, you are paying charges out of your hard earned money. Why do they do this? Well, because for years, we didn’t have a choice. We had to use a bank account to be able to continue living in our societies.

Bitcoin, was created as a means of offering an alternative choice for individuals, who wanted a decentralized, worldwide currency which was able to take that power away from banks. To provide a monetary system which operates efficiently and seamlessly (See Blockchain). Since its creation in 2009, the popularity has skyrocketed, and there are now ways to use Bitcoin in everyday society; to spend it anywhere regular money is accepted, withdraw cash from a Bitcoin account, and save money stored in Bitcoin.

Laid off, hours cut back at work, demoted, or worked for minimum wage. When we work for our money, we do so to be able to keep on top of expenses. This is rent, mortgages, utility bills, groceries, education or personal expenses. What unfortunately happens to thousands of people around the world, is it doesn’t always work seamlessly. A lot of the time, while we’re working, our place of work has a downturn in business, and our hours are cut, or we’re laid off completely. It causes stress and anxiety for all involved. Or perhaps, someone who is friends with the boss gets the promotion instead; or you find yourself hating work.

Yes, there is an alternative, that completely avoids those stresses of having to rely on people to be able to continue keeping on top of your expenses, to be able to save for holidays or spending time with loved ones. It is by being involved with currency trading, or what is also known as Foreign Exchange, or FOREX. Forex is a means of trading a specific amount of money from one currency to another, and earning a profit from the fluctuating values of the two currencies, or currency pair. This means of earning an income is dictated by the values of different countries currencies, which is dictated by each country's unemployment rate, their consumer price index (CPI), or the reserve bank interest rates.

Table Of Contents

Bitcoin

Cryptocurrency

Blockchain

Forex

Currency pairs

Metatrader 4 (MT4)

Hardware

Private Server

Virtual Private Server

Setup instructions

MT4

Bitcoin

Bitcoin, when release in 2008, was worth next to nothing. It was a virtual web-based currency which was scarcely used for online or offline purchases. However, after the Bitcoin blockchain system potential was realised, the value skyrocketed to popularity. There were few and far Bitcoin users before the value skyrocket in 2011, creating huge wealth for all those who held Bitcoin. Some even reaching 8 figure returns from a matter of hundreds of dollars.

What is a cryptocurrency? (source: CryptoCoin News)

A cryptocurrency is a medium of exchange like normal currencies such as USD, but designed for the purpose of exchanging digital information through a process made possible by certain principles of cryptography. Cryptography is used to secure the transactions and to control the creation of new coins. The first cryptocurrency to be created was Bitcoin back in 2009. Today there are hundreds of other cryptocurrencies, often referred to as Altcoins.

Put another way, cryptocurrency is electricity converted into lines of code with monetary value. In the simplest of forms, cryptocurrency is digital currency, Unlike centralized banking, like the Federal Reserve System, where governments control the value of a currency like USD through the process of printing fiat money, government has no control over cryptocurrencies as they are fully decentralized.

Most cryptocurrencies are designed to decrease in production over time like Bitcoin, which creates a market cap on them. That’s different from fiat currencies where financial institutions can always create more, hence inflation. Bitcoin will never have more than 21 million coins in circulation. The technical system on which all cryptocurrencies are based on was created by Satoshi Nakamoto.

While hundreds of different cryptocurrency specifications exist, most are derived from one of two protocols; Proof-of-work or Proof-of-stake. All cryptocurrencies are maintained by a community of cryptocurrency miners who are members of the general public that have set up their computers or ASIC machines to participate in the validation and processing of transactions.

History of Cryptocurrency

The first cryptocurrency was Bitcoin. Bitcoin was created in 2009 by a pseudonymous developer named Satoshi Nakamoto. Bitcoin uses SHA-256, which is a set of cryptographic hash functions designed by the U.S National Security Agency. Bitcoin is a cryptocurrency that is based on the proof-of-work system.

In April 2011, Namecoin, the first altcoin, was created to form a decentralized DNS to make internet censorship more difficult. In October 2011, Litecoin was released and became the first successful cryptocurrency to use scrypt as its hash function rather than SHA-256. This gave the general public the ability to mine for litecoins without the purchase of specific hardware such as the ASIC machines used to mine Bitcoin. Litecoin began receiving media attention in late 2013 – reaching a market cap of $1 billion. Ripplecoin, created in 2011, was built on the same protocol as Bitcoin but services as a payment system – think of it like a Paypal for cryptocurrencies that supports any fiat currency, cryptocurrency, commodity or even frequent flier miles.

Cryptocurrencies & Market Capitalization

Bitcoin is the largest cryptocurrency in both market capitalization, volume, acceptance and notoriety, but it’s not the most valuable coin. NEMstake, while only having a market cap of $1,116,720, trades at $1,117 a coin. Looking at the market cap, Litecoin takes second place after Bitcoin with Ripple close behind. One coin that you are more than likely familiar with is Dogecoin. Dogecoin ranks, on average, thirds in trading volume, but has a relatively low market cap – ranking number six in the largest cryptocurrency.

What is a Cryptocurrency Hash?

Cryptocurrency mining power is rated on a scale of hashes per seconds. A rig with a computing power of 1kH/s is mining at a rate of 1,000 hashes a second, 1MH/s is a million hashes per second and a GH/s is one billion hashes per second. Every time a miner successfully solves a block, a new hash is created. A hash algorithm turns this large amount of data into a fixed-length hash. Like a code if you know the algorithm you can solve a hash and get the original data out, but to the ordinary eye it’s just a bunch of numbers crammed together and remains practically impossible to get the original data out of.

SHA vs. Scrypt

While Bitcoin and a several other coins are mined using SHA-256, Litecoin and many other coins, use Scrypt. This are the two major hashing functions, but several different kinds exists and are used by other cryptpcurrencies such as scrypt-N and x11. The different hashing functions were adopted to answer concerns with the SHA-256. Before, individuals were able to mine Bitcoin with their GPU’s, which require a large amount of energy. But as Bitcoin grew in popularity, ASIC SHA-256 machine were built which made GPU mining obsolete.

To give you an idea of just how powerful these machines are, a mining rig running 4 GPU’s would get a hash rate of around 3.4 MH/s and consume 3600kW/h while an ASIC machine can mine 6 TH/s and consume 2200kW/h. This effectively killed GPU mining and left many individuals worried about the security of the network. With less individuals being able to profitably mine from their home computer, the network become less decentralized. Scrypt mining was implemented with the promise of being ASIC resistant due to the memory problem it introduced.

Scrypt hashes require lots of memory, which GPU’s are already designed to handle and ASIC machines were not. However, Scrypt mining require a lot of energy and eventually scrypt-ASIC machines were designed to address this problem. At this point Litecoin considered changing their proof-of-work function to avoid ASIC mining. Scrypt also taut that their proof-of-work is much more energy efficient than SHA-256. Bitcoin blocks are solved at a rate of 1 per 10 minutes while Litecoin blocks are solver at a rate of 1 per 2.5 minutes.

Cryptocurrency Security

The security of cryptocurrencies is two part. The first part comes from the difficulty in finding hash set intersections, a task done by miners. The second and more likely of the two cases is a “51%” attack“. In this scenario, a miner who has the mining power of more than 51% of the network, can take control of the global blockchain ledger and generate an alternative block-chain. Even at this point the attacker is limited to what he can do. The attacker could reverse his own transactions or block other transactions.

Cryptocurrencies are also less susceptible to seizure by law enforcement or having transaction holds placed on them from acquirers such as Paypal. All cryptocurrencies are pseudo-anonymous, and some coins have added features to create true anonymity.

Blockchain (source: Blockchain Technologies)

Blockchain technology can be a confusing concept to understand.

Luckily, we are here to simplify things. Blockchain technology is a relatively new concept and rapidly growing industry. Similar data structures have existed long before the popular bitcoin cryptocurrency was conceived, however, principal theories of blockchain architectures used today were first outlined and defined in the original bitcoin white paper written and published by Satoshi Nakamoto in 2008.

As this nascent technology is ripe with ongoing innovations, it is best to keep an open mind and expect new related-technologies to continue to emerge. Below we explore key defintions and concepts to understand of this basic pillars behind this revolutionary technology.

A distributed ledger is a consensus of replicated, shared, and synchronized digital data geographically spread across multiple sites, countries, and/or institutions.

Users of Distributed Ledger Technology (DLT) significantly benefit from the efficiencies and economics by creating a more robust environment for real-time and secure data sharing. Contrary to common belief, the Bitcoin blockchain is not the only distributed ledger, in fact, many other users of Distributed Ledger Technology use different methodologies to achieve the same consensus.

Blockchain Technology

A blockchain is a type of distributed ledger, comprised of unchangable, digitally recorded data in packages called blocks.

These digitally recorded "blocks" of data is stored in a linear chain. Each block in the chain contains data (e.g. bitcoin transaction), is cryptographically hashed. The blocks of hashed data draw upon the previous-block (which came before it) in the chain, ensuring all data in the overall "blockchain" has not been tampered with and remains unchanged.

Blockchain vs. Distributed Ledger What is the difference between the two?

A blockchain is just one type of distributed ledger, not all distributed ledgers necessarily employ blocks or chain transactions.

Although the term ‘blockchain’ is used more frequently than ‘distributed ledger’ in discussions, a blockchain is only one of the many types of data structures that provide secure and valid achievement of distributed consensus. The bitcoin blockchain, which uses ‘Proof-of-Work Mining’, is the most publicly proven method used to achieve distributed consensus. However, other forms of distributed ledger consensus exist such as Ethereum, Ripple, Hyperledger, MultiChain, Eris, and other private enterprise solutions.

Forex

Until the 1970’s, Foreign Exchange trading was only available to large companies. Trading currency pairs and commodities however has roots tracing back to the creation of the gold standard in 1875, being known as the ‘Bretton Woods System’ in 1944 as an international monetary management system, and this allowed the US dollar to replace the gold standard.

Currency Pairs

Two currencies with exchange rates that are traded in the retail forex market. The rates of exchange between foreign currency pairs are calculated as the factor by which a base currency is multiplied to yield an equivalent value or purchasing power of foreign currency. The currency exchange rates of foreign currency pairs float, meaning that they change continually based on a multitude of factors.

BREAKING DOWN 'Currency Pairs'

For example, the currency pair EUR/USD, or "eurodollar," represents the number of U.S. dollars that can be bought with one euro. As the value of the EUR increases, the currency pair exchange rate will also increase.

By going long the EUR/USD foreign currency pair, the currency trader is speculating that the value of the euro will increase in relation to the U.S. dollar. Alternatively, when a forex trader shorts the EUR/USD currency pair, he or she is speculating that the value of the U.S. dollar will increase in relation to the euro.

Metatrader 4 (MT4)

Metatrader 4, is one of the world’s most popular online trading platforms. It was released in 2005 from Metaquotes corporation, the Russian software company.

MT4 popularity is a result from their Expert Advisor (EA) plugins available for MT4, also known as automatic trading, autotrading, robot trading, or algorithmic trading; as well as their signal services, responsiveness, and forum support.

Metatrader is a trading software or trading platform. It is the most famous trading platform specially among Forex traders. You need a boat or a bridge when you want to cross a river. Similarly, you need a trading software when you want to trade online and through your personal computer. Indeed, a trading software or platform is a bridge that connects your computer to the currency market. You can have access to the currency market through a trading platform that you install on your computer. And, Metatrader is the most famous trading platform that you can download and install on your computer for free.

To trade Forex, MetaTrader 4 or MT4 is more than enough. To use this platform, first you have to install it on your computer.

MetaTrader has a lot of features and abilities. You can open price charts and follow the markets price fluctuations and analyze the charts. You can plot trend lines on the charts, analyze the charts and locate the trade setups. You can have candlestick, bar and line charts. It also supports Heikin Ashi candlesticks, and you can add Renko chart indicator to it to use Renko charts too.

You can place orders and set stop loss and target. You can set trailing stop loss and pending orders. You can follow the news.

Even you can use some special programs named Expert Advisors or EAs to do some jobs automatically. You can use some small software named scripts that can be added to MetaTrader. They can also do some special jobs and save a lot of time for you (read this and this).

MetaTrader is a light software that doesn’t overload your computer and doesn’t make your computer slow. You can run multiple instances of MetaTrader on the same computer and login to the same account through all of them. You can easily download several years of historical data for each currency pair, CFD and… from MetaQuotes Software Corp servers for free. You can use this feature to back-test your trading systems and robots.

Server

A server is used for file backups, as a media center, however for forex traders, it allows for 24/5 trading without needing to be behind a computer the whole time; thus allowing for maximum time to place trades.

What is a home server?

A home server is a computer, similar to other computers in your home, but with a specific role, or number of roles depending on your needs. The home server connects to your home network and for most users, those roles include the following: storing and sharing files to multiple home computers (i.e. a desktop computer or laptop), streaming music, videos and photos to networked media devices (e.g. digital media receivers such as the Logitech Squeezebox, Netgear Entertainer, Media Center Extenders and even digital photo frames) automatically backing up home computers each night and enabling remote access to various computers and devices on the network when you’re away from home.

You may have heard the term “Network Attached Storage” or “NAS” to describe similar devices. Whilst the distinction between a NAS device and a home server is blurry to say the least, generally NAS devices are low powered devices with minimal memory and processing power and tend to run a flavour of Linux. They excel equally to a home server in terms of networked storage and media streaming, but generally do not provide the advanced backup and remote access features of a home server, which will also come with a faster processor and more memory. NAS devices do tend to be cheaper than home servers, however, thanks to lower component costs and free Linux operating system. Whilst home servers launched at a premium to NAS devices, their cost is slowly dropping to compete more effectively in the marketplace.

Spotting an increasing trend of consumers in the western world purchasing multiple PCs and holding increasingly large collections of digital media, such as music, videos and photos with little real support to protect those “digital memories”, Microsoft launched a new operating system called Windows Home Server in 2007. Windows Home Server is a full-blown server OS as you would find in Enterprise, with many of the more advanced features hidden away and a friendly, easy to use dashboard helping you manage key features, which are as follows:

Automatic Backup and Easy Restore – Automatically backs up up to 10 PCs in your home each evening, with the ability to open up and navigate through each day’s backup and restore a single file, an entire folder or quickly reinstall the entire computer complete with all files, user data and drivers intact, thanks to its image based backup technology.

Folder Duplication – added protection of the data on your shared folders (in case of drive failure), by duplicating that data to a separate physical drive (if connected).

External Backup – further protection of your shared folders by copying all data to en external USB drive for off-site storage.

Health Warnings – Monitors all computers connected to the home server (courtesy of a small dashboard application called the Windows Home Server Console you install on each computer in the home) and detects issues with anti-virusand firewall status, using a simple “traffic light” (Red, Amber Green) warning system. Can also alert users to issues with the home server itself.

File Sharing – Shared folders on the home server act as central repositories for documents, music, videos and photos. Any authorised home computer and user on the network can then access those folders to add more files, copy and delete files as well and stream media files to an appropriate networked playback device.

Remote Access – A free URL (xxxx.homeserver.com) is provided for every home server to allow users to connect to it remotely from any location with Internet Access. Users can then access folders on the home server itself, or control any authorised home computer directly using Remote Desktop.

Media Streaming – Stream music, videos and photos to a wide variety of playback devices on your network, including digital media receivers, Media Center Extenders, networked TVs, digital photo frames, networked Hi-Fis etc.

Add-Ins – A thriving and growing library of third-party applications providing additional features for your home server including power management, enhanced media streaming, hard disk management and more. Check out Home Server Plusfor a full list.

Why Do I Need a Home Server?

Hopefully the list of features above provide a few pointers as to why you need a home server, but the headline is this – if you have multiple PCs in your home (for you, your partner, perhaps also a couple of computers for the kids too) and a growing collection of music, videos and photos, then all of those files need looking after. If a computer breaks, a drive fails or the kids accidentally wipe out a folder then those files could be lost forever.

A home server not only takes the pain out of protecting those files by automatically backing up each of those computers overnight, but also makes it much more easy to enjoy your music, video and photos thanks to its easy folder sharing and media streaming capabilities – both in the home, and increasingly, outside the home through internet streaming add-ins allowing you to stream you collections to remote computers and mobile phones.

Virtual Private Server

A virtual private server (VPS), also called a virtual dedicated server (VDS), is a virtual server that appears to the user as a dedicated server but is actually installed on a computer serving multiple Web sites. A single computer can have several VPSs, each one with its own operating system (OS) that runs the hosting software for a particular user.

The hosting software for each VPS can include a Web server program, a File Transfer Protocol (FTP) program, a mail server program and specialized applications for activities such as e-commerce and blogging.

The VPS alternative is often chosen by small businesses that need a customized Web site but cannot afford a dedicated server. Another useful aspect of VPS technology is the ability of a single subscriber to maintain multiple virtual servers. For example a Web site owner might use one server for the production-level Web site and the other for a "dummy site" that can be used to test planned updates, modifications or new programs.

So what does this all mean for building a system to earn an income online, with little investment and without needing my constant time and attention?

Well, it’s simple… We know that we can use Bitcoin in everyday transactions, we know that we can earn an income from currency trading using software and algorithms to place trades automatically, and we know that we can run the software on a server so that we don’t need to sit in front of a computer for 24 hours a day.

So, how do we set all of this up?

Autotrade Setup instructions

Autotrade Manual

Choose a Bitcoin Exchange (Ensure you verify your identity with your chosen exchange). The following exchanges are exchanges which specifically provide visa debit cards linked to your Bitcoin wallet.

- Coinjar

- Wirex

Choose a Broker (Ensure you verify your identity with your chosen exchange). The following brokers are brokers which specifically accept both deposits and withdrawals in Bitcoin.

- Traders Way

- FxChoice

- FxPrimus

Find a Server

- ForexVPS

- VirMach

- I’m using a home server

Choose 1 or more Expert Advisors, widely available on reputable websites such as Myfxbook, bestforexeas, or also the MQL5 community.

Metatrader 4 Setup

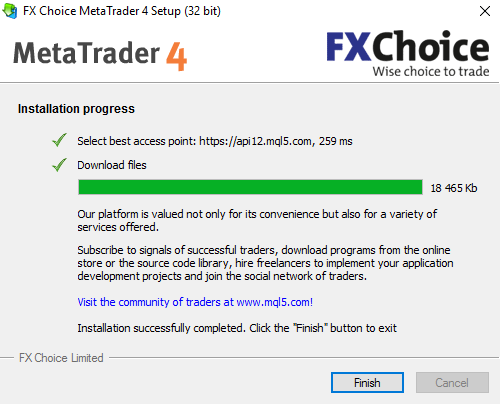

Step 1, Install MT4 on your server.

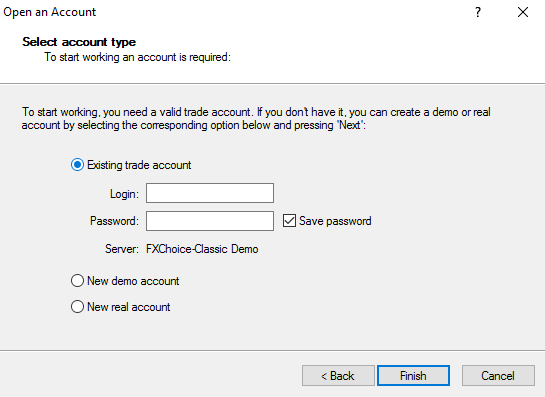

Step 2, log in with your broker account and master password.

Step 3, ensure your trading account is connected to the web server. Your charts should be open.

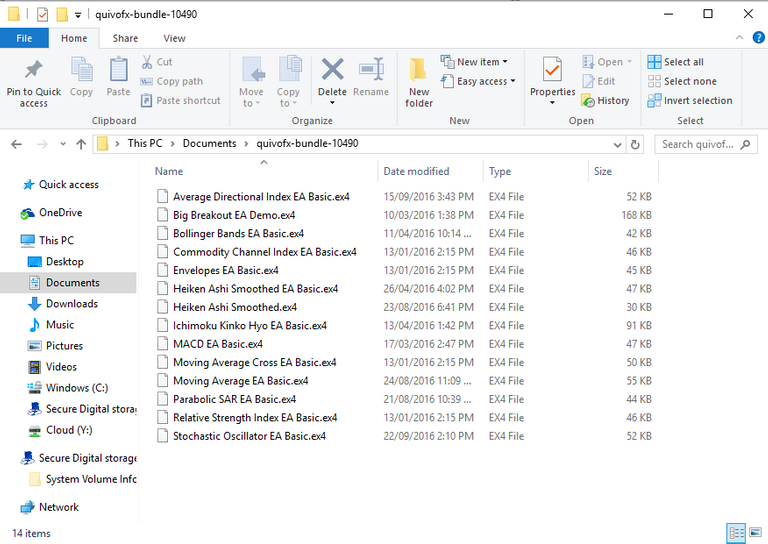

Step 4, go to your downloaded expert advisors. Normally in your computers downloads file. When you find your EA, copy the file.

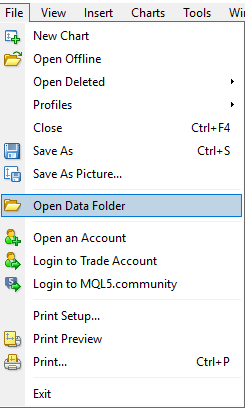

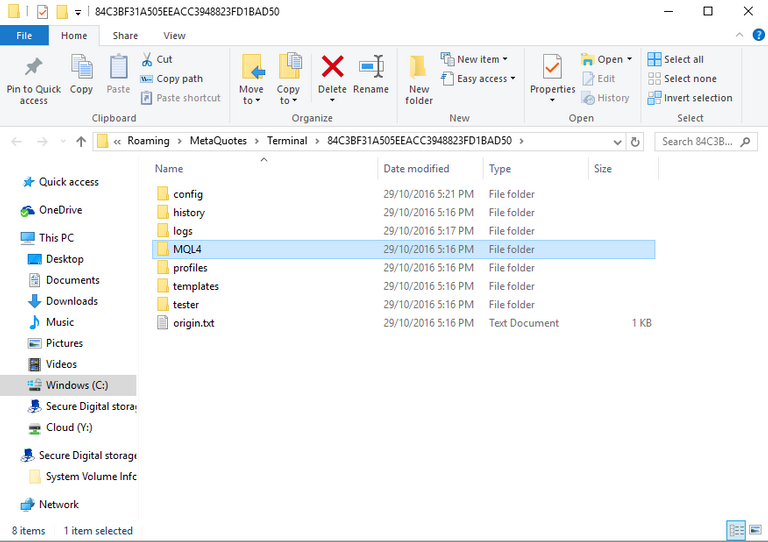

Step 5, open your MT4 data folder.

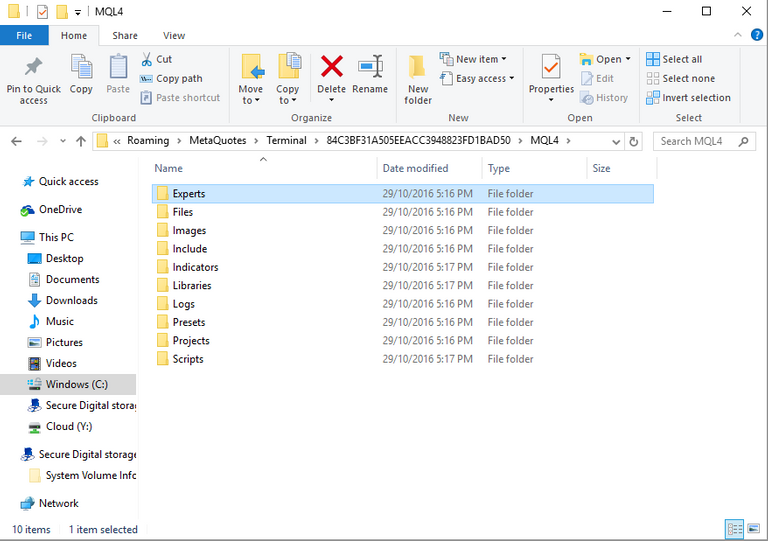

Step 6, navigate to your expert advisors folder. (MQL4-> Experts)

Step 7, paste your EA into the experts folder.

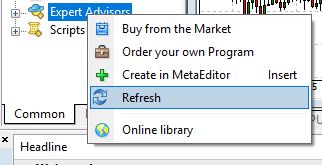

Step 8, close your folders, head back to the MT4 terminal, and refresh your expert advisors.

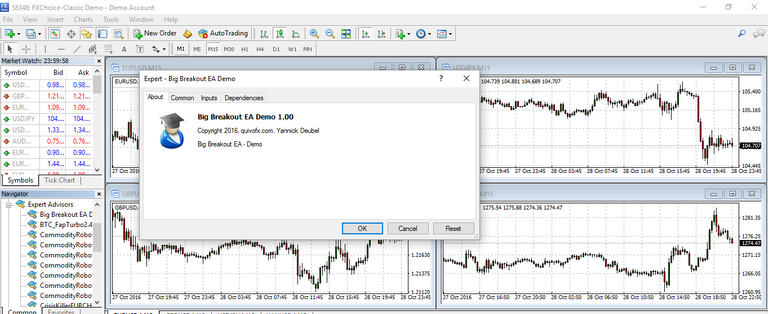

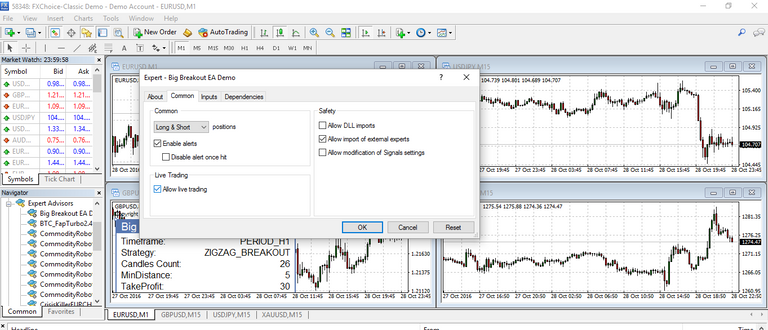

Step 9, click your EA in the expert advisors tab in the terminal. Click and drag your EA over to a chart. You should have your EA parameters appear like this.

Step 10, make sure you click ‘allow live trading’ on your EA parameters.

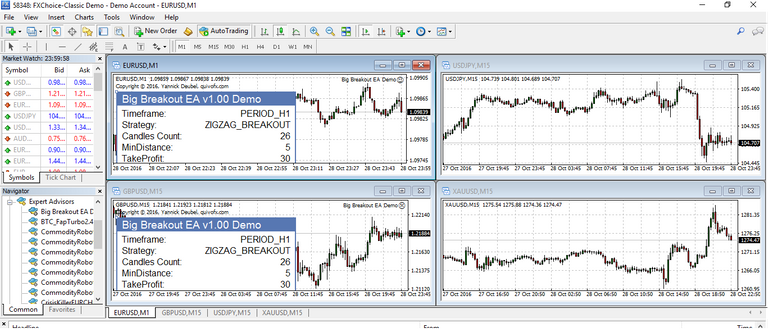

Step 11, now finally, you’ll want to click ‘Auto Trading’ in the top menu. When your EA is working, you’ll see a small smiley face on the top right corner of your chart.

Pointers:

- You can open as many charts as you want in MT4 (you are however limited to which currency pairs are available through your broker).

- You can only enable one EA per chart, however you can enable your EA on every chart you have open.

- If you exit MT4, your EA will not continue to run. However, you can exit your server and leave MT4 running, and your EA will place trades for you automatically.

Full Autotrade Checklist

Bitcoin wallet

Verified Bitcoin exchange

Funded Bitcoin wallet

Ordered visa debit

Forex account

Verified broker account

1 or more expert advisors

Funded via Bitcoin wallet

Server

Virtual private server running

Home server running

Stable internet connection

MT4

Installed on VPS or server

Logged in with real broker account

1 or more EAs installed on charts

Once all of the above is finished, you’ll have your standalone and independent autotrading system set up. This will give you a weekly return (Forex market runs 24 hours a day, 5 days a week).

Yes, it’s now possible to earn an income without relying on a bank, and you’ll also be able to earn an income without relying on influence from any other individual.

That's is a lot of information. Thank you, for taking the time and posting.

I am a little "greedier". I go for SimpleFX when I want to trade 24/7 on crypto-currency pairings & 24/5 for the regular pairings. Haha, trading with no ID required if you trade using BTC and other crypto-coins. Nonetheless, I also use FXChoice because the spread's better good. But lately, the numbers of pairings have reduced, am I right?

Thanks for your info...!

And I am curious about setting up "home server", and EAs... I have purchased one or two before... Didn't exactly work for me... Have you any suggestions?

Hi @Kiek, yes I left out the part where I had 6 EAs before I found a way that works haha. I use one called fxvoodoo, and the verified charts and backtesting we're very attractive, however I noticed anything larger than a micro lot would always end in a stop-loss. So my equity was full of peaks and troughs.

I worked around that being imaginative... I opened up a second account, registered my voodoo acct as a private signal, and copied trades into a second account; and I withdraw from my voodoo account every week so it keeps trading micro lots and increase the lot size when I can on my second one acct. So one account places trades, and the other has compounding returns :)

With home servers though, that's ideal if you have good, reliable connection. I use a home server (go microserver gen 7) because I have 8GB ram and it cost me $300, whereas a vps is normally 1-2gb ram and where I have multiple mt4 platforms running, a vps would lag.

Depending on how tech-savvy you are, I'm actually currently learning the google cloud platform, and I'm working on a template where using a Windows virtual machine instance, your ram increases every time an mt4 instance is installed, so you can run a scalable mt4 vps. However that's not fully functional yet ;)

Unfortunately... Not so... Haha... FXVoodoo? I need to check that out. I have BTCRobot, but... Oh well, my experience isn't great. Maybe it was the timing that was wrong when I use it.

I've also wanted to get into crypto trading, but I can't ever understand platforms like bitfinex or bittrex, plus I'm not even sure how you could automate it, or how reliable it could be as most cryptocurrencies have pretty wild fluctuations

The SimpleFX i'm referring to above, works with MT4, & it carries the usual pairings like EURUSD etc... As for automation & EAs... Hmm... I can't be too sure...

What other EAs/ scalpers do you use most frequently (other than FXVoodoo)? Some other EAs I have found are too pricey a capital layout?

Any broker using MT4 can use an EA :) except you can't install an EA on the Android or apple MT4 platform, only windows or mac (Linux you can, but have to install and run it through wine).

I don't actually use any other EAs or scalpers, just FXvoodoo :) some are pricey, but to be fair it's paid for itself 10x over