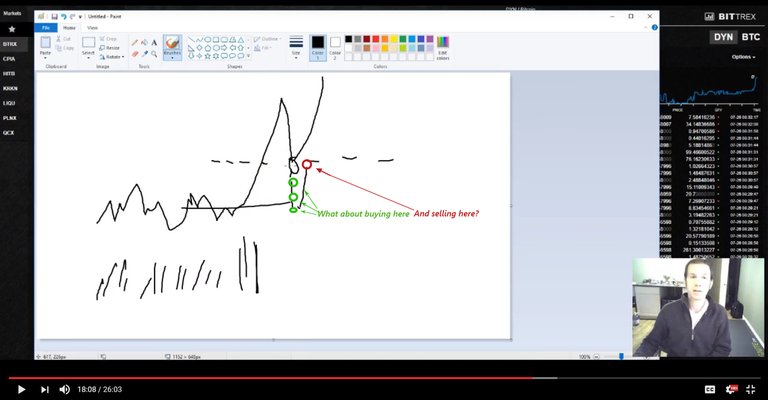

Here's a question I was thinking about while I was watching your video. around 18 minutes you were explaining how when there's a spike upwards the safest place to buy is at around 50% of the spike (the pullback) because 1. if it goes up, then you get profit, and 2. if it dives, it will most likely return to around the 50% mark where you would buy costing you little to nothing.

My question is this. If the price keeps diving in scenario 2 , why not keep buying as it goes down if it will most likely either return to around the 50% point or higher? That way instead of merely getting out even in the second scenario, you would profit from the low price buys. Is it too risky? Here. I'll try to include an image to clarify my question.