I posted this on your other post, but i'll put it here in case you are not checking the comments on the other one.

Hi Luc,

I have been working on a Market Scanner these past few days. I have something up and running. It only checks Bittrex at the moment, but I am going to add a few more exchanges in the next few days.

I think I've made it work the way you want. If not, I can tweak it to your requirements.

If you want to try it out just drop me a mail (dogphishtemp at gmail.com) and i'll send you the URL. If you think that it works good then i'll try and put this somewhere for everyone to access.

I have someone working with me on creating a scanner, and Im pretty confident it will do what I was hoping. However feel free to send me your results, and I will check the charts to see if your scanner results are working.. thanks

Hi Michael, I'm a developer myself. This chart scanner will be very helpful, I've been willing to build one myself, but if you're already building it I'll gladly help you adding more exchanges and features if you want.

Hey Michael - I know this is a little late reply, but I'm willing to beta test your scanner and give as much feedback as possible. Let me know if you're up for it! (Would have sent you a dm but doesn't look like you can on this website.)

This method seems to work great on a down-trending chart but how would this work on an up-trend? The base would not be broken on an up-trending chart. How would that work?

thats why you have to collect some of these coins and keep them.. trade them now and make some profit but keep some stored away with your profits, so that you can enjoy the ride up, when things change.. there are many stratagies you can use to participate on the way up, because as things go up every trade works.. but yeah, i should discuss this in my next video

That would be great, I have some coins I like and a percentage is kept in cold storage but would also like to be doing some trades on the way up also. Looking forward to the next video, your stuff is great.

OK, thanks.. I was hoping that the charting would allow us to trade your method (long) whether the price of, say ETH in my example, is going up or down without having to short. I figure the exchanges only want to price using certain base currencies. Thanks again!

hi luc....I too am an options, stock and futures trader. I am opening an account on cex.io. The question I have is, after you buy the currency, do you place it in a wallet or keep it on the exchange. This is all that is left for me to figure out before I start to trade. A video on what we have to do once we purchase the currency would be awesome along with the exchanges you trust and trade on.

coming from the stockmarket you might find some of these exchanges frustrating, because there is no help line to call if you have an issue with any trade, or a glitch in the exchange platform.. anyway think of the exchanges as your brokers, (even tho you cannot call them) and you simply buy and sell or trade the coins on there list.. you only send coins back in you wallet if your goin got hold them for a while.. Ofcourse there is the danger that an exchange will get hacked or close or something and you lose your coins.. that could happen so I spread out my coins at different exchanges, to keep me in the game

I keep my money in exchange simply due to the fact I don't think coinigy offers you to trade with money in your wallet, if you want some good exchanges check out kraken, bittrex, and I use poloniex too(which has had some bad rep lately) I know I'm not Luc, but I hope this helps(:

hey Luc @quickfingersluc , would you be able to go over the 50% retracement moves that you worked through in some of your old videos please? that was really interesting stuff and made sense. thanks very much!

Back in that video I was explaining the laws of averages.. and how a large group of people will tend to find an average price.. so even it something is trying to run higher in price, i likes to pull back to 50% before it makes its next move.. but yeah, I guess I could address that in the next video.. it isnt really relevant to the bases/safe circle method i have been explaining here.. but no problem, ill write it down

It wouldn't be as nice a chart or strategy in that case. Bitcoin and Ethereum both looked like that for a while tonight.

I think the answer is you simply would have to find something else to trade. It's not worth the risk of buying at a base and hoping it keeps going up. You may kick yourself when it goes up 10% without a crack, but you WILL kick yourself when you lose 10 or more % and have to hope it goes back up.

I would think you could use the same methodology. When it rises, on the first mini crash down (half way or even lower to its previous base) buy. Sell at 10-20% or whatever your target is. Repeat. Once you have a few rises and crashes you have data to look at and note how long the rises and crashes are and use that info to set your buys/sells if its a bull market. Does that make sense @quickfingersluc?

thanks for this question, that's what I was thinking about.. Luc's strategy is excellent on a downtrend period, but what about the uptrend period...

thanks to you and Luc

I'm testing it out, but there's an android app called Boilr that allows you to set alarms based on % change and time interval. I'm using BlueStacks Android Emulator to run it on my computer. I'll let you know if it seems to work, but you have to set each alarm up separately--yet it seems like you only have to do it once per coin per exchange.

Alternatively you could also run it on your phone. I set a test alarm (1% change in 5 min) and it worked! It could be a poor man's market scanner in the interim, provided you take the time to manually add an alarm for each crypto (unsure if there's a max alarm limit).

Thanks for letting me know about BOILR, ill check it out.. there probably is a limit to the amount of alarms, but it might be good.. Regardless thanks for the heads up, im working hard to find one..

Take care of that migraine Luc.

On that Scanner i know we want to pull info from the exchanges themselves to have better response time. Can you give me like your top 5 exchanges you would want this to scan. I have someone willing to see what they can do. I would like just a few to test with and if they work then we could expand to more.

These are the ones I gave for now.

Would it be possible to maybe give us homework? Say, Luc's top 5 coins/charts to look into. You don't have to tell us where the bases are or anything like that, but just the names of them and then we can do our own work within in them and maybe post our results to see if we are identifying the bases correctly and if anyone does a buy/sell they can show off their trades.

Its a nice idea, but that would encourage alot of replies, and I really dont have time for all that.. homework for you is more work for me.. and I need to be trading

Hey Luc, following along since about a week and watching past videos, thanks for the great insight you give. And get well soon, amazing that you even took the time to make this video.

I tried your method and it worked (of course!), although I did make a mistake and maybe sold too soon there, but at least it was profit so that's good :).

The 'Oops' refers to the mistake I made, guess was too excited to get in the coin again haha. But the next two buys were great I think, almost at the bottom. In for 3 buy moments now, average at about 0.083 so waiting for it to bounce (now at 0.084). For now 5 to 10% would we fine by me. For ETH that's a nice percentage I guess. And after that sell just wait for the next buy opportunity.

Probably should have sold after the Oops and Yes. Then make that Yes the new base. That would have pushed me to sell the final Yes in this chart already at 0.082 - 0.084.

Thanks 😀 ! Trying with very small funds. Also had a trade on AE/BTC, made almost 40% on that one. But it was just a $50 or so trade. For trying out Luc's method, so far if worked. Was on an exchange not supported by Coinigy so no nice chart.

It's impressive to see that you bought 3 times right at the low point. It looks like the first 2 were at support, but how did you decide to take the third trade at that point?

The third buy moment you mean? That was a mistake for sure, don't know why I did that. Depending on which coin I'm trying to sell at 5%, 7.5% and 10%. Also trying to buy like 5% below a base and then further down. That's a new goal at least. Which in case of ETH seem reasonable, although sometimes you see 30%+ on a day, but yeah you have to be there and read the story of the chart like Luc says. Not even close to what he is doing. Last week I also traded AE/BTC, just a small amount like maybe $40 but that got me almost 40% in a few days. But very low volume coin that AE thing, be careful with it. So for some coins it is possible to get 20%+ percentages on a trade. Just set the sell orders up and try not to touch them :) Have a little faith right ;) ?

Been following this low volume coin, and just a few minutes ago my alert got triggered (account in process so its not a buy order)then it dropped below 0.00001000 down to 0.00000911, by the time I pulled the chart up (some 30 seconds later) the price already jumped back up 25%. You can see on the chart I provided it just happened. Now my question is had I had a buy order down there at where I had my alert would I have gotten in down there? Or would that drop in price have happened too quickly. Kinda threw me for a loop, but if I'm looking at it right I could of had a quick 25% profit had I set a buy order down where I had an alert set, correct?

You would have gotten it.. the exchange doesnt skip orders.. we dont have a book like the stock market where participants can buy anywhere on the level 2.. so you would have been executed, because you would have been in the line up on the bid.. This happens to me all the time..25% in a minute

I had two alerts, one at 1000 and one at 900, the 1000 one went off since it dove past that to 911. I set my alerts that low for this exact reason to see if theres a quick drop like there seems to be on previous recent areas of the chart. It just all happened so fast, I doubt I could of manually done anything about it, just curious if the buy order would of taken place since the dive down and bounce back up was so fast and furious.

Sorry Luc, when I posted this earlier I was busy at the office and had not gotten a chance to watch the video itself and you answered my question with that last example of where to sell. Hope you feel better, this video was gold!

Sweet! In process of getting my exchange accounts set up, can be quite the pain in the beginning lol, in the meantime I've been watching all these trades I could of taken and its KILLING me!!

Could you do this lucs method upside down. I mean I just tested it with bitfinex eth/usd chart randomly and when things move up after huge move down it tends to come back to the previous base. Its bit hard to figure first but seems to be accurate in various spots. So you should basicly start selling your ethereum in these spots or use margin trading shorting. What do you think?

All those upper supports, if it had broken them it would have came back. I used the min 10% bounce down in this example

Not sure how this shorting works, does it have leverage or can you short without leverage, at least you have to pay interest.

Thanks Luc for taking your time, even when you have this severe migraine and creating quality content for us. Best wishes from all of your followers :)

This post has been ranked within the top 80 most undervalued posts in the second half of Jul 17. We estimate that this post is undervalued by $12.85 as compared to a scenario in which every voter had an equal say.

I´m watching/reading all your Post and also all the comments in this great community. I really appreciate when you use the terms "us" and "our group". This shows what your intentions really are about. Helping others discovering the huge potential in cryptos.

I´m just starting trading and bought my first ETH and BTC on coinbase and set up accounts on Bittrex and Kraken so far. I even managed to link them both to Coinigy. What I have problems with is, how to send the funds to the trades and implement them to coinbase, so I can start trading?

Also what wonders me is, how do you keep track off all the currencies you own? Or do you trade only BTC/ETH against other coins and back?

after you fund Coinbase, then you just make a transfer to the exchange of your choice.. this doesnt take long.. and since you have Coinigy linked to your exchanges your ready to trade.. I keep a set amount of ETH and BTC and USDT in my accounts so that I can trade any pair.. After you make a few trades, it will all get very simple..

Honestly I dont really keep good track of my portfolio..all I know is it keeps going up, because I can't even remember that last bad trade.. its all win win win.. so I just see charts and take trades, and make profits, and add it all up at the end of the year..

I've been using Excel to give myself a sense of how successful my trading patterns are while I'm still learning. But it's a real PITA to keep up. If you just want to see how your portfolio size / coin allocation changes over time, Coinigy will show that on the Balances tab. Just go there and then choose Chart View.

Hey guys,

Thought I'd share some good coins to trade. This is on Kraken for coin EOS/BTC. You can get 10-15% daily, and if you save some coins up to 40%. Here are the trades I did past couple of days. Good luck all. https://www.coinigy.com/s/i/5972377447724/

Sweet trades and thanks for the share! I've been tracking that one too on Kraken but with the EOS/USD pair, still not trading yet because getting everything set up at Kraken is awful and their support sucks! Hoping to be able to wire money anyday now and start trading and EOS is a coin I've been watching closely.

Thank you. Hope you get those funds on kraken smooth. If you live in US you can try Coinbase or GDAX. That is my preferred merchant/exchange for US to BTC funding, but the fees are high on Coinbase. Let us know how it goes.

Thanks for sharing that oneluckyflip. Do you set up buy-limit orders to catch these downward spikes in advance or are you watching the chart / alerts and then manually placing your buys?

nope, there really is no way to predict that volume buying.. you would have to be aware of the pump, and were its being pumped from.. or the news that might have come out (like it was added to another major exchange or something big)

Hey guys! Finally got my account approved 5 days later. Been dying to comment and participate in these convos. So I've been studying luc's method and have a couple possible trades. I know Luc himself isn't going to be here for the next few days, but, nonetheless, I would like to see what you all think.

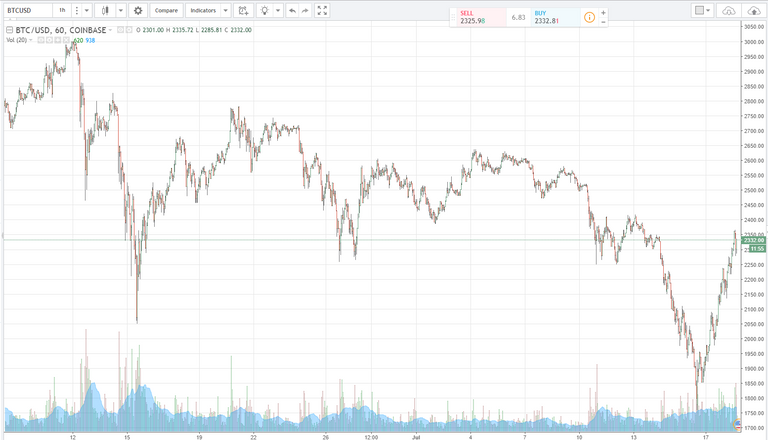

Looks like a couple of drops past a base. Could the sudden surge in Bitcoin price be causing this? I've had quite a few alerts go off at the same time bitcoin rises all the way to 2700-2800.

I was just about to ask the same question, had several alerts to detect falls in prices and began to sound all together. I suppose it is because the prices in the other currencies are relative to bitcoin. Unfortunately I bought when the bitcoin had not yet increased and now my purchases are in red, I will wait until tomorrow to see what happens.

I think it's a good time to buy

Yeah I've been going back and forth in my head whether or not to buy. I haven't pulled the trigger on buying bitcoin yet, and I feel like now would be a terrible time to buy some because the price is skyrocketing. At the same time I could miss out on some pretty good trades.

Do you set all your sell orders as soon as you buy ?

For example :

When you buy at the bottom, do you set an alert and wait to sell, or do you systematically place a sell order at the previous base ? (but then you'd probably miss % if it goes above the base).

yup, i set up sell orders right away.. I set up several all the way up .. but if the coin jumps up very fast.. I will cancel all orders and sell out quick.. a fast trade is better than a long wait.. Always take a gift in the market.. and redeploy your capital on another trade.. time is money.. but if it just slowly grinds up then I leave orders to sell as it slowly makes its way to the base and perhaps beyond..

Hope you're feeling better and thank you for your all posts/videos. I'm learning a lot.

I had a question in regards to you trading newly listed coins and/or IOUs. In all of your videos you preach looking at a minimum of about 2 months to determine the probability of a trade, however, with these newly listed coins there isn't enough data yet to fully analyze and get a feel of public sentiment. How do you go about trading these types of coins?

You need as much data as you can get, to get a story for what your probabilities are.. so if you dont have much data then you have to keep you trades small.. greater risk=less size trades

Thank you for the response, Luc. Could you describe your setup as far as dual+ monitors, best way to view the charts, any particular settings/features you use? I'm struggling with setting up the charts for viewing. When I try to zoom out to view the larger picture (1-2 months) I have a hard time finding the true bases because everything is so condensed and I can't really make out things as clearly so I'm constantly zooming in out of habit. I can't help it and every time I try to adjust the chart it always gets jacked up and moves all over the place and I lose my position. What's the best way to view everything simply? I feel really stupid not being able to easily scroll through and view a chart so I can implement your methods but it gets messed up every time. Maybe my settings are too sensitive. I don't know but it's driving me crazy that I can't even look at a chart right. Any tips to make this easier would be greatly appreciated. Thanks.

Yeah, i can understand that.. size does matter, in this regard.. I work with 5 monitors, 4 of them are larger than 40" and one regular size 24" .. so I have all the screen space I could want.. but if your on a laptop it can be challenging.. perhaps you might have an easier time with Tradingview.com :

That is a lot of space, that's like watching on 4 tv's haha. Yeah, I wouldn't do this on my laptop. I have a desktop with a dual monitor setup both 24" screens. With only having 2, what do you recommend is the best way for viewing and drawing my bases? Maybe I need to practice more get used to moving around the charts first. I don't know why I'm making this more difficult than it needs to be.

yeah, its pretty hard for me to advise you on setting up your screen space.. but you do need to see those charts clearly, so I hope you mess around with the charts until they are able to be scrolled out futher..

I have a Macbook Air 13 inch screen. At the office I connect up to my 27 inch monitor and its just fine, but oftentimes I end up at home having to chart bases on my Macbook, its a bit of a pain but I've gotten used to it.

I'm rewatching all the videos again. I think I'm still not confident in determining what's a true base and if the chart/coin is a good fit for the method. I kind of binged watched them all in a row and understood what Luc was teaching but I don't think I gave myself enough time to really digest the information. Hoping the refreshers will help.

Welcome back I enjoyed your old videos. I have taken a few things from your videos and integrated it into my trading, though I do trade differently. I'm not sure what advice has been given to you yet about securing accounts, etc. but I am going to give a few tips that have helped me immensely:

Use a password manager such as LastPass(this is what I use) and let it generate a secure, complex, unique, long password for every website. At least use if for the websites that security is a must.

Use 2 factor authentication wherever possible, particularly on important account related websites.

Your primary email that you use for logging into your financial websites(broker, bank, exchanges) you absolutely must use 2 factor, and have the longest most complex password possible. This is where LastPass shines as it can auto-fill that password for you. If someone gets into your primary email they can reset your password all over the place and have access to everything. It actually is not a bad idea to use a separate email just for your secure accounts.

If you do use LastPass, use a fairly long password and do not lose it as you cannot reset it like other places. Do not allow your browser to save this password and require re-logging periodically.

Thanks for all the tips.. Yeah Im pretty tough on security measures now.. basically everything sensitive is kept offline.. and my paswords are rediculous, and i 2 factor everything.. thanks for the advice, I agree whole heartedly..

Hope you feel better soon man. And thanks for this video. In my opinion it is your highest quality educational video, because you emphasize what not to do, and outline how to avoid the common mistakes.

I love how your Trading Videos 2.0 series is going. It seems like your engagement with this community on steemit is making it really clear what common mistakes us newbies make, and I can't express how valuable it is to get your help avoiding these pitfalls.

Thanks for the encouragement to keep making videos, I am so busy that I often think of slowing down with the videos. But then I start making lists of peoples common questions, and I decide, i better make a few more.. I hope that after a scanner comes out, my videos will be more about what awesome trades we got today, instead of always instructional videos..

Always appreciate your videos! I've signed up for a Coinigy trial and am really liking how it works at the mo. Still treading the waters and getting used to the world of #cryptotrading. Thanks for your help :)

I didn't realize that USDT was the tether coin that is basically a coin pegged to the dollar....so I had to sell 5% of my BTC for USDT to get into the trade.

I made a few mistakes along the way and realized I'll have to keep some USDT in my balance so I can make all the UDST trades that come up in the future.

Luc, thanks for being there today. Migraines suck and there is so little you can do about them but wait them out. Make sure you're drinking plenty of water.

Just got to thank you again Luc! :) I know what that headache means and it really sucks. Still you come through and give us this great knowledge. :) Thaaanks! :) The pieces are falling into place more and more.

Another Luc's masterpiece video. Even with a heavy headache he's here gently making an effort to share his knowledge, wisdom and experience with us.

Thank you, Luc! We all deeply appreciate! Wish you a swift recovery.

Thanks again for another great video! Sorry that you weren't feeling the greatest today. Been loving the videos, Made some really nice trades so far.

I was wondering if you could maybe do a video about a different trading technique on how to trade on an extremely Bullish chart, something like what was going on back in May. Maybe I haven't looked closely enough but back in May it seemed like a lot of coins, Ethereum especially were just going up so much that they never really broke any bases for quite awhile.

Just curious if there is any safe ways to trade on that kind of trend in the event that in the next few weeks or months down the road we get a similar situation. I'm mostly wondering because if I'm sitting with most of my portfolio in USDT waiting for bases to crack, I could miss big gains if everything skyrockets back to all time highs or further.

I know you say you don't breakout trade so I'm curious what you think someone with a smaller account should do when the market turns around. Just grab a few strong coins and ride them up, or maybe there's a strategy to getting in and out of positions in that scenario?

I often say to everyone in the videos that I hold some of most of the coins I trade.. you have to start building a portfolio of coins.. and even though the market turns up and you feel like your missing a large opportunity because you are not all in, you will still realize huge gains because you are sitting on all those free coins.. plus, trust me, there are always new trades and big swings to get you in.. its always a win win situation.. all the trades you take on the little coins will work even better with a bull market.. basically any trading system works in a bull market.. but mine even works in a bear market

ofcourse, thats fine.. Im just using steemit as my one center to answer questions and create a video teaching library.. but please feel free to promote this blog anywhere you think it will help others.

Whats happening with the PSD coin is pump & dump. There are several groups on telegram, some with 20k+ members that announce to buy a certain coin at a certain time, etc. So the suggestion is for those who want to look deeper into those coins probably good idea to join those groups and you can be ready for the pump and hope you hit! Coins are often repeated in pumps every few days within a couple weeks (or more) time frame period.

Good point, sure looks like a pump and dump. Putting in orders should take care of this though. If you buy it when it's relatively low, you can just put in a sell order for whatever point in the average spike that you want :)

Thanks again for your videos. You are valuable to this community and your posts are seriously undervalued in payouts here imo. I made a couple purchases today in the alt coin space. And was able to do some quick flipping of btc, ltc, and eth :)

I did like the looks of AMP today. Picked some up at 8200

Thanks for the screen shot.. 1st thing is I think your not on 1hr bars, and on the one hour timeframe AMP has not been trading properly, its missing the bounces.. So for that reason I stopped buy it for now.. 2nd, your not allowing a base to form and then a panic below the base..

It takes time to see the charts the way that I see them, but if you keep watching my videos, Im sure you will get it.. and you can always post charts, to check with me..

I agree that the upvotes are not paying me much in steem, however I am not making this blog with that incentive in mind. I just want to help others grow there accounts like me..

Thanks for your response. It's something that I'm learning to do . . and I appreciate you taking the time. I'll continue to keep watching the charts, and learning your style. I've been trading a different type . . . but I really enjoy the way you trade, so I'll keep watching :)

It doesn't look like you're following Luc's method here. His strategy is to wait until the price goes below a base, when there's a panic and a sharp dive down in price. In this case it looks like you're buying right at the base and hoping it will turn around there.

I should know, I've done this plenty. Just be careful not to get burned trying to predict where a price will go. What's great about Luc's technique is there's very little guessing involved - the price is so deflated by the time he buys, there's built-in upward pressure for it to recover.

Something isn't adding up here, AMP/BTC on Poloniex hasn't been anything near 8200 since the 11th, and my chart looks nothing like yours. PS: +1 to everything @wisebeardy says below.

I agree @wisebeardy, it isn't Luc's method. I'm learning his as well. The AMP purchase is using an RLZ around the 78.6 fib for an entry level, looking at the overall trend. It's more of a longer term trade. Momentum indicators and market structure are used in conjunction with price location. But . . I really love Luc's method. Hoping to incorporate it for day trading.

Quick question, would it wiser to trade pairs where one of them is a Fiat like USD or EUR? I understand that when trying to get more BTC (or ETH) you should trade BTC/ETH for example.

But because BTC/USD is going up and down so much, ETH/USD or ETH/EUR would seem wiser. Except of course if you want to hold BTC for later, like a couple of years: but predicting the future is hard..

Everybody needs to pay bills with 'real money' since it is not possible yet to pay everything using a crypto currency.

I dont worry about the ups and downs of the BTC im holding, or the BTC im using to trade other coins with.. if you keep switching back to fiat then you will miss many many good trades.. so you have to reserve some BTC to use for trading other coins.. its all part of the business

My thoughts: If you're not using the BTC you're making to pay the bills, then the weekly ups and downs don't matter as much. All that matters is the long term BTC trend. Which is up up up.

Yes that is what others tell me too. Buy, Sell, Repeat. And put a percentage of the sell profit away for later like Luc suggests. Sounds like good advice to me.

Hey Luc sorry to hear you're not feeling well. Do you like this base at 14? It's currently Monday night and we're sitting pretty at 9. I like this base but wanted your feedback and anyone else on steemit that follows you.

Ooh thats a tricky one.. the chart looks awesome, but that one drop from 17 to 10 was big and it did bounce imediatly to 1300, when the base could have arguably been at 1350.. so its hard to say if it will go back up to 14 anytime soon.. then that bounce off 8s to almost 11s is again huge percentages, so I thing you have to accept 8s as a base.. its such a good chart that im not sure how to advise you.. its somewhere between a low volume account builder type of play and a regular chart .. So I would just make your entries small and try to milk it for a while off any new low you get..just buy all new lows.. thats what seems to work.. I would also be layering in on this one, because its shown that it can panic dip..

Hi canada-tothemoon

I think that if you move down to 1h chart that would be a great winner, with more than 10% winning .

It jumped up to your 14 base in the next green candle.

please correct me if I'm wrong, just learning like you.

Hey Luc, thanks for the videos, they are really helpfull.

You said in the other video that in case you have the market scanner you will set alerts in case the price of a coin drops for 10% in the last 5 min. Don't you think that 5 min is too short, i think that a good interval might be 30min or 1hour. I don't think i ever saw a coin drops by 10% in the span of 5 min.

the market scanner would be for daytrading pimarily.. I agree that ETH and BTC and such dont ever drop 10% in 5 mins, and we will continue to trade these using alerts that we set in Coinigy.. But there are many lower volume, thinner coins that do drop very fast and will make small fast trades possible.. Look at FUN/BTC.. i got that spike down yesterday

there is never any fortelling how high it will go.. the spike depends on how big the buyers order was.. but you are in profit so thats a good sign, you might want to layer your sell order though, beacuse u dont have to factor in comissions

I let it go with a few dollars profit. Didn't want to get stuck. :) Off to other promising bases/panics and I'll maybe revisit this one in 3-4 days. :) Thanx for everything Luc! :) I feel really motivated with my new knowledge.

Kind of. It was not for more than 60s. Even though I bit inside the spike my order was just not processed :(. Probably we will need to wait for next 5 days :).

Hi Luc,

I just opened account with Bittrex and bought some bitcoin to trade after watching all your previous videos.

I will try the small account builder that you mentioned in this video. Hope to get to your level soon !

Hi Luc, just started watching your videos a few days ago and I'm extremely excited to give your strategy a try, thanks for sharing it! :)

Do you think ETC is a buy right now, or do you consider this dip to not be a "Surprise"? If it drops to 0.006 I'm going to get in (unless you reply to this first and advise otherwise). Thanks again for sharing your knowledge man, it's greatly appreciated!

Also, one more question: How do you adapt this strategy in a bull market?

Thank you for including a chart.. yup, it does look pretty good to me... you should scroll out so you can check your odds of success tho.. let me show you:

Hey Luc you're on a roll with these videos. They have answered every single question I have had. Can you tell me how you keep track of your profits and how you manage to not put all your profits into your next trades? Also do you move your profits off the exchange? You always talk about taking the profits out and keeping your original amount to trade with for free coins. I am using a smallish account and find it hard to keep track of everything unless I go to my orders and see how much was traded and even then I don't keep my profits.

Everyday Coinigy sends a balance statement to your email. That will lay it all out for you, what your in and what account is worth as a whole... besides that, in one of my videos I showed how to use Coinigy charting to see your % on a trade.. so that will maybe help you to figure out what you made over what you have... Im not sure if that answers your question.. but I always keep some of what Im trading in the actual coin, for the future

I never knew that but thanks that helps a lot. I actually understand now what you meant. You can sell at a certain price and buy back in at a lower price for the same amount you bought for and be sitting on free coins. Today was an amazing trading day. I just hope Ethereum panic drops again! You're awesome Luc! Also I avoided USDT because I didn't understand that it usually 1/1 for USD and now my two main wallets are ETH/USDT

@quickfingersluc .. Can you shed some light on expected gains from such trading. Let's assume one wants to play it safe, and only do high-volume well known currency pairs. What's an average return per month say? Thanks a lot for your vids, love em!

its impossible to know.. not only does every trade give different percentage opportunities, every trader will enter and exit at different spots.. take ETH for example.. two days ago we hit $135 and now its trading at 210, thats a 55% return in two days!!! will you buy the perfect bottom and sell the perfect top, not likely, but you will make some awesome percentages in there somewhere, here are my buys and sell on this last dip:

When you have a small account and you're setting buy orders on these low volume coins hoping for quick drops, do you have to be careful about not setting too many buy orders?

Like if I only have $1,000 and the amount of buy orders I set amount to more than that and they suddenly go off and execute the buy what happens? Will the buy orders that you no longer have enough funds for just not get processed?

I ask because I feel like to truly take advantage of those quick drops in price you're gonna have to set up a lot of little buy orders, kind of like little traps, I just don't want to overextend, but at the same time don't want to miss out by not having a buy order ready for those quick 25% gifts ya know. I hope I explained myself properly lol.

You cannot set too many buy orders, the exchange wont let you.. You can only set up buy orders equal to the amount of money you have availible.. and these are high percentage trades, so if you have $1,000 dollars, i would split that up, into atleast 3 parts.. $330 $330 $340 and then trade three different low volume coins.. even if you make 20-30% on a trade = lets say $100 profit per trade, that only takes you 10 trades or so before you have doubled your account.. but you have alot less risk than putting all 1,000 on the line in one trade.. 10 trades go by fast, maybe 2 weeks and you will double your account.. thats how powerful this type of trading can be on a small account

You mentioned that you hold onto 20% of your ethereum. Do you follow a specific set of rules to come up with how much you sell and how much you hold onto?

nope, not really.. I just hold some.. if it was a great high percentage trade, then I will likely hold 20% or more.. but if its a smaller trade then I will hold just a little, and i send those ETHs off to a wallet periodically, so that my numbers dont get confusing.. i just like to collect "free" coins..

Hi Luc. I just came across your blog and I find it pretty insightful. Thanks for the work so far. I only have Poloniex and bitrex exchanges. What top exchanges will you recommend I get in on? and I will be glad if you could share some of your favorites with me to get started with the chart analysis. Also I have been holding ETH in a coinbase wallet for a while . I got into it in march with an investor mindset. I will like to get in on the trader kind of mentality. Thanks

Thanks for this video Luc. I was wondering if it's worth or even possible to trade altcoins paired with BTC in channels (instead of trading pops/pumps)? I did some trades on SNM/ETH that you showed in your videos and some other coins and it worked fine, but I've looked over like 100 coins on Bittrex and didn't really find any coins that would move with high volatility like most ETH pairs do. And also, do you care about round numbers when trading? It seems that often there are going to be bases or resistance around 1, 1.5, 2 etc. Maybe that might help in gauging the bounce or dip size.

I only trade low volume thinly traded coins (account builders) in ranges.. its not predictable enought to try to do that with larger coins like ETH.. they break out of there range too easily.. thats why I trade ETH off bases and panics.. I read the charts and let the chart story tell me what strategy I should be using.. and yup, round numbers are important, because humans are the traders, and thats how they think.. so as an example 200 on ETH was great support in the past

Luc: I am growing concerned I may have made a mistake. ETC/ETH is experiencing a panic drop today, I bought at more than 10% below the base in the middle of the panic. https://www.coinigy.com/s/i/596e66abc6b56/

After this buy I checked out the ETC/USDT and ETC/BTC charts, both were climbing at the same time. Thats when it dawned on me that ETH is skyrocketing today, which is in turn decreasing the value of the ETC/ETH pairing - in fact virtually all of the ETH pairings that I watch are diving huge, my alerts are triggering so quickly I cannot keep up.

Should I have considered the strength of ETH prior to making this trade, or do you think it was fine? Am I being overly cautious? Should I have realized that when ETH skyrockets, it can negatively affect the alt-coin pairings that are traded with Etherium?

yes and no.. I agree that the drop is due to the value of ETH increasing fast.. however based on the chart of ETC alone, your entry is pretty good.. I would have drwn your base around .081ish tho and you should scroll out your chart to see a more fuller picture, but i think you will be fine, because I looked at the bigger chart and it has a great history of returning to its bases.. so in my opinion your entry is good, but make sure you participate in selling the next bounce, because you didnt catch the bottom on this and your profit % potential is not that high..

I reviewed 6 months of data before choosing the base at .078, I posted a more zoomed in chart only because I thought it would better express the post - we are on the same page. My base was initially at .081, but I revised the base to .078. Why would you choose the higher base, rather than the more conservative .078? I suspect there will be a good lesson to be learned for me in your response.

Can you go into greater detail about reviewing the gains or losses of coin pairings prior to placing trades? I intended to layer in and buy more as it approached the bottom, but I got gunshy - I wanted to wait until I understood the cause and effect of ETH skyrocketing so quickly, and ETC dropping like a rock before I placed any additional trades. So many opportunities yesterday to trade on ETH coin pairings, but without this understanding I felt it was best to sit out until I better understand why ETH's rise is affecting coin prices and how best to take advantage of it with my trades.

I choose my bases by the bounce they recieve.. ETC bounced from 81ish to 96.. the 78 you are refering to had no bounce (on the Bittrex chart) so it doesnt qualify as an area where buyers were willing to move in on the price and buy...

As far as your question on coin pairings.. Everything relates to eachother in the market.. So lets say ETC is paired with ETH... but ETC is also paired with BTC.. if BTC stays constant but ETH falls in value on the ETH/BTC pair, then what happens to ETC/ETH pair.. because all three are paired against each other..But its only ETH thats falling.. so should ETC lose BTC value? Or should ETC/BTC stay the same but ETC/ETH go up, since ETH is going down.. its pretty complicated to think about, but each coin in a pair effects the other pair relationships.. So basically if one coin is having a big move, in relation to BTC then you can expect other coins to react that are connected in pairing.. And i know that doesnt give you an exact answer but there really is no metric for this, because its not like the stock market, where there is one base currency, its like forex, where pairs are effected by other pairs.. Thats why its always best to trade the chart, and not let things get too overly complicated.

Hi luc ! thanks again for everything

I know you covered something similar in a video but I have to ask

In the chart I uploaded I drew some bases .. but since there are no close bases more than the left far one .. in this case can I consider it a base ? or it was too far and should be ignored?

Thanks again .. appreciate all your help in the videos and replies :)

Nope, sorry, that is not a base in my books.. you have to actually wait for ETH to pull back and form a base and then bounce hard off that base to give you a current understanding of where the crowd supports the price.. and it will soon, that was too fast of a tare

Thanks a lot ! That's what I actually did .

But I think I made another different mistake .. which happened to me before.

I bought when it broke the new base,but it didn't bounce that hard.. what do you suggest next? to wait more ?(days) or to accept this loss and get on with a different trade ..

When should we accept the loss and move on ?(I mean in time)

Again I really appreciate your efforts here .. and sorry if my questions are so intuitive but I'm still new :)

sorry I cannot get to these questions very fast.. I just have so much going on.. hopefully on those trades you got in small positions, because thats not too far from the base when you started buying.. not much profit back to the base.. However in this case you will have made a great trade possibly because the ETH price is now 235

I wouldnt set a goal like 10%.. i just trade the chart.. get out on the bounce a little at a time.. every positive trade is a good trade.. some will be 5% others will be 50%... it all depends what the chart tells you to do

After all I held my position and soll of for a profit of about 10% (Thanks to you).

But then again sometimes it may not come back , and I'm really still confused sometimes if to take a loss, or to wait .. or even if to sell where I sold or to wait more ..

I posted this on your other post, but i'll put it here in case you are not checking the comments on the other one.

Hi Luc,

I have been working on a Market Scanner these past few days. I have something up and running. It only checks Bittrex at the moment, but I am going to add a few more exchanges in the next few days.

I think I've made it work the way you want. If not, I can tweak it to your requirements.

If you want to try it out just drop me a mail (dogphishtemp at gmail.com) and i'll send you the URL. If you think that it works good then i'll try and put this somewhere for everyone to access.

Here's a screenshot.

http://imgur.com/a/mgqpO

Michael

I have someone working with me on creating a scanner, and Im pretty confident it will do what I was hoping. However feel free to send me your results, and I will check the charts to see if your scanner results are working.. thanks

Nice chart scanner 👌

Hi Michael, I'm a developer myself. This chart scanner will be very helpful, I've been willing to build one myself, but if you're already building it I'll gladly help you adding more exchanges and features if you want.

I'm not Luc, but that looks pretty sweet.

Hey Michael - I know this is a little late reply, but I'm willing to beta test your scanner and give as much feedback as possible. Let me know if you're up for it! (Would have sent you a dm but doesn't look like you can on this website.)

Micael. Just a quick not to thank you for the scanner. I will be donating to you as I grow my account.

Really cool dogphish!

This method seems to work great on a down-trending chart but how would this work on an up-trend? The base would not be broken on an up-trending chart. How would that work?

thats why you have to collect some of these coins and keep them.. trade them now and make some profit but keep some stored away with your profits, so that you can enjoy the ride up, when things change.. there are many stratagies you can use to participate on the way up, because as things go up every trade works.. but yeah, i should discuss this in my next video

That would be great, I have some coins I like and a percentage is kept in cold storage but would also like to be doing some trades on the way up also. Looking forward to the next video, your stuff is great.

Hey Luc, hope you're feeling better. Are there any exchanges that allow you to invert the trading pair?

As in, trade ETHUSDT using your method on the way down and then if the market turns around, switch to trading USDTETH.

that is the same pair.. regardless of how they lable it.. it would work the same.. when you make a trade your simply exchanging one for the other

OK, thanks.. I was hoping that the charting would allow us to trade your method (long) whether the price of, say ETH in my example, is going up or down without having to short. I figure the exchanges only want to price using certain base currencies. Thanks again!

hi luc....I too am an options, stock and futures trader. I am opening an account on cex.io. The question I have is, after you buy the currency, do you place it in a wallet or keep it on the exchange. This is all that is left for me to figure out before I start to trade. A video on what we have to do once we purchase the currency would be awesome along with the exchanges you trust and trade on.

coming from the stockmarket you might find some of these exchanges frustrating, because there is no help line to call if you have an issue with any trade, or a glitch in the exchange platform.. anyway think of the exchanges as your brokers, (even tho you cannot call them) and you simply buy and sell or trade the coins on there list.. you only send coins back in you wallet if your goin got hold them for a while.. Ofcourse there is the danger that an exchange will get hacked or close or something and you lose your coins.. that could happen so I spread out my coins at different exchanges, to keep me in the game

I keep my money in exchange simply due to the fact I don't think coinigy offers you to trade with money in your wallet, if you want some good exchanges check out kraken, bittrex, and I use poloniex too(which has had some bad rep lately) I know I'm not Luc, but I hope this helps(:

That would be great, as trading just ETH/USD at minute, and sold on last rise and things look to be turning

hey Luc @quickfingersluc , would you be able to go over the 50% retracement moves that you worked through in some of your old videos please? that was really interesting stuff and made sense. thanks very much!

Back in that video I was explaining the laws of averages.. and how a large group of people will tend to find an average price.. so even it something is trying to run higher in price, i likes to pull back to 50% before it makes its next move.. but yeah, I guess I could address that in the next video.. it isnt really relevant to the bases/safe circle method i have been explaining here.. but no problem, ill write it down

Great question!

It wouldn't be as nice a chart or strategy in that case. Bitcoin and Ethereum both looked like that for a while tonight.

I think the answer is you simply would have to find something else to trade. It's not worth the risk of buying at a base and hoping it keeps going up. You may kick yourself when it goes up 10% without a crack, but you WILL kick yourself when you lose 10 or more % and have to hope it goes back up.

I would think you could use the same methodology. When it rises, on the first mini crash down (half way or even lower to its previous base) buy. Sell at 10-20% or whatever your target is. Repeat. Once you have a few rises and crashes you have data to look at and note how long the rises and crashes are and use that info to set your buys/sells if its a bull market. Does that make sense @quickfingersluc?

thanks for this question, that's what I was thinking about.. Luc's strategy is excellent on a downtrend period, but what about the uptrend period...

thanks to you and Luc

Hey Luc,

I'm testing it out, but there's an android app called Boilr that allows you to set alarms based on % change and time interval. I'm using BlueStacks Android Emulator to run it on my computer. I'll let you know if it seems to work, but you have to set each alarm up separately--yet it seems like you only have to do it once per coin per exchange.

Alternatively you could also run it on your phone. I set a test alarm (1% change in 5 min) and it worked! It could be a poor man's market scanner in the interim, provided you take the time to manually add an alarm for each crypto (unsure if there's a max alarm limit).

Thanks for letting me know about BOILR, ill check it out.. there probably is a limit to the amount of alarms, but it might be good.. Regardless thanks for the heads up, im working hard to find one..

Took alook too, appears not update recently.Have found Coin Alarm & Widget by Nextcoin on android playstore has percentages +- we are after.

Congratulations @quickfingersluc! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPTake care of that migraine Luc.

On that Scanner i know we want to pull info from the exchanges themselves to have better response time. Can you give me like your top 5 exchanges you would want this to scan. I have someone willing to see what they can do. I would like just a few to test with and if they work then we could expand to more.

These are the ones I gave for now.

Those look fine.. I use your top 3 and I also like trading hitBTC

Would it be possible to maybe give us homework? Say, Luc's top 5 coins/charts to look into. You don't have to tell us where the bases are or anything like that, but just the names of them and then we can do our own work within in them and maybe post our results to see if we are identifying the bases correctly and if anyone does a buy/sell they can show off their trades.

That could be Fun = )

I like this idea!

Made my first trade yesterday with a 6% profit but man that was exciting :)

Its a nice idea, but that would encourage alot of replies, and I really dont have time for all that.. homework for you is more work for me.. and I need to be trading

Hey Luc...did you see the huge panic sell on BAT/BTC? I made some nice profit off of this.

https://www.coinigy.com/s/i/597004a84eb8d/

beautiful .. perfect trade :)

Nice trade! I was in there too :) lol keep em commin!

Niceeee 👏 It's time to make 💰💰💰

Hey Luc, following along since about a week and watching past videos, thanks for the great insight you give. And get well soon, amazing that you even took the time to make this video.

I tried your method and it worked (of course!), although I did make a mistake and maybe sold too soon there, but at least it was profit so that's good :).

The 'Oops' refers to the mistake I made, guess was too excited to get in the coin again haha. But the next two buys were great I think, almost at the bottom. In for 3 buy moments now, average at about 0.083 so waiting for it to bounce (now at 0.084). For now 5 to 10% would we fine by me. For ETH that's a nice percentage I guess. And after that sell just wait for the next buy opportunity.

Probably should have sold after the Oops and Yes. Then make that Yes the new base. That would have pushed me to sell the final Yes in this chart already at 0.082 - 0.084.

Two of your trades are ones I would have taken also, so thats a good start..

thanks! just sold the rest at 4.4% (.087) and 6.9% (.0891) New base set at .0832

GREAT trade on the 1st two buys you had on BTC/ETH!!!

Thanks 😀 ! Trying with very small funds. Also had a trade on AE/BTC, made almost 40% on that one. But it was just a $50 or so trade. For trying out Luc's method, so far if worked. Was on an exchange not supported by Coinigy so no nice chart.

It's impressive to see that you bought 3 times right at the low point. It looks like the first 2 were at support, but how did you decide to take the third trade at that point?

Thanks, beginners luck? I hope not :) ..

The third buy moment you mean? That was a mistake for sure, don't know why I did that. Depending on which coin I'm trying to sell at 5%, 7.5% and 10%. Also trying to buy like 5% below a base and then further down. That's a new goal at least. Which in case of ETH seem reasonable, although sometimes you see 30%+ on a day, but yeah you have to be there and read the story of the chart like Luc says. Not even close to what he is doing. Last week I also traded AE/BTC, just a small amount like maybe $40 but that got me almost 40% in a few days. But very low volume coin that AE thing, be careful with it. So for some coins it is possible to get 20%+ percentages on a trade. Just set the sell orders up and try not to touch them :) Have a little faith right ;) ?

Been following this low volume coin, and just a few minutes ago my alert got triggered (account in process so its not a buy order)then it dropped below 0.00001000 down to 0.00000911, by the time I pulled the chart up (some 30 seconds later) the price already jumped back up 25%. You can see on the chart I provided it just happened. Now my question is had I had a buy order down there at where I had my alert would I have gotten in down there? Or would that drop in price have happened too quickly. Kinda threw me for a loop, but if I'm looking at it right I could of had a quick 25% profit had I set a buy order down where I had an alert set, correct?

You would have gotten it.. the exchange doesnt skip orders.. we dont have a book like the stock market where participants can buy anywhere on the level 2.. so you would have been executed, because you would have been in the line up on the bid.. This happens to me all the time..25% in a minute

That's pretty damn exciting!

Your alert is set for 900, why so low? ADT dropped to 911, was the alert in your screen capture set after the drop?

I had two alerts, one at 1000 and one at 900, the 1000 one went off since it dove past that to 911. I set my alerts that low for this exact reason to see if theres a quick drop like there seems to be on previous recent areas of the chart. It just all happened so fast, I doubt I could of manually done anything about it, just curious if the buy order would of taken place since the dive down and bounce back up was so fast and furious.

Sorry Luc, when I posted this earlier I was busy at the office and had not gotten a chance to watch the video itself and you answered my question with that last example of where to sell. Hope you feel better, this video was gold!

I bought some of those in the early spike down. I did it just like you but instead of alerts I'd buy orders and worked just fine

Sweet! In process of getting my exchange accounts set up, can be quite the pain in the beginning lol, in the meantime I've been watching all these trades I could of taken and its KILLING me!!

Could you do this lucs method upside down. I mean I just tested it with bitfinex eth/usd chart randomly and when things move up after huge move down it tends to come back to the previous base. Its bit hard to figure first but seems to be accurate in various spots. So you should basicly start selling your ethereum in these spots or use margin trading shorting. What do you think?

All those upper supports, if it had broken them it would have came back. I used the min 10% bounce down in this example

Not sure how this shorting works, does it have leverage or can you short without leverage, at least you have to pay interest.

You would need margin to short... but yes a very good coin like ETH will work in both directions..

Hi Luc,

Thanks for the Videos.

HEY, I used to get migraines, suffered for 20 years.

Figured out it was from eating bananas!

Stopped eating them, haven't had one since.

Hope this helps,

Cheers

Chuck

Lol.. nice.. i havent eaten a banana for a few weeks, so i can rule that one out.. but thanks for the idea :)

Thanks Luc for taking your time, even when you have this severe migraine and creating quality content for us. Best wishes from all of your followers :)

This post has been ranked within the top 80 most undervalued posts in the second half of Jul 17. We estimate that this post is undervalued by $12.85 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jul 17 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Hi Luc,

I hope you are doing better today.

I´m watching/reading all your Post and also all the comments in this great community. I really appreciate when you use the terms "us" and "our group". This shows what your intentions really are about. Helping others discovering the huge potential in cryptos.

I´m just starting trading and bought my first ETH and BTC on coinbase and set up accounts on Bittrex and Kraken so far. I even managed to link them both to Coinigy. What I have problems with is, how to send the funds to the trades and implement them to coinbase, so I can start trading?

Also what wonders me is, how do you keep track off all the currencies you own? Or do you trade only BTC/ETH against other coins and back?

after you fund Coinbase, then you just make a transfer to the exchange of your choice.. this doesnt take long.. and since you have Coinigy linked to your exchanges your ready to trade.. I keep a set amount of ETH and BTC and USDT in my accounts so that I can trade any pair.. After you make a few trades, it will all get very simple..

@quickfingersluc How do you keep track of your portfolio? Excel sheets?

Online crypt portfolio trackers? And again, another great video.

Honestly I dont really keep good track of my portfolio..all I know is it keeps going up, because I can't even remember that last bad trade.. its all win win win.. so I just see charts and take trades, and make profits, and add it all up at the end of the year..

Also, is there a portfolio manager that can connect to Coinigy API? Been searching internet but I can't seem to find the answer.

Just found an answer...lol. I'll try cointracking.info and see how that goes.

I've been using Excel to give myself a sense of how successful my trading patterns are while I'm still learning. But it's a real PITA to keep up. If you just want to see how your portfolio size / coin allocation changes over time, Coinigy will show that on the Balances tab. Just go there and then choose Chart View.

Hey guys,

Thought I'd share some good coins to trade. This is on Kraken for coin EOS/BTC. You can get 10-15% daily, and if you save some coins up to 40%. Here are the trades I did past couple of days. Good luck all.

https://www.coinigy.com/s/i/5972377447724/

beautiful trading.. good use of the chart on a lower volume chart.. tons of spikes, a real account builder type chart... awesome job

Thanks Luc, very nice encouragement :)

Sweet trades and thanks for the share! I've been tracking that one too on Kraken but with the EOS/USD pair, still not trading yet because getting everything set up at Kraken is awful and their support sucks! Hoping to be able to wire money anyday now and start trading and EOS is a coin I've been watching closely.

Thank you. Hope you get those funds on kraken smooth. If you live in US you can try Coinbase or GDAX. That is my preferred merchant/exchange for US to BTC funding, but the fees are high on Coinbase. Let us know how it goes.

Thanks for sharing that oneluckyflip. Do you set up buy-limit orders to catch these downward spikes in advance or are you watching the chart / alerts and then manually placing your buys?

When I was working EOS on Kraken a couple of weeks ago, I just set a buy order in advance. We didn't have a market scanner at the time.

The trade I made yesterday

Is there any way to avoid this/see it coming?

nope, there really is no way to predict that volume buying.. you would have to be aware of the pump, and were its being pumped from.. or the news that might have come out (like it was added to another major exchange or something big)

thanks for making me feel better about missing the 200% trade ^^

' May I sell here? a little bit above buy.Sure, totally fine :)'

-----luc

Hey guys! Finally got my account approved 5 days later. Been dying to comment and participate in these convos. So I've been studying luc's method and have a couple possible trades. I know Luc himself isn't going to be here for the next few days, but, nonetheless, I would like to see what you all think.

https://www.coinigy.com/s/i/597140ea97cc9/

https://www.coinigy.com/s/i/5971410aab62e/

Looks like a couple of drops past a base. Could the sudden surge in Bitcoin price be causing this? I've had quite a few alerts go off at the same time bitcoin rises all the way to 2700-2800.

I hope you took the Dash trade.. it really bounced form .067 to .078 ... nice percentages

I was just about to ask the same question, had several alerts to detect falls in prices and began to sound all together. I suppose it is because the prices in the other currencies are relative to bitcoin. Unfortunately I bought when the bitcoin had not yet increased and now my purchases are in red, I will wait until tomorrow to see what happens.

I think it's a good time to buy

Yeah I've been going back and forth in my head whether or not to buy. I haven't pulled the trigger on buying bitcoin yet, and I feel like now would be a terrible time to buy some because the price is skyrocketing. At the same time I could miss out on some pretty good trades.

Hi Luc,

Do you set all your sell orders as soon as you buy ?

For example :

When you buy at the bottom, do you set an alert and wait to sell, or do you systematically place a sell order at the previous base ? (but then you'd probably miss % if it goes above the base).

Melanie

yup, i set up sell orders right away.. I set up several all the way up .. but if the coin jumps up very fast.. I will cancel all orders and sell out quick.. a fast trade is better than a long wait.. Always take a gift in the market.. and redeploy your capital on another trade.. time is money.. but if it just slowly grinds up then I leave orders to sell as it slowly makes its way to the base and perhaps beyond..

Hope you're feeling better and thank you for your all posts/videos. I'm learning a lot.

I had a question in regards to you trading newly listed coins and/or IOUs. In all of your videos you preach looking at a minimum of about 2 months to determine the probability of a trade, however, with these newly listed coins there isn't enough data yet to fully analyze and get a feel of public sentiment. How do you go about trading these types of coins?

You need as much data as you can get, to get a story for what your probabilities are.. so if you dont have much data then you have to keep you trades small.. greater risk=less size trades

Thank you for the response, Luc. Could you describe your setup as far as dual+ monitors, best way to view the charts, any particular settings/features you use? I'm struggling with setting up the charts for viewing. When I try to zoom out to view the larger picture (1-2 months) I have a hard time finding the true bases because everything is so condensed and I can't really make out things as clearly so I'm constantly zooming in out of habit. I can't help it and every time I try to adjust the chart it always gets jacked up and moves all over the place and I lose my position. What's the best way to view everything simply? I feel really stupid not being able to easily scroll through and view a chart so I can implement your methods but it gets messed up every time. Maybe my settings are too sensitive. I don't know but it's driving me crazy that I can't even look at a chart right. Any tips to make this easier would be greatly appreciated. Thanks.

Yeah, i can understand that.. size does matter, in this regard.. I work with 5 monitors, 4 of them are larger than 40" and one regular size 24" .. so I have all the screen space I could want.. but if your on a laptop it can be challenging.. perhaps you might have an easier time with Tradingview.com :

That is a lot of space, that's like watching on 4 tv's haha. Yeah, I wouldn't do this on my laptop. I have a desktop with a dual monitor setup both 24" screens. With only having 2, what do you recommend is the best way for viewing and drawing my bases? Maybe I need to practice more get used to moving around the charts first. I don't know why I'm making this more difficult than it needs to be.

yeah, its pretty hard for me to advise you on setting up your screen space.. but you do need to see those charts clearly, so I hope you mess around with the charts until they are able to be scrolled out futher..

I have a Macbook Air 13 inch screen. At the office I connect up to my 27 inch monitor and its just fine, but oftentimes I end up at home having to chart bases on my Macbook, its a bit of a pain but I've gotten used to it.

I'm rewatching all the videos again. I think I'm still not confident in determining what's a true base and if the chart/coin is a good fit for the method. I kind of binged watched them all in a row and understood what Luc was teaching but I don't think I gave myself enough time to really digest the information. Hoping the refreshers will help.

Welcome back I enjoyed your old videos. I have taken a few things from your videos and integrated it into my trading, though I do trade differently. I'm not sure what advice has been given to you yet about securing accounts, etc. but I am going to give a few tips that have helped me immensely:

Use a password manager such as LastPass(this is what I use) and let it generate a secure, complex, unique, long password for every website. At least use if for the websites that security is a must.

Use 2 factor authentication wherever possible, particularly on important account related websites.

Your primary email that you use for logging into your financial websites(broker, bank, exchanges) you absolutely must use 2 factor, and have the longest most complex password possible. This is where LastPass shines as it can auto-fill that password for you. If someone gets into your primary email they can reset your password all over the place and have access to everything. It actually is not a bad idea to use a separate email just for your secure accounts.

If you do use LastPass, use a fairly long password and do not lose it as you cannot reset it like other places. Do not allow your browser to save this password and require re-logging periodically.

Thanks for all the tips.. Yeah Im pretty tough on security measures now.. basically everything sensitive is kept offline.. and my paswords are rediculous, and i 2 factor everything.. thanks for the advice, I agree whole heartedly..

another thing would be to not have all your coins at the exchange but transfer them to your own wallet(s)

Hope you feel better soon man. And thanks for this video. In my opinion it is your highest quality educational video, because you emphasize what not to do, and outline how to avoid the common mistakes.

I love how your Trading Videos 2.0 series is going. It seems like your engagement with this community on steemit is making it really clear what common mistakes us newbies make, and I can't express how valuable it is to get your help avoiding these pitfalls.

Many blessings.

Thanks for the encouragement to keep making videos, I am so busy that I often think of slowing down with the videos. But then I start making lists of peoples common questions, and I decide, i better make a few more.. I hope that after a scanner comes out, my videos will be more about what awesome trades we got today, instead of always instructional videos..

nice post!

Always appreciate your videos! I've signed up for a Coinigy trial and am really liking how it works at the mo. Still treading the waters and getting used to the world of #cryptotrading. Thanks for your help :)

Thanks for sharing this Luc! Check out my 1st trade on BTC/USDT:

http://imgur.com/cH5x63H

I didn't realize that USDT was the tether coin that is basically a coin pegged to the dollar....so I had to sell 5% of my BTC for USDT to get into the trade.

I made a few mistakes along the way and realized I'll have to keep some USDT in my balance so I can make all the UDST trades that come up in the future.

Luc, thanks for being there today. Migraines suck and there is so little you can do about them but wait them out. Make sure you're drinking plenty of water.

A shot of espresso helps because caffeine is both a migraine trigger and also the cure. Thats why they include caffeine in Excedrin.

Just got to thank you again Luc! :) I know what that headache means and it really sucks. Still you come through and give us this great knowledge. :) Thaaanks! :) The pieces are falling into place more and more.

Another Luc's masterpiece video. Even with a heavy headache he's here gently making an effort to share his knowledge, wisdom and experience with us.

Thank you, Luc! We all deeply appreciate! Wish you a swift recovery.

Thanks again for another great video! Sorry that you weren't feeling the greatest today. Been loving the videos, Made some really nice trades so far.

I was wondering if you could maybe do a video about a different trading technique on how to trade on an extremely Bullish chart, something like what was going on back in May. Maybe I haven't looked closely enough but back in May it seemed like a lot of coins, Ethereum especially were just going up so much that they never really broke any bases for quite awhile.

Just curious if there is any safe ways to trade on that kind of trend in the event that in the next few weeks or months down the road we get a similar situation. I'm mostly wondering because if I'm sitting with most of my portfolio in USDT waiting for bases to crack, I could miss big gains if everything skyrockets back to all time highs or further.

I know you say you don't breakout trade so I'm curious what you think someone with a smaller account should do when the market turns around. Just grab a few strong coins and ride them up, or maybe there's a strategy to getting in and out of positions in that scenario?

I often say to everyone in the videos that I hold some of most of the coins I trade.. you have to start building a portfolio of coins.. and even though the market turns up and you feel like your missing a large opportunity because you are not all in, you will still realize huge gains because you are sitting on all those free coins.. plus, trust me, there are always new trades and big swings to get you in.. its always a win win situation.. all the trades you take on the little coins will work even better with a bull market.. basically any trading system works in a bull market.. but mine even works in a bear market

Great post, scanner is a super idea for all of us.

Can promote on FB as have a lot of collegues who want to get into crypto trading

ofcourse, thats fine.. Im just using steemit as my one center to answer questions and create a video teaching library.. but please feel free to promote this blog anywhere you think it will help others.

Whats happening with the PSD coin is pump & dump. There are several groups on telegram, some with 20k+ members that announce to buy a certain coin at a certain time, etc. So the suggestion is for those who want to look deeper into those coins probably good idea to join those groups and you can be ready for the pump and hope you hit! Coins are often repeated in pumps every few days within a couple weeks (or more) time frame period.

Good point, sure looks like a pump and dump. Putting in orders should take care of this though. If you buy it when it's relatively low, you can just put in a sell order for whatever point in the average spike that you want :)

Thanks again for your videos. You are valuable to this community and your posts are seriously undervalued in payouts here imo. I made a couple purchases today in the alt coin space. And was able to do some quick flipping of btc, ltc, and eth :)

I did like the looks of AMP today. Picked some up at 8200

Thanks for the screen shot.. 1st thing is I think your not on 1hr bars, and on the one hour timeframe AMP has not been trading properly, its missing the bounces.. So for that reason I stopped buy it for now.. 2nd, your not allowing a base to form and then a panic below the base..

It takes time to see the charts the way that I see them, but if you keep watching my videos, Im sure you will get it.. and you can always post charts, to check with me..

I agree that the upvotes are not paying me much in steem, however I am not making this blog with that incentive in mind. I just want to help others grow there accounts like me..

Thanks for your response. It's something that I'm learning to do . . and I appreciate you taking the time. I'll continue to keep watching the charts, and learning your style. I've been trading a different type . . . but I really enjoy the way you trade, so I'll keep watching :)

It doesn't look like you're following Luc's method here. His strategy is to wait until the price goes below a base, when there's a panic and a sharp dive down in price. In this case it looks like you're buying right at the base and hoping it will turn around there.

I should know, I've done this plenty. Just be careful not to get burned trying to predict where a price will go. What's great about Luc's technique is there's very little guessing involved - the price is so deflated by the time he buys, there's built-in upward pressure for it to recover.

Spot on!

Something isn't adding up here, AMP/BTC on Poloniex hasn't been anything near 8200 since the 11th, and my chart looks nothing like yours. PS: +1 to everything @wisebeardy says below.

It's over 8500 sats right now @tizzle

https://poloniex.com/exchange#btc_amp

I agree @wisebeardy, it isn't Luc's method. I'm learning his as well. The AMP purchase is using an RLZ around the 78.6 fib for an entry level, looking at the overall trend. It's more of a longer term trade. Momentum indicators and market structure are used in conjunction with price location. But . . I really love Luc's method. Hoping to incorporate it for day trading.

Quick question, would it wiser to trade pairs where one of them is a Fiat like USD or EUR? I understand that when trying to get more BTC (or ETH) you should trade BTC/ETH for example.

But because BTC/USD is going up and down so much, ETH/USD or ETH/EUR would seem wiser. Except of course if you want to hold BTC for later, like a couple of years: but predicting the future is hard..

Everybody needs to pay bills with 'real money' since it is not possible yet to pay everything using a crypto currency.

I dont worry about the ups and downs of the BTC im holding, or the BTC im using to trade other coins with.. if you keep switching back to fiat then you will miss many many good trades.. so you have to reserve some BTC to use for trading other coins.. its all part of the business

My thoughts: If you're not using the BTC you're making to pay the bills, then the weekly ups and downs don't matter as much. All that matters is the long term BTC trend. Which is up up up.

Yes that is what others tell me too. Buy, Sell, Repeat. And put a percentage of the sell profit away for later like Luc suggests. Sounds like good advice to me.

Thanks for making a video despite the headaches. Hope you feel better.

Hey Luc sorry to hear you're not feeling well. Do you like this base at 14? It's currently Monday night and we're sitting pretty at 9. I like this base but wanted your feedback and anyone else on steemit that follows you.

Cheers!

https://www.coinigy.com/s/i/596d5ec654ed5/