Where is the safest place to buy on any chart?

Your looking for an imbalance in buyers and sellers where the buyers totally outnumber the sellers. You want tons of buyers and almost no sellers. That's where you want to buy, right?

Where on a chart can you find an entry where you can be sure that there is more buyers than sellers? How can you read a charts history to get a clear understanding of where buyers are willing to buy and sellers are unwilling to sell?

Years ago when I started trading I came up with a Mantra that has been my guide ever since: "no one man can make a market".. Basically that means that One person or even a few people cannot decide where a price should be. There are just too many participants with different views, therefore the current price of BTC (as an example) is a colaberation of thousands of participants, buying and selling.

It would be crazy to think that if you found 30 friends and you all dump all your BTC on the bid, that you could keep the price down for even an hour.. You might be able to drop the price for a few minutes, because you overwhelmed the book with a few big orders (the book is just a list of parcipants who have active orders). But behind the scenes, behind those bids listed on the book, there are thousands of buyers waiting and willing to submit buy orders when they feel there is a deal (a cheap buy price). So the book is really just a small representation, a small subset of the actual participants who are ready and willing to press buy or sell. So while you might be able to quickly move the price on the book, the is a crowd behind the scenes ready to refresh those bids.

What is consolidation?

Consolidation is where buyers and sellers are starting to agree on a price. Lets say for example that some news just moved the price a few hours ago. After the initial move happens some participants will reject the new price and take the opposite trade, but other will support the new price and continue to trade in that direction.. Eventually there will be a range that forms where buyers exhaust sellers and sellers exhaust buyers and a new price area is accepted by the majority.. Its like an argument. Say the price was 3 and ran to 10, but then came in a bunch of sellers who felt that 10 was a great place to take profits. Still others feel it should go to 20 and so they are willing to buy 9s and 8s.. but the sellers keep holding it down with more sell orders at 10.. And eventually some traders are biding/buying 9s and 8s just to trade the spread and sell at 10 for a 20% profit.. Soon everyone realizes that the price may not pass 10 and the buyers relax, and the sellers are not getting many sells anymore at 10 either, volume starts to drop off, and there is a new price range, from 9 to 10. That's consolidation, and that lasts till there is a new price breakout in either direction.

So after a while of price bouncing back and forth from 10 to 9 what would happen if you decided to unload all your ABCD onto the bid with a market order? (a market order will sell for the best price available, until you run out of coins to sell) Assuming you have quite a bit of ABCD coins, perhaps you can drop the price down to 6 in a matter of seconds, because there were not enough bid orders at 9 or 8 or 7 to eat up your sell order. But as soon as traders notice the new price of 6, the bids will start coming back in because everyone sees the same chart, and understands that 9 was a good price to buy only moments ago and 10 was a good price to sell. Just because you were willing to take any price for your coins, do you think many other will be ready to sell at 6. Do you think your sudden price drop changed everyone's mind about the value of ABCD. Nope, withing a minute buyers will be bidding, trying to get some 7s and 8 and then 9s, but you were the only seller, so there is nothing to buy at those prices and the bid is now 9 and the ask is still 10 and you managed to move the price for a second or two. You are only one guy, and cannot influence everyone,s belief of where the price should be, even with the complete dump of your account.

So how many players would it take to move BTC down a thousand bucks and "hold it down"?

The answer is: the majority. Anything less than the majority and it will bounce. Have you ever wondered why every little dip on BTC seems to bounce? That's because every little dip is being tested by the crowd, and if THERE ISNT ENOUGH PEOPLE TO HOLD IT DOWN, it will return to where everyone thinks its a buy or a sell. This also explains why news moves markets, because it influences traders to change there outlook and then many traders at once may turn from buyers to sellers or from sellers to buyers.

Consider this: In every market there is a limited amount of sellers but an unlimited amount of buyers. Take BTC as an example, how many sellers are there, if you include all the short sellers and all the BTC owners? Ok, i dont have a clue, but lets guess between 1,000 and 100,000 sellers can come into the market at anytime.. How many buyers are there? Unlimitted.. Loads and loads of new buyers entering the market daily. That doesn't meant there wont be a correction or a bear market at some point, where the Majority of the traders feel the price has gotten too high and fear starts to set into our market for a while.

Why do so many traders fail when using Technical Analisys and Indicators?

Reading a chart effectively is really about understanding the where the crowd thinks price should be relative to where it is, and how quickly it has recently moved away from points of consolidation.. When it comes to using TA, and indicators, there is often a huge component missing, and thats the understanding of Why prices move.

Looking behind the curtain

In my blog, I am really trying to get everyone to see whats behind the chart, to see the chart as a story of the auction, and to understand where the majority of the players are positioned, and how to take advantage of that information, by reacting to price action that is clearly at unreasonable prices.. it's like using an program that you have downbloade and trying to predict what will happen when you press certain buttons, or looking more deeply and examining the code behind the program and understanding exactly how those buttons were created.

My method is a crack of a base and a panic. The panic is very necessary beacuse it makes for unrealistic prices. A situation, where for a few minutes or hours, a smaller group of traders have managed to pushed the price down to obvious new lows and the crowd didn't have an opportunity to react, because everyone is not looking at the chart every momment of every day, and remember only a few people cannot dictate the price of a coin.. So after the panic, as the crowd notices the new lower price, they buy, and eventually return the price to where it surprised everyone, because that is where the crowd actually decided the price should be, before a few panicers dropped it way too far.

Lets look at some examples:

If you bought here, ($4,200)you would be predicting the future. You are a saying that even though the crowd believes that the price should be between $4,500 and $3,800 , you feel that they will eventually think its gonna be worth more.. Your chances of a successful trade are 50/50..

If you buy here, ($3,800 to $3,850) you would be buying beside other big players, at a price point that they have stepped in an bought in the past. They will likely buy here again and this price should be supported with a bunch of buying. If the price where to break this point than that would be a big surprise to everyone. So your chances of a successful trade here are much much higher, maybe 80% depending on where you plan to sell.

If you buy here, ($3,600 and below)in this circle, then you have bough at unrealistic prices. There has been no crowd participation in deciding on this price. A few big traders have been surprised and paniced, (or there stop loss orders were hit).. The price dropped so quickly because their orders hit the bids on book faster than the crowd can notice and react. Now that the panic is over the crowd will slowly notice the lower price and buyers will step in and unless the drop has some news behind it, the price should head back to where everyone last agreed it should be.

So again, Where is the safest place to buy on any chart? Your looking for an inbalance in buyers and sellers where the buyers totally outnumber the sellers.. Well perhaps $3,600 seemed like sellers were outnumbering the buyers, in that momment, durring the panic. But now you can see, that behind the book, there were many many more participants, waiting to spot a deal and refresh the bids all the way back up to $4,000 and higher. Now you broke the code as it were, you are seeing behind the curtain. Now your thinking like a professional trader.

Luc

Very nice information here, good read. Upvoted

Great article! I've been holding on to my cryptocurrency and just waiting. I think after watching some of your videos and reading your blog posts, I'm going to start trading a portion of my BTC and ETH. Maybe you've answered this in a video I haven't watched, but do you mind telling where you buy and sell bitcoin? I've used Coinbase previously (buy and hold mentality), but now that I plan to enter and exit the market more regularly, I'm not sure Coinbase is the best option.

Just my 2 satoshis, but Coinbase has been a nightmare customer support-wise. If you're still able to buy, hopefully it won't affect you.

In the meantime, I switched to Gemini and love them so far. Only supports ACH or wire transfers (no credit cards like Coinbase), and while you can deposit and buy BTC or ETH immediately, you won't be able to transfer your coin to other exchanges for trading alts until you deposit to Gemini clears. Gemini also seems to be the easiest to deal with when withdrawing back to your bank account from all I've read.

That's all just for buying BTC with USD/fiat, of course. I don't believe Luc really buys in at all that way, and most of his trading seems to be on Bittrex and HitBTC. He can certainly answer that better than I, of course. :)

I've noticed that not all wallet formats accept mac (yet, anyway). Does gemini support mac?

Honestly not sure on that... the only wallet I've messed with was a transfer from Gemini to MyEtherWallet which - as far as I know - doesn't have anything to do with Mac vs PC. The rest of my deposits so far have gone to exchanges for trading. Sorry I can't be more help!

I appreciate the reply either way... Thanks!

Just my 2 satoshis, ha, nice.

Coinbase charges high fees as I'm sure you have noticed. Gemini's ACH transfer only permits deposits of $500 a day unless you wire transfer which can be a hassle. I prefer gdax because you can deposit funds of up to $10,000. The catch being it usually takes about four business days for the money to show up. They allow USD/BTC, ETH, LTC. ETH/BTC, USD, EUR, and LTC/USD, BTC, EUR trading pairs.

If you have anymore questions about exchanges and purchasing let me know : )

I use Bittrex and then link that to a Coinigy account. I think this works well for analyzing charts and setting up automatic alerts, buys, and sells.

Thanks @fitzydoesthings and @rocs57. Both of your comments were very helpful and much appreciated! I will look into GDAX and Gemini. If I have further questions along the way, I'll let you know.

also gdax and coinbase are the same company

Coinbase has a trading platform, gdax.com. If you wanna just trade BTC, ETH and LTE, then coinbase will let you transfer money or coin onto the gdax platform for free. Just go to gdax.com and sign in with your coinbase credentials. Then click the deposit button, select coinbase wallet and amount. DONE. Now you can buy and sell without being charged the coinbase commissions and spot price premium.

FYI-

If you deposit money in USD into coinbase, there is no fee. Then transfer onto gdax, there is no fee. Then buy crypo, SUPER SMALL FEE. Then transfer new coins back to coinbase wallet, there is no fee. Now you can basically buy and hold cryto on coinbase for FREE! Coinbase exchange is good. I use Coinigy as my interface though because I don't like how gdax looks. Also because QuickfingersLuc uses it...

Great article thank you! I'm 100% new to trading (like most others that follow you it seems) and have been binge watching your YouTube videos this week. I've been doing fake trades in a spreadsheet to practice but picked two days ago to start and the market has bombed since then so I'm not doing so well. Will keep practicing and hopefully start trading for real soon. Thanks for all the tips.

One newbie question I've had so far is: Is there a way to see % of orders/trades that are buys vs. sells as an indicator of whether the price is going to go down? I'm assuming if there was a clear indicator like that everyone would use it, so curious why that wouldn't work?

Another quality post by the best. Well done. Resteemed

Thanks for a great article! I'm 100% new to trading (and about 95% new to crypto). Watched what felt like about 100 hours of your stuff yesterday and loved every second - this is the kind of opportunity I've been looking for.

One question that's somewhat related here since we have a pretty downward trending week driven by news/rumors/etc. - does your strategy change at all in a clear bear market environment?

It seems like with the daytrading approach it would be easier to deal with: catching shorter-term dips and spikes. With a more position trading approach (I'm not sure if I'm using those terms correctly, by the way) where you intend to move in and out over periods of hours or days, it seems like it would be MUCH harder to catch the bounces.

Keep up the good work, sir. You're a gem in the community!

I'm finding it a bit challenging to catch the bounces using position trading; this current drop of ours being a prime example. I set a bunch of buy order to trigger at this 'unrealistic price' but I think they were still a bit too conservative, as they all triggered pretty early into the drop. I'm now left holding the bag on 'suddenly expensive' coins as I watch the drop fall further. Granted, the chart is nearly back to where I bought in and as I'm in BTC, I'm not worried about having to hold on a bit longer than expected, but it does leave me without capital to play future bounces until I can make myself whole again.

I think once I settle, I'm going to lean a bit more on alerts, or at the very least, split up my advance buy orders a bit more so that I'm covered against any overnight, sudden sales. Setting all my buy orders in advance has left me out of the game for both of September's surprises; I think I've finally learned my lesson there.

The use of trend lines really helps when trying to find the price at which to buy, awesome article and thanks for sharing!

Fantastic article! It really goes over how you trade very well!

What I haven't seen yet is your mindset for where exactly you set your buys and sells. We know how the strategy works, but when it comes to you personally, there must be a lot of thought behind where you position your limit orders.

For example, say the old support/base is at 4,000... would you think, "just to be safe i'm going to place my limit sell at 3990"... 10 points of range to give the order time to execute. Things like that.

We see how the dips go down enough to hit gaps, and how the bounces try to meet old support, but to not miss perfect times to buy and sell, how do you dictate the exact prices for your limit orders (buys and sells) given different situations?

Thank you so much for your insight Luc!

@quickfingersluc I also wanted to ask if you think its better to trade lower price markets for bigger returns. ETH > BTC, LTC > ETH, Altcoins > LTC.. ect. as long as we can back check the consistency of the gap filling and it trades high volume.

Thanks for sharing quality information like this. I think its important to try and spread information free of bias or hype in order to raise individuals from speculators to intelligent investors.

Luc is the best teacher in the tradingland. No one can keep up with him. I'm a big fan and follower. Always sharing masterpieces with us :)

Luc, out of all the trading wisdom you've already imparted to us, this is obviously the Master Key. Understanding it is one thing, but putting it into practice as second nature has been the hardest lesson.

Hey Luc great article. It explained your strategy and why charts work the way they do.

You probably already know about the BTC exchange ban in china. You were right about "every gap gets filled". Could you post a video on this? I would really like your opinion.

Thank you @quickfingersluc! Great post. Really simplifies it.

Thank you as always Luc for another important lesson that reinforces our path to walk in your shadow in Crypto land. Cheers Paul :) (UPVOTED as always)

Hey I have a question regarding how much money you should trade with. If I have $500 should I only use 10% of that $500 or should I trade with the full $500? You mentioned 10% of your capital. And also how much of a percent do you put in on each trade? Like 13% of your 10% capital? Just wondering about the percentages.

Luc, relatively new trader but I have found your postings to be of great quality and value. Yet, I didn't listen to what I had learned and believe I made a newbie mistake. I was trading hvn a few days ago as it rocketed, making good money on trades. So far, so good. Here is the dilemma though - I bought in at what I thought the final drop would be, .00016 as well as .00013. In the day-or-so that followed, the coin has worsened and I believe I should "hodl", even if it is for a few days/weeks. What is your advice? Continuing to learn, "pinnacletrader"

I had something similar happen with NEO which has been taking an absolute beating this month, so I did in fact take the 'loss' and decided to HODL, moving the coins out of the exchange and into the NEON wallet where they'll at least generate their dividends while I see where the coin ends up. Not an actual loss, but it is funds permanently removed from trading, so it stings a bit.

Hurts when you crack a base and don't stop cracking...

great article...

What is that CryptoCurrency traders should know about technical analysis? Francis Hunt, stock market trader and educator comments. Can you use traditional technical analysis to analyse cryptocurrencies? How is the value of cryptocurrencies determined? How do you determine whether a crypto coin is going to soar or crash? The value is the number people associate with it so it is very much sentiment based - at the moment value is being driven by supply and demand. We use technicals so I look at volume, OBV (on balance volume) and price patterns. You tend to get good charts with cryptocurrencies provided a coin is liquid enough.

Thanks Luc. Really appreciate this post. Anyone used Coinfloor? Thoughts?

@quickfingers luc Do you think you could make more videos on the stock market and which apps/apis you use(market scanners, etc)? Also pennystocks vs regular stocks. I am trying to make more trades throughout the day and not all crypto. You give the best trading information out of anyone I know. Thanks.

Luc, one of your best lessons on crypto coins. It may seem a logical way to look at trading, but the reminder is necessary. Would love to see more of this style lesson. Love the videos, but I love more the written word. Thanks!

Awesome article. I am a newbie and learning trading coin. Your trading strategy applies to all types of market. I applaud. I am still working on setting up the trading account with Coinbase, Coinegy and GDAX. But the last 24 hours move in the Bitcoin market really gives me a pause. I think the China ban will insert downward pressure on the coin prices in the short run.

Hey Luc, I find this post and the next video somewhat contradict each other? In this one you talk about how a few people aren't able to manipulate the market and in the video, you kind of say that some whales have in fact manipulated the market. Slightly confused.

This was a very rare event, kinda the perfect storm. Yes I believe it would take a party with alot of money to buy up all those dumpers at 3,000 and then come in heavy as soon as they stopped selling and pop the price.. But there are other forces that played into this pop..With all the bad press in china there would have been alot of shorts entering the market, expecting that with each additional exchange closing, the price would continue down. Easy money for the shorters... but last time BTC was at 3,000 it gapped up and never looked back, so there are many buyers dying to get a repeat move up at that spot. Then after a little manipulation from some deep pockets the price gets an unexpected pop and all the shorters who were getting short from 3600 and down, were quickly getting squeezed, and when you surprise may people who have used borrowed coins like that you get a short squeeze, plus the buyers coming in because of remembering that history. Its really a series of conditions that made for a huge wave of buying. Now that most shorters got hurt, they are a little scared to short again and the price stabalizes up here for a bit.. But nothing has changed, the news is still bad, and this could easily move lower again..

Ok so what im saying, is if you and 30 of your friends tried to move the market right now, it wouldnt be that easy, but with the perfect storm, at the perfect loacation, crazy things can happen.

Thanks for the thorough explanation about this, your insight is unreal Luc!

Just amazing. You just made a summary of all your videos. What a way to explain it. Even new traders will fully understand now how to trade with base breaks and panic sells. Thanks a lot Luc!

This is GOLD!!! It's very useful information. Thanks a lot Luc

Awesome post, I stopped trading for a while and when I started again I realized I was trading with a gamblers mindset. Thanks for helping to correct my mindset ;)

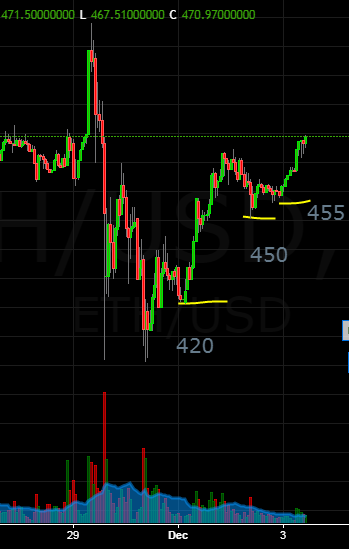

I did this two days ago for eth with my first layered buy at 440 continuing down to 385. I got anxious for some action and added buys at 445 and 450, and of course one buy hit at 450 and it bounced right back to 460ish so I think that confirms that the base needs to crack below that and I started my buys too high.