Hey everyone, I spent some time in the slack chatroom today, because its a great place to find the news fast and today with that morning drop in BTC, I wanted to see what news everyone heard. After the drop and a few daytrade opportunities, we were all discussing many subjects around China's plans and what might happen next.

I realize not everyone following my blog has access to the slack chatroom yet.

But, I was thinking I would share this thread I started, because I feel its a subject that might help others to think like a trader.

(I removed the names of the members involved in the discussion)

quickfingersluc [Today at 1:28 PM]

in #general

Thinking like a trader: I had this convesation with my wife last night. Because after making yesterdays video she was like: "hey your running out of bitcoin? But don't you think its going to be worth 100x some day? Why would you sell so much of your BTC?" She was not thinking like a trader.. I see things differently..Heres the thing, a trader grows his account.. You cannot be only thinking in BTC (or Fiat for that matter)... Even if i run out of BTC, im not out of BTC.. Let me explain:

quickfingersluc

Lets say you had 1 BTC when it was worth $2000 fiat, and you did nothing.. well today you still only have a 1 BTC balance and its now worth $4,300 Fiat.. So lets say you sell your BTC for $4,300 USTD.. well what do you have? Your account is still worth 1 BTC (or $4,300) its the same.. In trading we can rebuy with one click, so the balances are always interchaingeable .. so your not really out of BTC.. Traders see the pair, all you are trying to do is grow your account size...But i know, It's hard to get that simple idea straight in your head sometimes.. As an example, yesterday I was selling at 4,400 ..4,500, and then 4,700 (lets call it converting into fiat instead of selling) and today I converted Fiat back into 6 bitcoin (with a nibble) at $4,000 ish and then I sold 2 BTC at 4,350 ish (a few minutes later).. So whats my balance?? well lets just say its higher, whether you calculate that in BTC or Fiat, its much much higher than yesterday.. And what would have been my balance if i did nothing? Lower..

Just because you sell BTC doesnt mean your out of BTC, in order to trade you have to buy and sell. If you only hold, then you only grow when BTC goes up, and you cannot compound your money which Albert Einstein called the eighth wonder of the world...

Albert Einstein

“Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.”

Friend1

hey man, one day I'll get there, today, with all the market going down, I cancel all my planned orders and now I see that I could profit from all of those orders, It's hard to pass the psychological aspect of trading with the whole market crumbling down, coinigy not responding. I just stop trading.

Friend2

weird, i never experienced that, the reason why i didn't buy is because i ddint want to buy into a panic above a base

quickfingersluc

You get paid as a trader, for participating.. thats the job.. so in the example above, i only nibbled, because I was daytrading.. not position trading.. the last base is still 3900

Friend2

yeah i actually sold at a small loss today cuz when the rumor hit i thought it would panic below and get stuck at base

friend2

i guess it was quite foolish

quickfingersluc

90% of traders lose money.. your enemy is always emotions (fear and greed) but the chart never lies

Friend1

I had really small buy orders on lots of coins, I had place those orders on places that I thought the price would bounce and give me a small profit, like Luc said just to participate, but when the rumor came and the damn coinigy started to get buggy, I cancel all those orders.

Friend2

even if i lose a trade i almost always end a day on green thanks to your method

Friend2

in the last panic i butchered most trades and still walked away with biggest profit ever yet

Friend2

cause its so easy to take profits

quickfingersluc

It will all get easier in time.. it takes practice to keep a clear head and just read your charts..

quickfingersluc

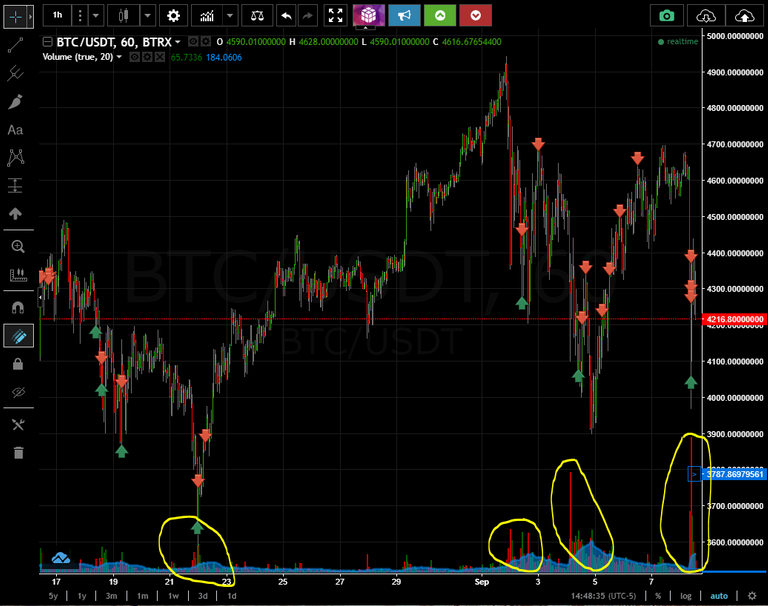

How many of you consider the volume... When the crowd reacts, and there is emotions running wild, there is added volume.. How ould you have done if you only bought decent drops where there was a volume spike? https://imgur.com/jNpNxpA

Ok, so I just copied and pasted this discussion because I thought it might help others to develop a trader mentality.

Luc

Fantastic ideas here. And you are right. Capitalizing on the dumps is the way to go. This is what I have been learning and attempting to get better at doing. Thanks for sharing.

I use Slack quite often and would appreciate an invite when and if it does become public. I wouldnt mind sharing some of my chart ideas too . . sharing info is great for all of us!

hey @quickfingersluc ,

thx for sharing this discussion, interesting to read.

Hey Luc!

I, too, was hoping for that Slack invite. Last I heard there would soon be a public Slack channel - any update on that?

Anyways, the real question I have is: how do you identify those "obvious" bases, as you expertly call them?

I am looking for a few objective factors I can use to identify legitimate bases. For instance, should the base have been consistent over a specific time frame (i.e., 2 weeks; 2 days; 2 hours)? How significant of a jump are you looking for off of the base (i.e., 20%; 50%; etc)? How many jumps off of a single base would you like to see before it's considered a base? Does the trading volume weigh heavily in your identification of a base?

I am sure the Breaking Base Scanner would be helpful, too, but as far as I know I don't have access to it since I am not a Slack member. I do have the Cryptomarketscanner, which is really cool! Would love to use the Breaking Base Scanner - I'm sure it would help my confidence in identifying a base!

I placed my first three buy orders last night using your method, so I'm excited to see what happens. Nevertheless, I just don't feel really confident in my base selections.

Really appreciate all you've done, and everything you continue to do! You offer really great advice in an informative, entertaining manner. I look forward to sticking with you for the long-term.

Thanks, dude!

"I am sure the Breaking Base Scanner would be helpful, too, but as far as I know I don't have access to it since I am not a Slack member. I do have the Cryptomarketscanner, which is really cool! Would love to use the Breaking Base Scanner - I'm sure it would help my confidence in identifying a base!"

My advice might surprise you - I recommend that you do not use any of the scanners. Focus on learning how to read charts, set alerts, make enough positive trades to triple your account. THEN and only then should you incorporate the scanners. The scanners should be used to find incremental opportunities, they should not be a part of your core profit strategy. The base scanner is still in BETA, its far from perfect - but I occasionally fine some nice opportunities that I missed on my own. Usually the base scanner finds situations that I already found on my own by reading charts and setting alerts - THAT is what it takes to become a great trader, there is no substitute for hard work, study and dedication. From our experience in the Slack, the people who are looking for shortcuts to success seem like they are more likely to fade away - if you want to be a long term winner, don't take the shortcuts. Seize the day.

Good luck, look forward to seeing you all in the slack someday soon when we re-open the doors!

Thanks for the feedback. I certainly wouldn't rely solely on the scanner for trades. Rather, I consider the scanner to be analogous to a tutor. I do the work on my own, but the scanner helps provide both positive and negative feedback, to either validate or invalidate my answer. The "answer" in this context would be my identification of a base. Now, I couldn't trust the robots enough to make all of my decisions, eh? :)

I'm definitely looking forward to participating in the Slack channel when it's more accessible!

Thanks for all of your contributions - I hope I get a chance to return the favor.

The robot is not good enough, you cannot trust it. It's a rough guide, but it's far less accurate than you can be. There are frequently false triggers because it's logic is very basic. It's good for catching ideas you ,ugh the have overlooked, but you cannot trust the bot to do the work for you - even a beginner will do a better job than the bot. Strange, but true!

That was well said but @tizzle when we are going to find out? and how about the re-open of the doors to the slack channel?

Thanks and happy trading guys

Not today, sorry. when we are ready, everyone will know - on that I can promise.

Thanks Man

@tizzle Could you help me out with the Slack invite? I would really appreciate it!

Is there any sight on when the re-opening might be?

No need for a new public slack, the slack invites for the normal Slack Chat will be made available soon. @tizzle is dragging his but on that ;) It's basically ready to go though, any day now...

Im overwhelmed with work, too much on my plate. @pelt is right, its my fault - but once I get my job done, we will be safe to open up again.

Thank you guys for the update. I've been following Luc since July and was on holiday when the Slack chat opened up; was really disappointed to have missed the opportunity to join, but am glad to know it will be available soon!

Awesome! I'll be looking forward to it.

hey @quickfingersluc , just wanted to say a huge thanks for all ur videos.. I only found them a couple of weeks ago, and i went through em all in the space of a day.

I've been through so many Youtube traders and you are the first and only to offer a strategy that agreed with me and that i immediately felt like i could employ with success. and i have been! I've made dozens of successful trades in the last couple of weeks, and only messed up 2 or 3. And even the bad trades i don't know if they're necessarily bad, they just didn't really bounce like i expected and are still sitting around where i bought in. The successes have all been in the range of 10-40% profit..

I'm now thinking about liquidating some of my long term positions in coins that aren't moving much so i can go a bit bigger on some of these trades..

Anyway, i owe my recent success to you so a huge thanks to you..and like a lot of the guys in here i'm looking forward to this slack channel reopening so i can join ur community..

Cheers!

Thanks for letting me know of your success. You sound like me, at the begining when I first started to trade. Its very exciting when you realize that now there is no limit to the money you can make :)

Hey luv love your stuff!! send me an invite on the slack channel :) @dwuser892

Hi Luc, I'm going to build professional scanner, I want to contact with you, can you share your email ? I will need your tips and suggestions about functionality.

Hi Luc,

I am new to Steem, and just wanted to drop you a quick note to say thank you! I have been trading lots of different instruments for almost 20 years (stocks, options, futures, forex) with minimal success. I have spent thousands of dollars (maybe even tens of thousands) over the years on newsletters, seminars, trade rooms, gurus, etc. Some have made me some money, but most were worthless.

About a week ago, I stumbled onto your blog from a Google search. I have spent the last week watching every video, and reading every comment in your blogs. It is fascinating. I had no idea that the crypto market was this developed.

I opened a small account (less than $100) just to tinker and try the concepts out. Your concepts are simple, but not easy. Although, I guess you could say that about most successful systems. Anyway, late last week and over the weekend I placed a couple super small trades. Both were winners! Neither of the trades were huge returns, but they were simple trades to execute, and over time these returns will add up (especially as my account grows!). The charts are linked below if you want to have a look.

I just wanted to say thank you for your generosity. It is not often in this business that you find someone who is willing to give his knowledge away for free. And even less often when that knowledge actually has any value. Instead of just copying some guru's trades in a chat room, you are actually teaching us how to be successful traders in the crypto market. For that I am incredibly appreciative! I look forward to continuing to learn from you, to hone my skills and become the trader I have always wanted to be.

If you're ever in the Chicago area, let me know and I'll gladly buy you dinner!

Thank you! Thank you! Thank you!

Brian

https://www.coinigy.com/s/i/59b6de8b1fdc5/

https://www.coinigy.com/s/i/59b6e1bd9f621/

Thanks for letting me know that my blog has helped you. So often I am only msged with questions and usually the same questions over and over. So i really appreciate it when someone just takes a few minutes to let me know that they have watched enough videos to understand the basics and ofcourse share some successful trade.

You are right in saying that its not easy to trade my style. Not that there is anything difficult about the simple method I use, its developing the patience to wait for the right opportunity to come around that is difficult .. Look at BTC for example, gah.. Just days of consolidation, waiting for it to drop or pop.. I had an awesome day on the stock market today, (quick and easy money) and that helps me remain patient while I wait on BTC, ETH, BCC, NEO or whatever else is lolleygaging

Yes, I've seen others on message boards who really know their stuff and try to help people, but then they get deluged with questions. And after a while it gets to be too much, and they burn out and disappear. It really is a shame.

Everything anyone needs to get started is right in your videos and in these comment threads. I have found a few nuggets in these comments that are just gold! If people are serious about learning, they need to devote time to dig through the materials. It seems too many people want the short cut, and be spoon fed. What they don't realize is that THIS IS the shortcut! I spent, literally, a full week going through all this stuff. Only a week. That's it. Probably 40-50 hours. Now I have a good enough understanding to make profitable trades. Compare that to the almost 20 years I have been floundering around trading all kinds of stuff using all kinds of stupid, worthless systems (some of which I paid ungodly amounts of money for). If this truly winds up being what it appears to be, then the 1 week it took me to get up to speed is the best short cut I've ever found!

I purposely didn't ask a question or make a comment until I finished all the videos and comments. And every time I found the answer to my question as I moved forward in the blog. If people would simply invest the time to learn the material, then you wouldn't get anywhere near the volume of basic, dare I say stupid, questions that you receive.

My point is this... don't let them ruin this experience for you. Clearly you are enjoying what you are doing. And you are a great teacher, you have a gift. There are many of us out here who genuinely appreciate what you are doing, and are willing to put in the time and effort to learn. Don't be afraid to tell people who ask a basic question to invest the time to watch the videos and read the threads. I guarantee that they will be able to answer their own question after that. But if they aren't willing to do that, then they are not worth your precious time. It's harsh, but sometimes a good slap in the face is what is needed. And it will help you keep your sanity too. :)

Thanks again for everything!

Brian

THIS by @bdrex95!

Hi Brian

not even sure if I should ask you. I have subscribed to Coinigy and really like the interface though still looking around. Do you think better to use Coinigy just for the analysis whilst doing the actual trades from individual exchanges - or link exchanges to Coinigy and do all trades through Coinigy itself?

Thanks

Michael

I'm currently consuming all of Lucs information (even steemit comments) before asking any questions, same as you.

Your post is word for word what I would have typed after I was done. If only everybody would follow your example - Luc wouldn't get bombarded with the same redundant questions he's gotten since he's started teaching us.

Its surprising how difficult it is to remain patient, take out emotion, not try to predict the market, and just read the chart waiting for bases to be broke.

i totally agree.. It sometimes takes forever to crack a base, and usually you only get a nibble before it heads back up.. I hardly ever get a big trade.. But when they happen, oh man, they can be unreal, big time game changers for an account of any size.

Just nibble.. Thats what I do.. Remember that your playing BTC here, where we all expect it will be going to the moon anyway.. so in that context most of your trades will work out anyway.. But if your at a base or just under it, and you really get the impression that its about to turn up, then nibble.. let's say your account is $10,000 bucks, then a nibble might be $300-500 .. it will help you control your emotions, because atleast you can participate.. and if it goes up you get a small reward, and if it goes down, that would be awesome because you can actually get a real position.. so its win win.. but a word of caution, if you do make a few successful nibble trades, don't start sizing up where you should only be nibbling, or you will find yourself trapped.. remember your nibble has lower odds of success, and that we profit big from when everyone is surprised and in a panic.. you don't ever want to be the one surprised..

Hey Luc, never managed to get into the slack. Is there an updated invite link?

Not yet. When the doors open again, the link will become public. Sorry for the delays.

Great - looking forward to joining the Slack.

I'm interested in getting in as well.

I look forward to joining the slack room as well. Thanks for your work on it.

Can't wait. Would love a focused realtime conversation on trading in addition to blog-type discussion.

I'm waiting also :)

I am interested to get in as well. It's been 3 months already. Hope the doors will be open soon.

Sorry, I did not create the room, and I don't moderate it. But @tizzle will be letting more people in soon. Its pretty great to have so many in the chat looking for good settups.. and everyone is quick to answer questions.. Today is was very timely to have soo many eyes looking for the china rumor..

Can you give some advice how to analyse charts

I know this guy who makes pretty good videos and has like a 99%+ win rate.

He doesn't analyze the charts too much, in terms of technical analysis.; instead, he just buys below bases.

Luckily you found the guy too ;)

Yeah he definately puts it into mad simple layman terms - certainly made me believe that I too could grasp trading to the point of investing the energy to just watch and download all the @quickfingersluc tube clips I canas well as a heap of other tube clips and thanks to the base man I'm constanly looking for cracks , bases and lifts or highs cos with just a few clips it is really almost like exciting to feel confident to trade a bit now ! I'm almost confused wether I'm talking about something else but no it's trading cryptocurrency which is volatile enough for me to be feeling like I could possibly do ok and that's being a trader on a money marketplace - who would have thought, lucky I found the guy too - boy am I glad cos he explains it all !

Hi Luc,

If volume (stuffing) is an indicator of when to buy, does volume appear just prior on the chart as it is heading back up, or is it simultaneously? I'm wondering how you timed your buys so perfectly. Where you just watching and waiting for the volume to come in?

Volume is just a confirmation.. I time my buys based on where I think the crowd will support the price.. I think $4,000 is an obvious level that should act as temporary support.. and as you can see I have no idea where it will stop going up, as I made plenty of sells all over, layering my sells as it goes up.. also please understand that these are only daytrades, I'm not taking big size.

Hello Luc, are you day trading with the Crypto Market Scanner? I really want to know how to use the Market Scanner to nibble trade like you do.

That's a great post Luc. I wrote up an example, it's pretty clear how you will be in a better position trading than holding .

Person A buys 1 Bitcoin for $2000. He holds it for months, not checking the price, until one day he sees it's at $4500 and sells, making a net profit of $2500. He is still only worth 1 Bitcoin at that point in time.

Person B also buys 1 Bitcoin for $2000. He holds it and is checking the charts, until the price reaches $4000 and then sells. When the price panic drops down to $2500 he buys back in and now has 1.6 Bitcoin! When the price eventually reaches $4500 he can sell for a net profit of $5200 and is worth 1.6 BTC at that point in time.

Of course, that's just a simple made up example. Imagine selling and buying back in multiple times!

I think the math might be off a bit for Person B. After selling the first bitcoin, he has $4000 ($2000 profit). When he buys back in at $2500, he has $1500 cash and 1 bitcoin worth $2500 (1.6 bitcoin total worth, as you noted). When the price reaches $4500, he sells and now has $6000 cash, or 1.33 bitcoin total worth ($4000 profit, since the coins he bought appreciated $2k both times he owned them).

But you are right that participating is where you make the most. You make profit on many of the swings up and down. Whereas the person that just holds and doesn't trade makes profit only on the overall upswing, and not on any of the dips and repeat upswings.

Person B makes 60% more profit than Person A ($4000 vs $2500). And that is figuring in just a couple trades. The difference could be much much more with many trades.

It does help understanding trading to break it down into simple examples like this, and why it is important to sell at the tips, and then wait for the dips to buy back in again.

Sorry if it wasn't too clear, I was trying to keep it simple and assume Person B sells all BTC to USD and vise versa when he buys. So he buys 1 BTC @ $2k the price doubles and ends up at $4k (sells the lot). He buys $4k worth of BTC when it hits $2.5k and ends up with 1.6 BTC. Sells everything again at $4.5k and ends up with $7.2k. Net profit of $5.2k, or worth a total of 1.6 BTC with his initial investment included in that.

Oh, ok. That makes more sense. Thank you for the clarification. I would definitely go for the $5.2k over $2.5k. That's over 2X more profit!

Very good example. I also think it would be even better to give person A and B a certain time frame like 3 months or something. And do the example like: let's give them 2,000 usd each and see who would win or have more btc in 3 months.

Hey Luc,

IIRC you'd said you'd moved most of your holdings out of Bittrex since they moved to USDT. I've been trying Kraken simply because it was a convenient way to exchange fiat, and the volume seems to be high, but today was one of the most frustrating experiences I've had trading. I could barely set any trades due to the constant page loading errors and slow response, and forget about trying to use it through Coinigy. I missed several trades :-/

basically, have you (or anyone) been encountering this, and what exchanges respond the best to a heavy load like today?

Thanks for the videos and advice, and I look forward to getting into the slack group.

Kraken has its drawbacks for sure.. There is plenty of issues placing orders and coins are priced higher than other exchanges because of the tether/fiat difference.. but there is that sense of security, knowing your money is not in tether.. So I don't know if thats worth it for you...

Are there reasons to not trust Tether? It looks like it's broke with the dollar a few times, but seems to stay pretty close most of the time.

The tether gives me pause, but the lag/bugs don't exactly instill confidence either :-/ Looks like 6 one way, half a dozen the other.

I don't like using tether, but one needs at least one 'stable' value store per exchange to hedge all the swings. Hopefully one of the gold-backed tokens takes off to some degree of reliability. Until then, I don't see a way to trade a bunch of alts and avoid tether. It's especially convenient, unfortunately, for day Americans doing day trading since, technically, they are supposed to track any time they sell into USD. Technically...

I think for smaller amounts taxes are a non issue and if you are making a substantial income through gains, there are many ways to protect yourself from extortion, like a foundation, or even better move out of oppressive countries like the U.S. or Canada and renounce your citizenship (if you are a US citizen). On the isl of man for example there are no taxes for anyone earning over 100,000 pounds per year. Luxembourg does not have a gains tax. The U.S. however is one of two countries that will hunt you down wherever you go on the plant if you dont report.

Kraken is slow and buggy for me even when trying to place orders directly on there sight. a little worse on coinigy. but there fees are so much lower sometimes its worth it if you are trading higher amounts like 10k or more. Bittrex is smooth and allows me to profit from quick clicking even when using coinigy.

That's what really screwed me. I had a few limit buys, but was relying on notifications for deep dives and got royally screwed on a couple trades. Doubled up transactions because of erroneous failed orders, completely missed pulling some profit on the first rebound, and by the time the market bottomed out below 300 I was so frustrated I had already walked away. That was all through their website! I gave up on trying to go through Coinigy and the API early on.

Luckily I've got some more money that just made it into the exchange or I'd be stuck hodling till the market recovers

Just the absolute quality and high end information and teaching from @quickfingersluc soooooo much BULLSHIT on the web about trading these days, everyone wanting money before they give you the Magic formula to winning trades. NOT Luc... you are a good man. And we thank you sir!

New to this whole thing, and thanks so much for just the skim of information I've perused from you. Quite excited to keep following, and learn the ropes from someone who does things so refreshingly simple. Best to you.

@quickfingersluc, thank you for all these great videos and discussion. They are very helpful!

I have a question. It seems most of the videos have been about position trading cryptos, or trading large movements. Have you done any videos about day trading cryptos? If not, could you share what your strategy would be for that, or how it is similar or differs from position trading?

I do have some videos on this subject and the different strategies I use.. I made those videos a month or two back.. so you will have to search a little.

Hi Luc, I really appreciate your philanthropic posts. I look forward to the next one each time, especially when it's in regard to the core strategy again and again.

I wanted to ask you about the account builder trades. From your videos and posts, I gather that it should be done on a chart with low volume and when it's ranging and when it has that inorganic look to it.

Have a look at the chart below. It has that inorganic look and is moving sideways and has low to average volume.

Now have a look at this chart. This one looks even more inorganic.

So I'm a little confused.

If a chart has decent volume but shows that inorganic pattern, is that an account buider?

If a chart has good volume but is moving sideways in a range, can that be used to build your account?

If a chart has low volume but has no sideways movement, can that be used to build accounts?

So you have a mixture of these three elements. How do you view a chart in relation to these 3 elements before you decide that it's an account builder chart?

Really appreciate the help,

JH

Im sorry, I cannot open your charts, but I do have a video a few videos back on small account building trades. And here and there in my other videos I give examples of account building trades that I have take... The only reason for the low volume aspect, is that it creates large spreads between buyers and sellers which is quite easy to use, to take very high profit perscentage trades.. the down side is that you cannot take any size and therefore can only be for small accounts.

Right, but does this work with all low volume coins, or only those that have that inorganic look? Does the coin also have to be in a range to use it as an account builder?

Thanks again.

No, it's just one of tradeable patterns. You can also trade pump and dumps(buy low, sell on spikes) and broken bases on charts which give u high percentages.

How to contact with you via slack for example ?

Assuming all goes as planned, we hope to be ready to re-open the slack within the next coming week. We are reviewing FAQs, introductory content, and security settings to make sure everything works - once confirmed the doors will reopen. Hang tight, very soon!

Hi tizzle, are there any Slackbots which you would find useful for the channel? I'd be interested in making some tools for the community.

Thanks for asking @marteezy. We are working on building a gateway at the moment that will allow us to inform potential users about our community rules before they join, and also remove the need for a publicly accessible master URL to access the Slack. We have hit a few small roadblocks, once thats fixed we will be opening the doors again - at which time I hope you ask the same question in the Slack.

There is one thing we need help with - we need someone who knows how to implement BrianWilliams in Slack so we can have a dedicated read-only channel for FAQs, permanent info, and announcements. If you have any knowledge, please let me know once you get the opportunity to join when the doors open.

Thnx!

You can just private msg me in the slack chat.. I get that alot

Thanks, can't wait for new invitation link from tizzle how to join, I'm excited to show you my plans for cryptoscanner...

If you need any other developers I'd be happy to help. Was thinking about starting a scanner of my own.

Hi Luc. Really enjoying your educational video series and all the info you putting out there for community. Thank you so much! I have watched all of your videos in 2 days which was fun to do.

Recently I have tried to use Crypto market scanner for small account build up (which is an amazing tool). However, I have noticed that most of the alerts for trades (on HITBTC) that are down more than 20% look like this:

https://www.coinigy.com/s/i/59b5630fa5d47/

https://imgur.com/a/5UvRw

I have also noticed that there is only 1 BID price and a lot of ASK prices in Level 2 Data, which I also don't quite understand.

Any suggestions what is it about and how to trade it? Like, it looks very predictable (up and down by the exactly same percentage), but I am like most of us here newbie and never seen charts like this before.

Any advice at all would be appreciated.

Again, thanks a ton for all your input.

D

Thanks Luc for the help! I'm pretty new so this question may be kind of basic but I've noticed sometimes watching the active trades that a repeating number of trades (sells in particular) seem to happen. I assume that this is from the same person. To clarify, I will see a sell happen for the same amount of coin for the same price over and over again... Is this some type of strategy to sell your holdings?

Years ago, in pennystocks, I came across the same situation.. I would find "computer sells", thats what I called them back then, on illiquid stocks.. I would gobble them up as soon as the computer selling algo was finished and it worked brilliantly.. My understanding is that at times a broker will need to offload a huge amount of some stock and so as not to drop the market, he will have a computer sell in small equal amounts every minute or two, hitting the bid.. I loved finding these trades, because it was easy money for me. It clearly identified a drop being created by one person, and that never stays down.. One person cannot decide market price... Anyway, I'm not sure if that is what you have stumbled on in crypto, I would have to see it for myself, and it would have to be on a low volume coin, where one player could actual affect the price..

I have seen a lot of those recently on BAS/ETH in HitBTC, but they were on both sides. I have also seen what appears to be a person trying to block movement up and sometimes down by placing an obscenely large order (about 10 to 30 times the other large orders). It has the effect of causing people to not even get close to those orders and when people get used to them being there, or if someone actually does start nibbling on them, they move further away from the current position or are taken out completely. If one disappears, it tends to cause movement in that direction, but I have also seen them cycle in and out. I suspect a rookie market maker or something. Have you seen this? If so what do you make of it? the bottom one just dissipated on BAS.

Sorry for the delay... I've been having trouble with my Bittrex acct. Thanks for the reply! If I get a little more savvy, I will take a screenshot and show you what I mean

Hi Luc, Thanks for all the effort that you've put forward in building a community of profitable crypto traders. Looking forward to learning all that you have to offer.

Hi Luc,

First of all thanks for the efforts you make by spreading your knowledge to us newbies in the field.

watched your vids, and must say they surely helped.

I do would like to ask you or another of you pro’s for some advice.

Been riding the ETH/EUR chart for a month now, and via little nibbles (trying to follow the advice here ;-) ) I’ve been able to gain profit here and there.

Tho, the latest days, with the bad news from china and all, I think I made a mistake somewhere. And I would like to ask you your advice on how I HAD to react.

As you see on the chart, my latest buys ETH were at 276 and259 & 257 (buying the dip right?)

I also added a little history of the previous sells, maybe it helps to give you an idea of my trading style (good, bad?)yellow is buy, blue is sell. When I sold, I always sold ALL of the ETH I bought btw.

My question is, now with the latest drops, did I had to sell with a loss? Or do I hodl? Which is what I am doing right now, ETH/EUR being at 230 right now.. or do I buy BIG right now?

What would your reaction have been?

https://imgur.com/a/qOrJK

@tizzle Could you help me out with the Slack invite? I would really appreciate it!

@tizzle Could you help me out with the Slack invite? I would really appreciate it!

same to me ... get an error when trying to join :-(