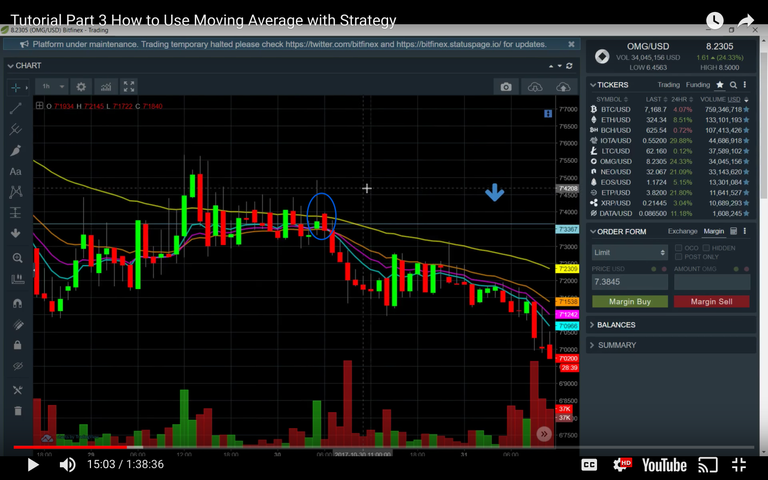

Video 3 - Tutorial Part 3 - How to use moving averages with strategy like a boss

Videos will be released almost daily. I also do tons of Technical Analysis on our favorite coins like OmiseGo, EOS, and more.

Some other video series of mine

- Daily Technical Analysis on OmiseGo, ETP, IOTA, and more

- Starting with $200, how to turn $200 into $1,600 in 16 days. All trades recorded live, narrated.

These are educational videos intended to teach how to think through thought-out rationalization.

Follow me on Twitter for some awesome play-by-play TA.

Twitter - https://twitter.com/PhilakoneCrypto[/size]

Hi Phill, your videos are very useful to educate new traders, I would like your permission to publish them on CryptocurrencyGuide.org on a video tutorial section to be created, the author will be identified and links to your steemit will be placed. Thank you.

it's me again, this is an awesome video dude, thanks!

Thank uuuuu!

awesome video and learned so much- couldnt wait and moving on to part 4

I love your videos, so easy to understand and so much energy. Thanks for doing this. I truly feel I can change my life within the next year.

Good call on the November 2017 correction...

Honestly Phil this video and method has changed my life. Thank you so much.

Dude, NEO has already CROSSSSSS! lesson 12...... YAHOOOO!

Amazing tutorials! I truly appreciate your time and talent!

This is least thing I could do at this point:

Actually, least you can do is pay Luna for it, what you think it's worth, that would be fair, don't you think so? ;)) So much valuable real knowledge from this expert, immediately applicable, directly profitable, deserves a fair fee in my opinion. People should do that. Good luck! ;))

"Least" = "minimum"!

Whoaw just checked out this 3rd tutorial. Great stuff. Will do some simulations on tradingview this week, and start using these lessons as of this weekend. :) Thanks a lot! Greetings from The Netherlands

A question while I am watching this video: in this screenshot, based on previous tutorial, look at the two candles in the blue circle: why "close" of the left candle is not equal to the "open" of the right candle?

simple enough for beginners to understand yet powerful indicator for profit

Finally I found a solution, so for those might have this problem. I am setting my trades on Binance, but as you know Binance sucks for TA. I do my TA on TradingView. TradingView Only allows you to use 3 indicators for free. So for EMA, you can use 4EMAs as one indicator and for the other two you can use like MACD, RSI, and etc. To get 4 EMAs go to this link and simply click on "add to favorite scripts" then it will show up on your "favorites" on you TradingView, and you can customize their properties as you wish. https://www.tradingview.com/script/2mnKukOf-4-EMA-s-in-one/

around minute 17 u are talking about a bull trap , before the long green candle that crossing the 55 and the one green that opening and closing above the 55 there is one red doji with a high above the 55 - all of that from what i understand signal us indeed a bull run which is actually a trap. What i am asking is is the best way is to wait for a few candles closing above? and how many?

much appreciated.

You rock man. You know you're doing things right when you have haters. Gratitude my dude.

How is this strategy affected by the news or pump and dump groups? Nothing is certain I know :)

Also, during the last 24h (15-Feb-2018) LTC grew ~30%, is this approach more predictable with coins with higher market cap or smaller market cap like Pepe Coin, for example?

Great content,

Thanks!

Hi

Thanks for all of these videos :-)

In some of the trades that you show here where the amount of profit taking is small because we wait for it to cross over, you show where you would have taken profit, increasing your reward. However on some of them if we wait for the line to cross over, you make a whole lot more even though the MACD etc showed it was declining, It crossed over in MACD and RSI also showed decline, is there a way to decide when to take profit earlier and when not to?

Mate, your videos are fantastic. I have been learning about crypto from the ground up. having a background in accounting/banking (from a career path i happily abandoned to do something that could actually help people) certainly helped, but it was not until i discovered your tutorials that i know exactly what i need to learn next, and you enable me to do so without the tedious process of trial and error and fumbling about in the dark trying to put the pieces together. i have watched countless tutorials over the past 9 months and my knowledge has slowly grown and consolidated,but progress has accelerated exponentially since finding your video tutorials; i am no longer wasting time getting sucked down internet rabbitholes. i love your genuine enthusiasm and lack of ego, it's obvious you genuinely want to help people learn and are passionate about what crypto trading has done for you in your own life, personally i find your confidence and ease to be a breath of fresh air. and you are smart as hell. i am not writing this to flatter you, i am sure you get plenty of that and i know you dont need it anyway, i just wanted to express my gratitude and thank you for providing such a wealth of info to the community. i have never written a post like this, but after watching yet another tutorial i have to say it. you are a good man. thank you. there are not many people out there who can express pride in their abilities yet retain humility and just be themselves. thanks mate. when i get to the point where my short term debts are gone, as i am confident i will if i keep learning (and reading), i look forward to buying you and your dog dinner. in person if you ever come to australia. i imagine it would be an interesting conversation :)

Much gratitude my friend. - Cory G

Thank you so much for all of your videos, Philakone! Quick question, though; do you have TradingView Pro, Pro+ or Premium? I'm not seeing how it's possible to setup 3 EMA's with the free chart, unless I'm doing something wrong..

I can't figure out how you have MACD, RSI, and all 3 EMA's (including volume) all on one (free) chart.

Thanks again in advance :)

since my mama whale senpai has been gone for the past few days, I'm going back and studying up on my material...great stuff dood!

super helpful. thank you!

Thank you!

If your Tradingview subscription is limited to only 5 indicators, as mine is, I've written and shared a quad EMA at 8,13,21,55 levels as Phil uses in this tutorial.

This gives four trends whilst only using 1 of your indicator count.

The script can be added / found here:

https://www.tradingview.com/script/HX4MY5P8-Crypto-Quad-EMA-8-13-21-55/

sent back from elliott wave all the way back to part 3 , thats probably how i lost that 10 k on the plus 500 mobile phone app , jump first look later , im gonna try all your lessons and try the correct way ,