This blog is an update to Monday's Cryptomarket Panic trades. The previous blog can by found here:

https://steemit.com/trading/@oneluckyflip/cryptomarket-is-falling-some-trades-i-m-taking-to-make-money-during-a-panic-market

Today's blog will show results of all completed trades as actual vs. expected. All chart markups were intact for comparison. In addition, Pending Trades list and Trades Not Taken list are presented.

Red X mark = expected selling point(s)

Green arrow in circle = actual buy points during panic

Red arrow in circle = actual sell points during panic

TRADES COMPLETED

BTC/USD (GDAX)

Thoughts: Sold on the first bounce once there was steady resistance. Moved from 4625 to 4525. Next buy order was set at 4000 but never reached that far.

Expected return: 6%-10% on nibbles

Actual return: 5.2%

NEO/BTC

Thoughts: Moved sell down to steady resistance

Expected return: 30%

Actual return: 24%

QTUM/BTC

Thoughts: Sold 100% position on first bounce.

Expected returns: 8-25%

Actual return: 8.8%

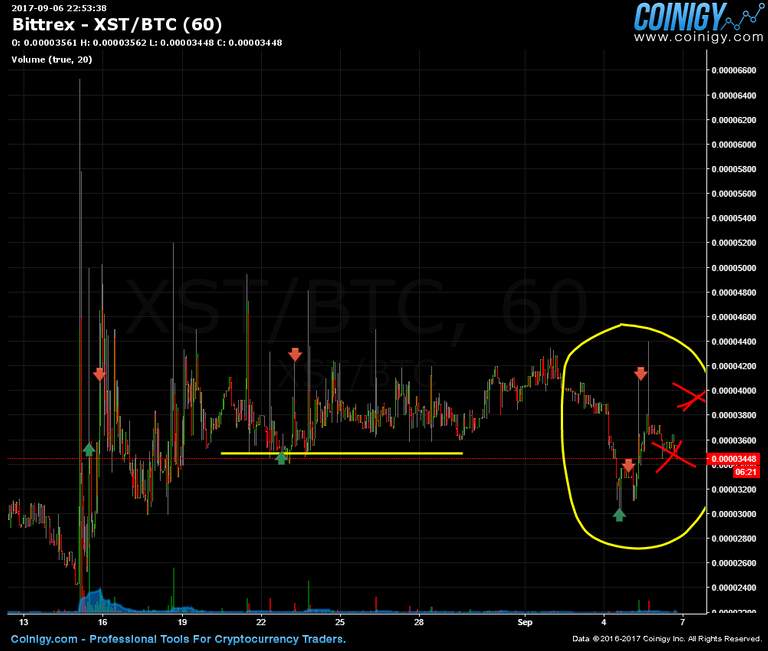

XST/BTC

Thoughts: Trade went according to plan.

Expected return: 20-25%

Actual return: 18.5% total

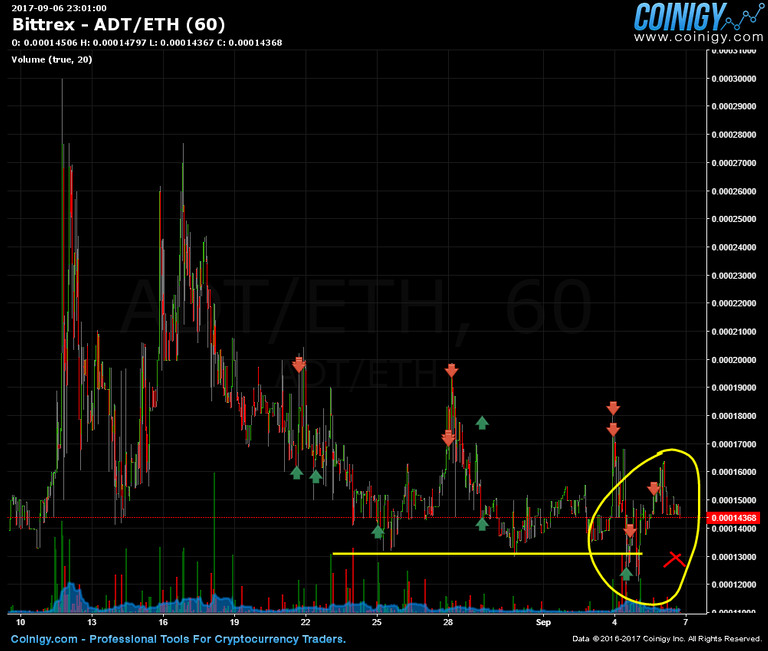

ADT/ETH

Thoughts: Had sell order higher as bounce was quick and strong but sold over half position on first bounce.

Expected return: 15%

Actual return: 13.3% total

EBST/BTC

Thoughts: Caught this flash sell upon cryptoscanner notification and all position sold on this flash.

Expected return: 10%

Actual return: 30%

PENDING SELL ORDERS

POT/BTC

DCT/BTC - Half position sold, other half pending about 10% higher.

EMC2/BTC - Awaiting pump.

TRADES NOT TAKEN

ETH/BTC - Did not reach target buy of 0.656 btc.

BAT/BTC - Did not reach target buy of 3717 satoshis.

WHY DID MOST OF MY TRADES NOT REACH EXPECTED TARGET?

4/6 completed trades DID NOT REACH expected returns. The reason is that the whole crypto market reached a resistance point off of these bounces so I sold most which netted me at least 5% returns. I was hoping for another panic of which I can buy back my position, but the panic wasn't too strong for that. However there was still a small dip and another bounce that followed across most of the market.

DISCLAIMER

Nothing here is meant as financial advice. This is just a strategy that I'm using as a cryptocurrency day trader. Please seek a duly licensed professional for any financial advice. Never forget, cryptocurrency trading is extremely risky and never invest more than you can afford to lose!

Thanks for visiting my blog and happy trading everyone. Let me know what you think in the comments section below.

No offense, but this looks like pretty random trading to me. Would be suprised if you did make a profit at the end.

It may seem like a bunch of dangerous trades but they are not. Have you checked out QuickFingersLuc yet? Watch him and understand what he does, then come back here and check the graphs.

These are safe and solid trades.

I little bit of flying by the seat of your pants due to the speed of each trade, but perfectly safe trades.

The only criticism would be that a couple of the trades went longer than they should have to be strictly safe. However this is trading, if you weren't willing to live a little and take some risk, you wouldn't be here

thx @howcrazyisbob, I value criticism as much as the praise.

Had to give it a try and see what happens :)

Good luck mate!

100% random trading confirmed best strategy

Would you like to see my bunghole?

No I would not like to see it. I would like to see this spam bot stop however. ;-)

I am the Great Cornholio! I'm a gringo!

Which trades look random to you, and why? Can you be a bit more specific @donaldcrypto ?

Half of them are trying to catch falling knifes. Also, in all of the trades there is a lack of volume which is very important

Thank you for providing a thoughtful and detailed response.

oh wait...

Sorry, I am not here to babysit.

I would have held out for more with BTC... its only going to go up eventually, your in no rush. With that said, nothing wrong with taking profits where you did, its absolutely fine.

That is a matter of trading style. Pure QuickFingersLuc trading is fine, its money in the bank

Don't see ETH/USD here.

I wasn't able to get my buy order completed for ETH/BTC listed in Trades Not Taken section.

How long will you hold DCT/BTC waiting for a higher bounce before adjusting your sell order down?

Hi @ed21857. I typically don't move my sell order down unless another panic happens. When another panic happens, I'll go ahead and buy more to have an average buying position that's lower. Then go ahead and sell off on the next bounce for a little profit or sometimes small loss. Here today was a good example where a buy happened on the next panic to be at an average position of ~17k satoshi and sold above 18k (~6% ROI total).

Now if the coin's price becomes stagnant (like for a few of days), then i'll sell off the rest of the position.

What is the minimum timeframe which should take into consideration when trying to determine the 'base'? Hours, days? I am not sure ever heard this by Luc. Thanks LuckyFlip, keep up the good work and publish new blog posts please!