Image Source

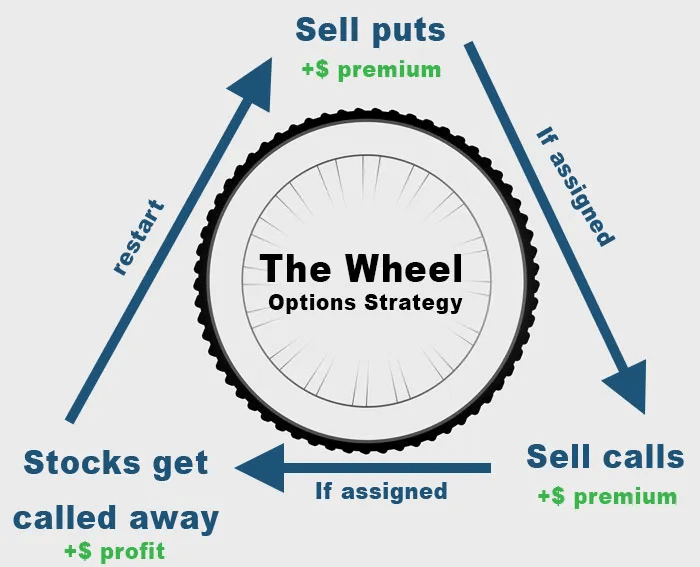

Today I would like to talk about not popular but interesting one Wheel Strategy. You put up the collateral to potentially buy a stock (that you wouldn't mind owning at a potentially, and hopefully, discounted price because you think it may be a great investment long-term.

You get the premium from selling a Put, then get assigned because the stock drops below your strike price at the expiration date. So now you own the shares.

The next week, you can sell Call options against those shares and acquire premium.

This can go on infinitely until you decide to sell the shares, or the shares you have sold calls against are called away, because the stock went above the strike price, and the buyer of the call exercised their option to buy them at a discounted amount.

TechConversations has some great YouTube videos about trading options for beginners, and there are some playlists already set for your convenience on his channel.

Don't hesitate to ask before you do anything so you don't get caught in a situation where you are standing in line for food because you made a mistake. Learn from our mistakes, and from paper trading.

Note: This is just a strategy I wanted to talk about so there's no guaranteed profitable strategy .

Congratulations @manjaro! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 30 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!

Yay! 🤗

Your content has been boosted with Ecency Points, by @manjaro.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more