Brady, I've held this same exact position for years. Until... I started watching traders nail things perfectly. Like... it seemed almost magical. I saw it over and over again. Eventually, I had to suspend my disbelief a little and recognize I was getting data points about reality which couldn't be ignored and required explanation. These were facts I was being presented with that were far beyond statistical noise. As you said, it's possible it's all just a "self fulfilling prophecy" but I don't think it claims to really be anything else. Once I started trading a bit more often, I started to "feel" what other traders were feelings. These are emotion based responses. People (on a bell curve) have similar emotional responses. Get enough data, and those responses can be known within various trading situations with various volume, price history, sentiment, etc.

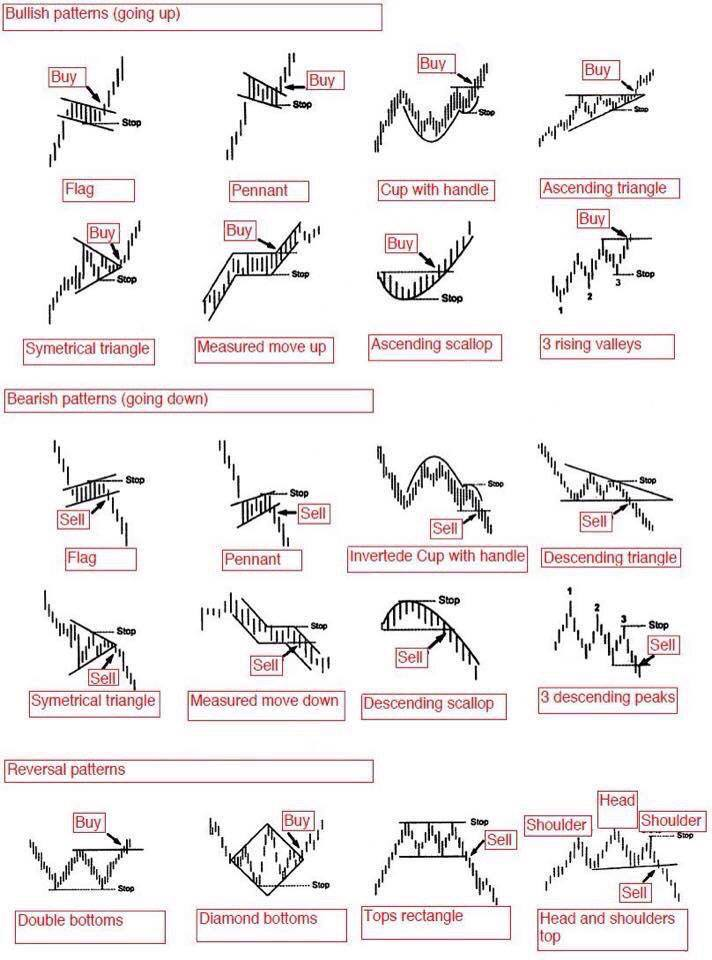

These patterns start to emerge:

It could be crazy, sure. But when you get around really good traders (they are rare and I happen to be in a group with a handful), you start to see it for yourself.

Give that article I link to a read. If you're able, get around some really good traders (guys that throw around millions of dollars like it's no big deal). Then start to see if the patterns mostly work. It's freaky stuff, for sure, but we humans are part of nature and our emotional fear and reward response mechanisms are determined by our inputs like anything else.

@lukestokes thanks for another great article. I mostly follow and contribute writing and art on Steemit, but when it comes to crypto writers here you're my favorite; I find your writing and way of thinking very relatable. The quote you shared "It’s only by doing that we learn anything in life" is so true. I know I've said this a few times in comments to you and on my blog, but I watched bitcoin grow from the fringe and was always very curious. I've learned so much in the time that I've joined Steemit just by getting my hands in it.

I'd highly recommend to anyone new, learning, or apprehensive to take some of your Steem you earn from posts here, transfer it to Bitshares, and just start playing. Read on coins that interest you, see who else is interested, and buy it with your Steem. I've gained knowledge and comfort that I've put my earned USD into buying BTC. I haven't owned it long, but I already feel those two sides of approaching crypto arguing inside me: I said I'd HODL the BTC I bought, but Smartcash is so exciting right now. I may eventually do something else with that BTC, but I promised I'd at least leave it in my wallet until the hardfork, then I'll have Bitcoin Gold to play with.

As always, thank you Luke for what you do in the Steemit community and thanks for sharing what you learn.

@lukestokes In the early days of computers, long before spreadsheets like Multiplan or Lotus123 existed, I spent five years of my life trying to mathematically and statistically prove that the chart patterns shown above actually work.

They do, about 33.33% of the time. In another 33.33% of the time I found the exact opposite of what was forecast happened. In the remaining 33.33% of the times, neither bull nor bear developed. It did nothing.

This was tested with gold, silver, stocks, indices, currencies and commodities. Statistically less than 50% of chart patterns evolved in the forecast way. I could not discover a way to guarantee profits based on the chart alone.

As far as I was concerned, I had disproved all the books ever writtten on chartism and chart theory.

However...... I have come to learn that after you have done your fundamental analysis, and found a promising investment, the chart patterns can be useful to help you time your entry point.

By the way, you made a great comment :

“I'm learning to separate out my investor side from my speculator/trader side.”

Yes, distinguish between safer long term savings, and fun investing.