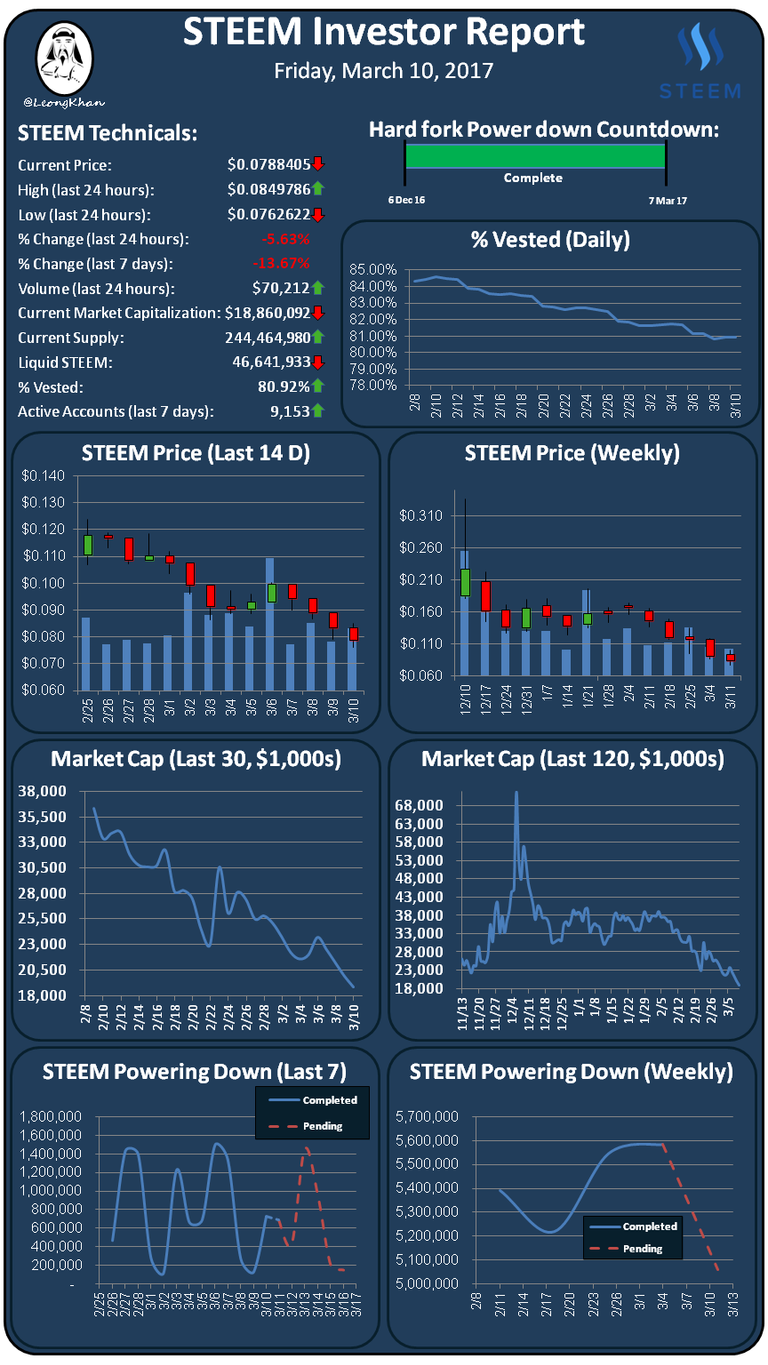

Trading Recommendation:

Look for minor bull trends on 15 minute/1 hour time scales, I think the next few days will be volatile but the long term trend is still down

Investment Recommendation:

Hold current STEEM and slowly begin accumulation below the $0.10 level (dollar cost average), I purchased 1,000 STEEM at $0.0975, 250 STEEM at $0.0918, 1,000 STEEM at $0.085, 1,500 STEEM at $0.0825, 1,000 STEEM at $0.081. I'm currently looking at placing my next order at $0.075 but I have not entered it yet.

Analyst Commentary:

The STEEM price fell 5.63% verse the USD over the past 24 hours on higher volume than yesterday but still lower than the average volume over the past 14 days ($106,000). The trading volumes of both Bitcoin and Dash are sliding back to normal levels but trading activity has not yet picked up in STEEM. The low volume over the past few days continues to indicate that there is a significant amount of liquid STEEM that sellers want to unload which has resulted in current price slide as patience gives way. The % vest rose slightly over the past 24 hours as some investors are powering up and power downs are still low. Power downs are scheduled to pick up today through Tuesday which may be punishing for the STEEM price if there is no news that causes investment to pickup over the weekend. I will continue to watch to see if the % vested indicator can maintain its current level for the remainder of the week before Monday's big power down.

I advise traders to watch for short term price rallies with the ability to loosen up the stops in hopes of catching longer up trends (there was one significant price spike yesterday which would have been very profitable). On the investor side, the % vested figure has stabilized which is a positive indicator for the long term price. I hope to see it remain stable through the weekend which could indicate we are near the bottom.

I powered up another 2,500 STEEM at these value levels. I continue to dollar cost average my investment to pick up more STEEM as the price continues to slide. On the up side, I just invested my way to Dolphin Status! Full Steem Ahead!

Data Credit:

Steemchart.com

Coinmarketcap.com

Steemdb.com

Disclosure:

The report published above is based on my assessment of the cryptocurrency market. Investors should consider this report as only a single factor in making their investment decision. All investments involve market risk, including possible loss of principal invested. The author is a cryptocurrency investor and while he seeks to provide honest assessments to the best of his ability may have a conflict of interest that could affect the objectivity of this report.

I really hope your investment pays off. It's odd that I'm actually making more (dollar wise) than I was a few weeks back. Okay, so it's losing value, but I expect a recovery eventually

Disillusionment may be causing other authors to post less which is allowing us to capture a greater % of the STEEM paid out each day. I think this is a great opportunity ... I wouldn't mind if we continue to slide down for the rest of the month. Just a better opportunity for my run at becoming a whale :-p

At what value of steempower is considered a whale ?

I've seen most people calling it 50,000 SP.

I reckon Steem will settle in the 0.0003 range.

What indicators are you using to figure that out? I'm curious what methods others are using.

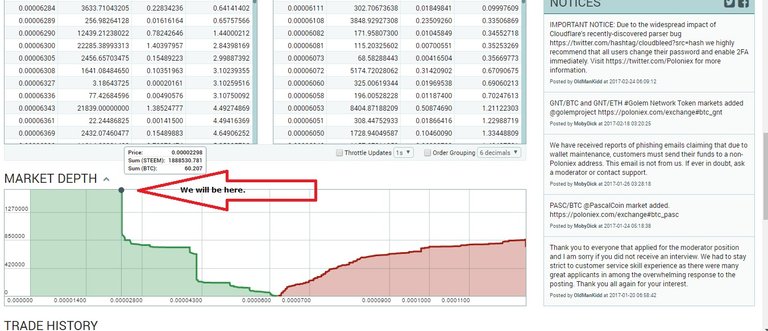

Set buys in the 2k range, clearly thats where we are headed. Shocking, obvious, price manipulation + whales selling, 2k might not even be floor price.

All i know is that i would not be surprised to see 2k. Then insiders can buy it all up and then it might start to go back up, right now, Steem has to be one of the worst performing alts ever made.

What is the 2k based on?

The constant sell pressure and whales with big wallets still. Plus this on Poloniex.

I find buy or sell walls far out from the current price to be unreliable indicators. The market depth does show that there is more sellers at close to current market price which is a negative indicator.

Indeed, but you will find this constant sell pressure will drive the price to the floor. Thats clear to see, still too many big whales exiting with huge early gains, they seem to have endless supply of coins. We will see closer to 4k by the end of this month, thats for sure. And i bought a ton at 18k avg. S

I'll be watching to see what happens. I'm hoping the oversupply clears out by the end of the month.