This is an image from Google

Dear LAZYTRADERS,

One of the most asked question in perspective of trading is whether you can get rich or not. To get down to this question we have to make a few assumptions here and there.

First that you are already a successful trader who makes money consistently.

Secondly that you have round about 2 months in the year in which you actually lose money. This number is based on a statistic where they monitored professional traders and every professional trader has about 2 months in the year in which they lose money. You want to work with that kind of data because it gives you a perspective and shows you the reality of trading. No BS just the straight truth.

A realistic view of trading money is when you risk about 0.5%-1% of your portfolio to achieve a return. This is crucial because you want to reserve your capital and do it longterm and not just a couple months. Trading is a longterm play of creating wealth and not a get rich quick scheme. You can make a lot of money relative to your account size safely in a short time period but I will get to that later. Most professionals make about 1.5$ for every dollar they invested. So if they risked 1000$ they make 1500$ on average. When they lose they obviously are short of 1000$ so the ratio would be 1.5:1. I know everybody tells you about wanting to make twice the amount they risked but that is not true most of the time because you have to always pay fees whether you make or lose money. And you can never know if the opportunity is good enough to achieve twice the amount youve risked, you always assume if that can be the case but it dont have to be. Clearly there are exceptions like when you make a great trade an the ratio is 5:1 and you make 5000$ for 1000$ invested or even more but we dont want to work with exceptions and just with the basic average returns and when you hit a better trade that is just icing on the cake which helps you to grow your portfolio even further. You will later understand why this kind of trades will help you to grow your account faster just bare with me! Just a hint: The more money you have the more you make. I hope that gives you a more realistic view.

Now lets get to the question!

Lets say you had 20.000$ to your name and youve grown that money consistently over the last 3 years to about 45.000$ which would leave you with a return of 50% per year which can be achieved if you make 5% a month and lose 5% in 2 months of the year. Keep in mind that im just showing you a concept here and the reality is a bit different but it will help you to understand what you can do to scale this up.

Now you made 25.000$ in 3 years and your biggest losing streak(5% loss in a row) was 5% which would be your max drawdown in those 3 years. You now have some good numbers to work with and it only comes down to psychology. When your max drawdown was 5% in a row and you would be comfortable losing even 10%(This is what I talked about earlier with making huge amounts of money in a short time period). You now just have to risk twice the amount you risked before to get double the return! If you want to play it safe just split your account in 2 accounts and let 1 account mirror the other. Almost every broker has that feature of mirroring accounts which means that if you execute a trade on 1 account the other account automatically does the same. You could just take 10.000$ of your money and put it in a second account and earn 100% a year with only ramping up the parameters of your risk tolerance. You risk 2% instead of 1%. You now have 2 accounts which execute the same trades but generate a different return.

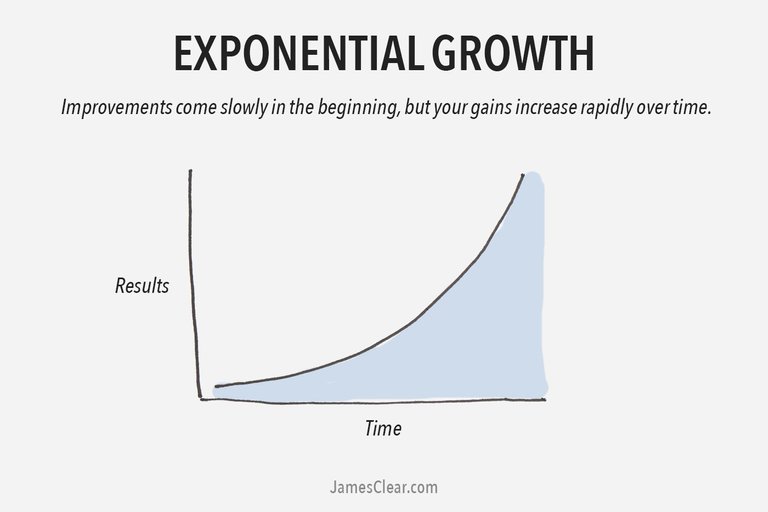

In reality the more money you have the more money you generate. If you earn 100% on 10.000 you have 20.000$ and when you just do the same with the twenty thousand you now have 40.000$. Its exponential growth if you dont use a linear approach of risk management. A linear approach would be always risking 100$ a trade regardless of the size of the account. A non-linear approach would be risking a percentage of the portfolio but that is what creates exponential growth. An example for illustrating this so that you can clearly understand: 1% of 100$ would be 1$ and 1% of 200$ would be 2$. The more you grow your account the more you risk but it all stays relative to your portfolio size because its basically the same if you risk 1% on 100$ or risk 1% on 100.000$. The game is the same but the numbers are different so dont be afraid of that. You literally make twice the amount if your account is twice the size in the same time period simple as that. So overtime if you just make 5% per month dont get discouraged because that 5% will most likely stay the same but your account size wont. 5% on 20.000$ would be a thousand dollars a month. 5% on 40.000$ is 2000$ a month. Can you see how this is just crazy and seems unrealistic but this is the truth and the reality of trading.

This is how the equity curve of a professional trader looks like:

This is an image from Google

This is what most people expect from the equity curve(which is only true for traders who dont know what theyre doing)

This is an image from Google

The moral of the story is to use a non-linear approach in terms of risk management and splitting your account in more parts to play both sides of the game. An account which uses not so risky parameters like just risking 1% per trade and an account which risks more but with a smaller balance. This will help you to grow your net worth both stable and fast. You have the best of both worlds. One is more on the conservative side and the other more on the riskier side. This shows you that even a small account of just 20.000$ can generate a lot of money over time just imagine how much it can grow in 10 years with you even investing more money every couple months from your job you doing right now. Even just a 100$ every month would make a huge difference in 10 years! There are a lot more ways to speed up the process but I will get to that in another Blog post of mine so stay tuned!

I wish you a great day and dont forget to work hard and play even harder!

- Lazytrades

good

Thank you @nadirnaji :)

click here!This post received a 3.7% upvote from @randowhale thanks to @lazytrades! For more information,

This post has received a 0.52 % upvote from @drotto thanks to: @banjo.

Congratulations @lazytrades! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @lazytrades! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!