MACD stands for "Moving Average Convergence Divergence". This indicator measures how much two moving averages are moving apart from or toward each other... there are three things we look in MACD

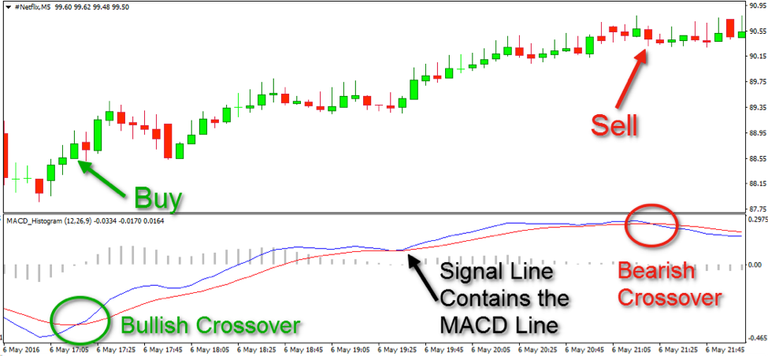

- MACD line...which measures difference between two moving averages

- Signal Line... which is nine-period moving average of MACD line

- Histogram...which measures distance between MACD line and the Signal line

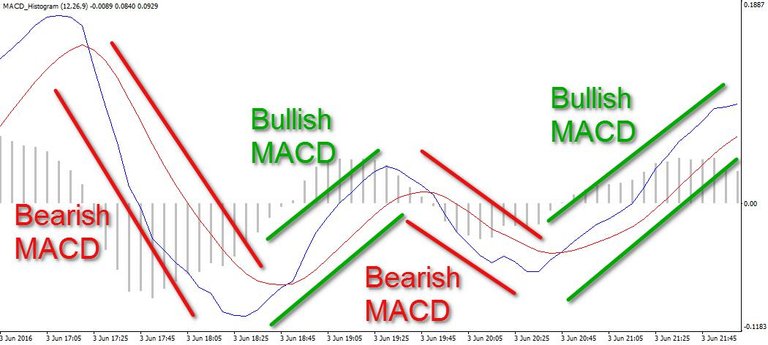

Scenarios...when two moving averages are going farther apart from each other and down then MACD line moves down away from 0 - this indicates downside momentum.

When two moving averages are going farther apart from each other and up then MACD goes up toward 0 - this indicates upside momentum...pretty simple right?

More scenarios...when two moving averages going toward each other and down then MACD line moves down toward 0, this indicates that momentum is slowing or reversing because the spread between the two moving averages is narrowing. When the two moving averages are going toward each other and up, MACD line moves up toward 0, this indicates that momentum is slowing down or reversing because the spread between the two moving averages is narrowing

And more scenarios...when two moving averages cross, MACD line is at 0 because there is no distance between the two moving averages

So how the hell do you use MACD for your trading?

When the trend is up

if the MACD line is above 0 on the retrace in the trend, consider the trend STRONG

if the MACD line returns to 0 or below on the retrace in the trend, conside the trend WEAK

When the trend is down

if the MACD line hold below 0 on the retrace in the trend, consider the trend to be STRONG

if the MACD line returns to the 0 or above on the retrace in the trend, consider the trend to be WEAK.

Just to simplify take a look at picture below...

I hope this helps and as always ...Happy Trading !!!

This post received a 4.5% upvote from @randowhale thanks to @krypto101! For more information, click here!

Good stuff, explained well!

Thanks, more coming soon

That was really helpful! Great post. Upvoted for you sir. I'll be trying to use this method in the future.

cool, aslo check out RSI indicator, i use it all the time

This post has received a 1.56 % upvote from @booster thanks to: @krypto101.

Macd indicator is my favorite tool for short term to mid term trading. I still have some learning to use it more efficiently. Thanks!

Awsome, thanks for comments!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by krypto101 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

Source: https://books.google.com/books?id=yXXCBwAAQBAJ&lpg=PA118&ots=-XG1yJCLEI&dq=Fibonacci%20Levels%20are%20very%20often%20used%20in%20trading%20for%20support%20and%20resistance.%20Traders%20believe%20that%20Fibonacci%20levels%20work%20in%20trading%20because%20so%20many%20traders%20use%20them%20that%20they%20function%20as%20a%20self%20fulfilling%20prophecy...%20Market%20in%20fact%20responds%20to%20the%20them%20so%20you%20should%20incorporate%20it%20in%20to%20your%20trading%20too...&pg=PA118#v=onepage&q=macd&f=false

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!