Trend trading is a very cool opportunity to make some money, it gives you a way to make profits while risking smaller amounts of money. Just to clarify...trend trading is trending long term moves and as we already know non of the markets are going straight up or down, in between those moves have wiggles, oscillates or waves.

Those waves form short term highs and lows as the market moves in direction of the trend...something like surfing on the ocean

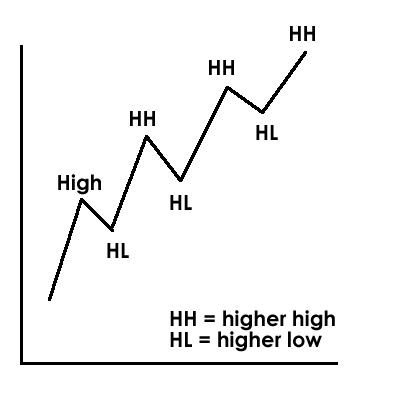

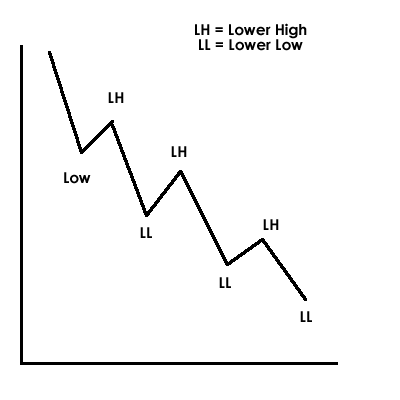

You may have heard of higher highs or lower lows, but what do they really mean? To make it simple...

Uptrend usually forms a pattern of higher highs and higher lows in a long term ascent.

Downtrend usually forms a pattern of lower lows ans lower highs in a long term descent

OK, let's jump on that wave!

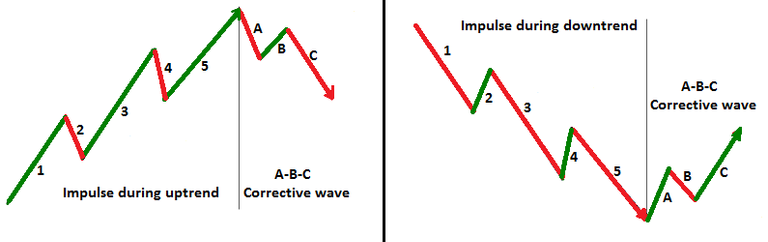

Our charts represent price patterns of cryptocurrency and if you look closely those price patterns make short term moves against long term moves .those oscillating waves are akin to our experience of moving toward long term goal but the path that people take is referenced to taking 3 steps forward and 2 steps back

Best way to go deeper in the waves is to understand Elliot waves witch is the most well known approach to wave counting and Fibonacci numbers as the most popular approach in measuring mathematical movements of waves.

There are 2 primary emotions we experience when we see those fluctuations in the market...and those are fear and greed.

Generally we jump in the market because we are optimistic and we have a sense of confidence that we'll make money, buy as we see the market moves in the trend , the emotions of fear and greed begins to creep up in to our thoughts.

- Fear, because market can turn against us and we lose the money that we have already made

- Greed, because regarding the money we have already made , we want to take out our profits and cash out

After the market moves up for a while, many of us will sell all or part of positions. We want to lock in some profits and reduce the risk of cash we already exposed in case the market turns against us. Sometimes we'll feel for some reason that it is time for the market to go down. when we see market turning down on us, it's because people who got in early are now selling, so we take this opportunity to short the market thus adding more volume to the downside and pushing market downtrend

That is just a little simplification of what makes those waves in price as markets trend in a direction

Let me know if you guys have any questions and as always ....Happy Trading!!!