To begin an article let us ask the obvious question: Why trading cryptocurrency, why not just invest and hold? The answer is very simple: Much better risk control.

Principle of this strategy is to use continuation structures of technical analysis and use them as entry triggers on the crypto currency that trader picks as tradeable. A currency or token can be added into "watchlist" if it meets the required charasteristics where we as investor assume that there is a potential in such instrument. Adding currency or token into watchlist and possible play is only step one, the next key step is not to invest yet, but to wait for adequate technical setup to appear and then enter in long trade, using tight stop loss. Using such approach allows trader/investor to have much more flexible and improved RR (risk to reward ratio) on trade compared to default invest and hold method.

This strategy can be used on margin or non margin trades in cryptos.

The key aspect is to focus on clean symmetric structures which are following strong up trend. If there is a strong up trend, often there is a good reason for it, and therefore we have fundamental reason for why to be involved in such asset.

Research

Personally i do research in ERC20 token space every week for about 1-2 hours to see if there is any new and exciting project with solid potential on horizon, and if there is such token i add it to watchlist. Once the asset is on watchlist (could be piece of paper, or notepad file or marked/flagged in trading software), i will start to track it on m15-h1 charts if there are any continuation structural setups along the trend. Usually looking for structures with 3 highs and lows that are tightening towards right side and potentially squeezing after breakout.

Watchlist

Current watchlist on my side currently consists of this assets:

-Augur

-Ethereum

-TenX

-SNGLS

-Musiccoin

-Stellar

-BTC

Doing quallity research can make a huge difference, however it is rather hard to teach someone how exactly to do proper research on coin becouse it touches so many different areas from understanding the technology, to market cap, to projects development team and other factors.

Factors to consider adding token on watchlist

Main three factors to consider adding token on watchlist as tradeable asset, those factors are required to be understood:

-understanding technology, understanding the potential of use

-market capitalization

-development team (best reliability with proven experianced team, less reliable simply by judging developers as capable).

The key part of using technical structure for entry is that investor has less risk if one does not properly judge the project/token based just on the 3 factors described above. Using only the factors above would fit the strategy into "invest and hold" type of strategy, however as soon as one adds technical structure as execution of entry then the strategy quallity improves, simply becouse the room for error is narrowed down on risk side (as long as trader uses stop loss and controls the risk of course).

Understanding the technology is usually not a very hard part, especially since we live in era where new technologies keep coming out every week, especialy younger generations have no problem quickly adopting to new tech. In most cases when it comes to solid tokens sadly that is not enough, just becouse token or technology looks good on whitepaper it does not mean that such token will be successful.

The next key aspect is understanding the market capitalization and the overall supply. A very simple way to explaining it would be to simply look for tokens that have low supply (eg bellow 100 million tokens) and have also market capitalization that is bellow 10 million USD. Using 10 mil as rough number since it could vary a lot what trully is low market cap for specific project as it depends on potential of users that such technology can be expanded into.

The lower the market cap the better it is.

Last factor is development team, if team is proven with past record of good projects then its generally a very good sign, however often that will not be the case and it will require for each investor to judge the development team based on the info they can gather (either interviews, or CVs, or else).

For trading i would highly suggest IQ options trading software or Coinigy since both of those brokers have quallity data feed and great robust trading softwares, however technically this strategy can be executed in any exchange/platform as long as data for asset is good enough on candlestick charts.

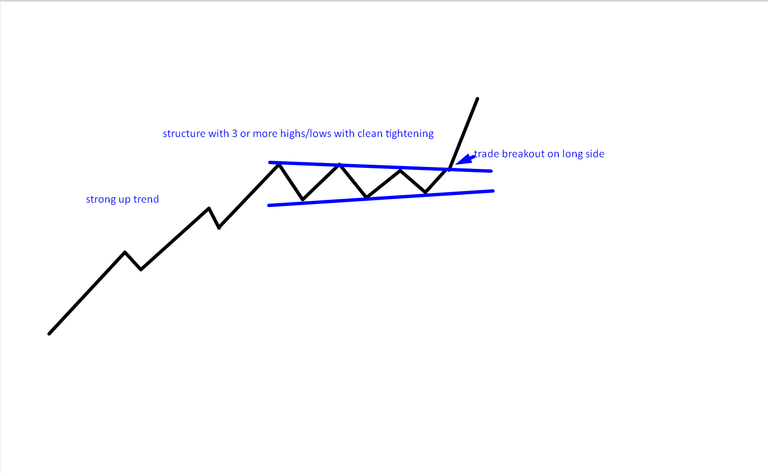

To keep it condensed this are key properties of structures that trader should be looking for:

-asset has strong up trend

-current formed structure has at least 3 highs and lows (extremes) in it

-structure is tightening towards right side

-structure is symmetric and clean where first (left) high is always higher than next 2 highs towards right side, this ensures that supply is still intact

Conceptual representation of structure:

Stop loss can be put automatically or trade can be stoped out manually this depends on traders prefference but also on liquidity, on lower liquid assets it is much better to use manual stop if spread is too big to prevent being stoped out "for nothing".

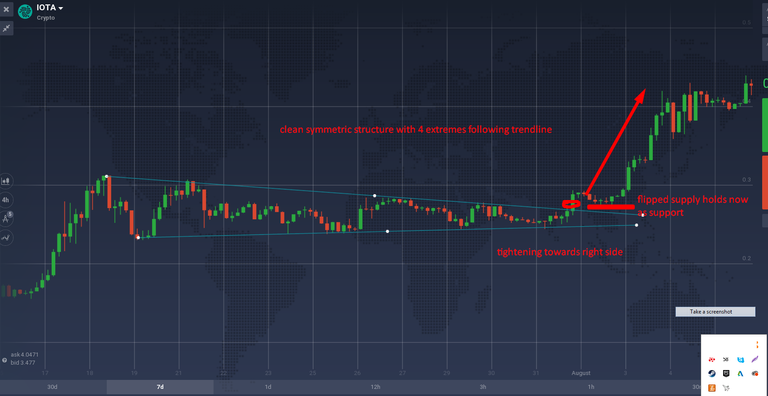

Examples of structures, entries and risk control:

Leave a comment if you have any questions.