I took around $200 worth of my Steemit post earnings, turned them into $600 in 3 hours. Here's How:

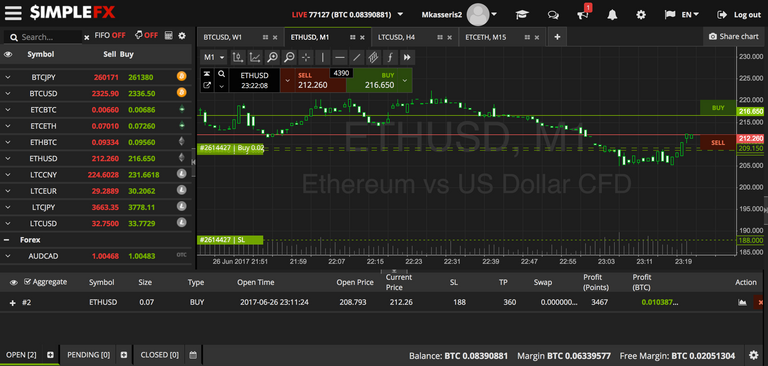

I converted the $200 from Steem into BTC (around 0.08 BTC) using blocktrades and moved it to SimpleFX where I can trade crypto, forex, stock, index and commodity CFDs on leverage using BTC as my account basis. I have traded on this platform before. Here's the documentation of my current live long ETH/USD CFD trade and the mechanics behind it.

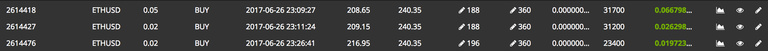

I opened three different positions of different contract size; in total the contract size is 0.09 with an average entry price of $210.606, using 0.08BTC of margin overall.

Mechanics

You can open a position using as much BTC margin as you please. The value of a point (minimum change) in a trade is determined by the contract size, which in turn is determined by the margin utilized and the leverage.

Simply put, with a 0.08BTC margin and 1:10 leverage on ETH/USD CFD, I can open a position worth 0.8 BTC.

The 1:10 leverage implies that a 10% change of the price either doubles your investment on the position (if +10%) or evaporates it (-10%), since 10% change with 1:10 leverage is a 100% change.

So at my entry price of $210, if the price moves to ~$190, which is my Stop Loss, I will lose all my 0.08BTC utilized to open the overall position. (At first glance this seems startling in terms of risk management, well I have actually maintained different trading accounts for different instruments, and overall I usually risk max 5% of my trading account on a single trade, and roughly 10% of my cryptocurrency investment holdings are for trading.). So this is obviously not my entire trading account, just a small portion utilized for such trades.

Conversely, each 10% increase doubles the investment. So at a live price of ~$245, the trade earns roughly 150% ROI, or 0.125 BTC on the 0.08 BTC used to open the trade. At $255 around 200% return with over 0.16BTC in profits, and so on. These are small amounts and hence the overall trade is handy for demonstration purposes.

Trade Management

There are several different approaches one can take here.

One is to let the winner run until it goes back to the historic highs of $400 ETH/USD. This would be roughly a 1,000% return on the trade, turning the $200 into $2,000. I have done this before, it's not crazy. However, this requires that the price does not retrace back to the entry price and lower to take out the SL at $190. If the price drops again to the daily low = entry price =(and deepest correction low to date since historic highs), and the profits are lost, one can make sure at least the investment money is not depleted by puting the SL at the entry price. Yet, the drop could be just about enough to take out the SL at the entry and move back up (has happened many times before) so it always comes down to trade by trade management, always following more fundamental management principles across.

Another approach is to just claim the profits now - a sweet 150% return in just a couple of hours - and then seek another entry at a good price. And overall take it back to the highs by going in-and-out. I have also done this before, and it's tricky. Every new trade is a new risk, and it's likely that some consequtive trades may be losing trades and claim back profits from your prior winners. Overall it always comes down to the time horizon, risk appetite and strategy of each trader. And my own management is not always the same across every trade (but there is always an underlying approach).

One of my favorite strategies is trading fractal breakouts, liquidating at Elliot 2 & 4 consolidation waves and re-entering for the next breakout waves, using profits from the previous trades as well.

I will be updating you on the outcome of this trade in the comments section.

Moving forward

I will be authoring posts on risk:reward, risk management and trading strategies in an attempt to help new Steemian traders you could find this information valuable (let me know if there is something specific you would like to see). And will be documenting new trades.

Eventually, I plan to also create an account on either 1Broker (recommended by @kingscrown) or eToro which allows for the trading history to be visible to the trading communities and also other users to easily copy your trades. This way, I could allow other Steemians to very easily copy my trades on auto-pilot and make the same returns as I do using BTC. Let me know if this is something you would like to see.

Till the next trade (and post), much love Steemians!

If you liked this post and want to see more, please Upvote, Re-steem and Follow me @irf1 :)

gee... maybe I should just hire you to manage my assets (not much though)... haha!

haha thanks for the vote of confidence bro! Actually lowkey my plan and aspiration is to help other people with trading and investing (and many years down the road form my own hedge fund) - while also working on my Data Science Marketplace startup Algora - so let's see how things go! Starting with a Minimum Viable Product (being profitability and certain ROI from trading and investing with a small capital, and just leverage up and use more capital crowdfunded), a great scalable recipe. I'm working out the ingredients right now :) same would go for the startup. Maybe I took your reply too much at face value ha, well now you know what my aspiration is!

In fact, once I setup my account on 1Broker, where anyone can just copy my trades on auto-pilot and keep the entire P/L from the trade, you will be the first one to know it!

Seriously be it from my posts, other people's posts and the wealth of resources online, again I think you would really find it worthwhile to engage yourself with trading. I hope with one post/trade at a time, I will be persuading you more to explore this lucrative sport :)

Cool. :)

Trade closed at profit.

I made a SECOND trade, in fact same as the first, entered earlier today (since ETH/USD retraced back to the previous entry price, so it was another great entry opportunity), I entered at $216 (didn't manage to catch the bottom for a second time but still good entry), exited at $248, a cute 0.1BTC profit from the 0.07 risked on the trade.

Congratulations @irf1! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

Congratulations @irf1! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!