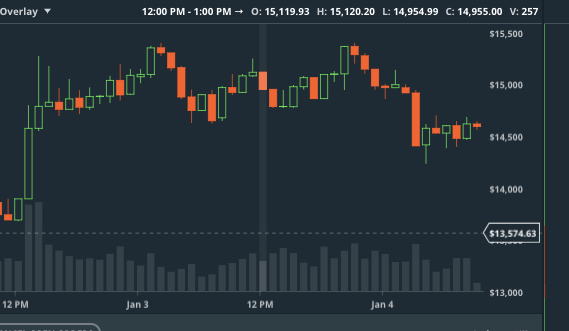

Hey Luc, you speak a lot in your videos about bases (supports) and you get very enthusiastic about how easy they are and how trading is super simple, and you go through days and days of graphs and show "look another base" and it's like it all follows a perfect perfect code that is always the same. Now, I started trading a couple weeks ago, and I do see the bases, but here is my problem: the rise in percentage from a base upwards is always minute, so I make very little from it, and when a resistance gets broken, its unpredictable and does it over many hours without following any pattern. Then, unless it falls just a few percent back down to the "new base" it falls drastically down and I am often unprepared for that (like it will happen at 4 a.m.). Also, you speak very rarely of resistance, like, maybe I've seen you speak of it one time, even in your video on bases and resistance, you basically say bases are what matters. However, bases aren't much good if you don't know when to sell. Would you be able to give me a sort of concise explanation of how to actually use the base AND resistance, how many hours of returning to the same point constitute a base, and what actually constitutes resistance?

I took some screenshots if you wanted to see why I feel like my trading shots look so different than yours. Does GDAX just suck for getting nice bases?

THANK YOU SO MUCH FOR EVERYTHING YOU DO!

Screen Shot 2018-01-04 at 9.22.53 AM.png

Also, and this would probably be helpful for all, was there a good way to predict that Ether would go shooting up while BTC fell in the last few days? Stupidly I ended up with BTC at a bad time, when if I had known I would have bought ETH low, then bought BTC with it once ETH shot up and BTC shot down.