It's possible yesterdays massive leg lower on the $ across the board was the final squeeze to shakeout traders. Supporting this thesis is the fact DXY DSI (daily sentiment index) was ultralow - 8. Time to squeeze out latecomers.

Keep in mind, these are daily candles and day hasnt ended yet. We will revisit these pairs tomorrow for followup. Everything can change in a bit, so dont start betting your houses on it. Being a dollar bull isn't easy and this might be nothing more than a squeeze. Looking to resell the US dollar higher, much higher though. Also the squeezes/reversals/bottoms may take time to work out, patience, but these are some excellent levels to bet small on the dollar.

So, charts.

First of all, what do i consider a key reversal? Well, its a candle in an uptrend, that forms a higher high, but then closes lower, in short higher high, lower close (HHLC). In a downtrend, inverse, lower low, higher close (LLHC). Usually these candles on bigger TF at key levels are important indicators.

USDCAD daily - massive trendline below, an excellent area to build USDCAD longs. Longer term still see this lower.

USDCAD the squeeze starting with 30 minute inverted H&S. Cautious entry at H&S pattern breakout

EURUSD do you see where we stopped, at the long term 38 fib

EURUSD closeup - day is not over but might be posting a key reversal.

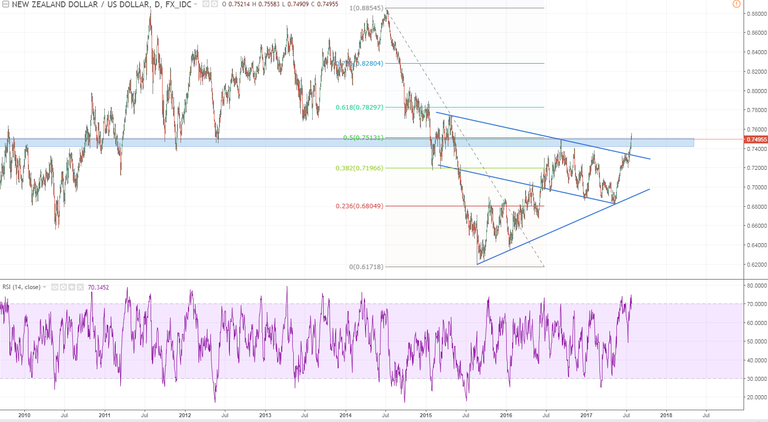

NZDUSD daily - stopped at 50% fib

NZDUSD daily closeup - i expected to test these levels yesterday (breakout levels), but in trading always the least expected happens. Looking to test them quite soon, if these key reversal candles hold.

AUDUSD daily - same key reversal candle forming.

Remember, wait for daily closes. Sentiment against the dollar is warning about a squeeze.

Trade safe everyone! Remember, cut losses fast to reenter at better levels ;)

Also, check out @forexbrokr 's recent "Ways to manage risk" post and we talked about a nice little tool there, the Equity Curve Simulator. I find it quite handy and with it sometimes have to remind myself of the advantages of a good risk-reward.

Check it out in action here

http://www.equitycurvesimulator.com/

Congratulations @furious-one! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPHey Furious,

Cheers for the shout ;)

EUR/USD has done enough to get me shorting. Might be stepping in front of momentum, but the risk:reward is there so I'm taking it.

Hey @forexbrokr, so many shooting stars at key levels, but im cautious, not taking them all. Squeezing usdcad, trying audjpy swing short, maybe wti short soon. today Canadian and US GDP

GBPUSD chart here with possible long target being the black centreline. It looks weak dollar across all the usd pairs at the moment.

your chart looks good and being a dollar bear should be the right thing to do, after a bounce, i cannot be a dollar bear in this sentiment DXY 8! but i really like you chart. question - isnt the blue fork invalidado if price gets outside, thats kinda messy, isnt it?

Daily sentiment index from 27.7

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by furious-one from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.