Traders suck, right?

Nobody likes financial types. Our collective imagination is littered with images of greedy, hubris-filled sociopaths. Razor-sharp trouser creases, impossibly shiny shoes, the GDP of some South American nation on their wrists. Nick Leeson and Jordan Belfort, Gordon Gekko and Patrick Bateman; they all end up blurring into the same grotesque caricature of the capitalist scumbag, whose scarf collection is worth more than your house. Even Bobby Axelrod, charming as he might be, is still a bit of a knob.

So, understandably traders get a bum rap. Even in the magical world of crypto, they're still somehow regarded as a kind of annoying sideshow/necessary evil. On many Slack channels you'll see them swiftly shown the door when they start asking about which exchanges will list such-and-such a coin, or talking their books as they inevitably wind up doing. Even by projects that are building trading-related products! I'm going to argue that crypto traders are actually way out at the forefront of something and that perhaps we should cut them some, ahem... slack. I don't think it's a particularly contentious claim, but it may help to cast the insane growth we've experienced over the past few years in a slightly different light. Crypto traders are, after all, the earliest of early adopters, the ones who've been playing with this technology since it was just a number you couldn't do much with other than buy pizzas and become legendary.

Trading then and now

At the turn of the last century, brokers kept offices as close to 11 Wall Street as possible, so that their messenger boys could quickly run to the exchange, delivering orders and returning with the latest news from the trading floor. Skip forward a century and gone are the frenzied pits and the obnoxious wheeler-dealers. Today the new sound of speculation is the datacentre hum. The brokers, specialists and floor traders having almost completely been replaced by servers, matching engines and HFT algos. Today the length of cable supplied to each co-located firm must be equal, lest a discrepancy of a single foot should confer a billionth of a second’s advantage to one party over another. Today bots have brain farts and companies go under.

This should be a lesson for those who champion the Internet or technology in general as a some kind of blindly democratising force. In the silo of finance it has led to impossibly rigged markets in which algos fight algos for fractions of a penny, thousands of times per second, millions of times per day. We could go on to discuss what it's done in the worlds of marketing and politics but let's just stick with trading for now. Suffice it to say, technology always creates a push and pull between competing interests. It frees, but simultaneously allows for new ways to capture.

In the good old days, big money threw its weight around by fading the market, influential players fomented negative sentiment about the securities they were short and dealers front-ran their clients’ orders. Today big money wields tools so powerful that it consistently outsmarts entire markets. Think about that for a second.

The “revolution” of retail trading

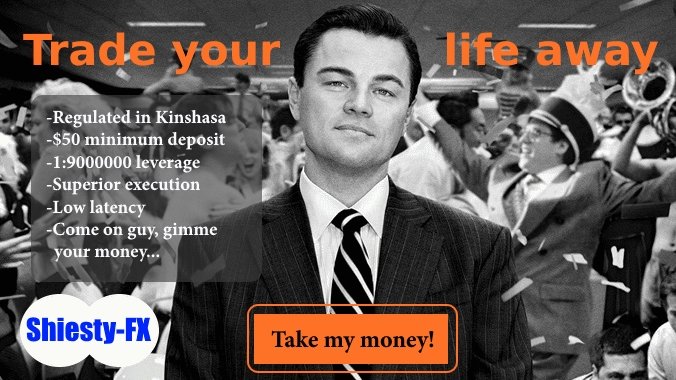

In the late 90's online trading stared becoming a thing. Facilitated by the trickle-down consumer version of the computer revolution, online brokerages started popping up everywhere, offering trading facilities that were formerly reserved for institutions and high net worth investors. They were bringing trading to the masses through the democratising force of the Internet. The decade that followed would see these outfits spreading like wild fire, getting some regulatory clout behind them, becoming much more sophisticated in their marketing and making themselves evermore accessible to the general public.

You know, it's funny, the first time I actually came across the word “decentralised” was in an online FX broker's marketing spiel, trying to sell FX trading as a decentralised version of the stock market because it isn't traded over an exchange but over a network of computers. This despite the fact that retail FX brokerages are as centralised as they come and that unlike banks they can't even be considered trusted parties.

Budding bite-sized Warren Buffetts and George Soroses trading stocks and FX from their bedrooms were only ever the newest generation of lambs to the slaughter. Retail stock traders ended up being the very last to the party, essentially dump-fodder for the insiders and early investors who bought in behind the scenes. Meanwhile, the FX traders imagined they were trading real markets, only to be relieved of their money by unscrupulous brokers who bucketed orders, controlled the feed and ran stops all day and night as if being chased by the police. Chuck in minimum deposits as low as $100 and 1:500 leverage and you get the picture.

In Japan, which still possesses one of the largest retail FX markets in the world, housewives were affecting the price of their actual real-life national currency with their margin trades. Drawn to trading by Japan's ultra-low interest rates, these traditional bastions of Japanese family finances ended up trading leveraged FX derivatives on a market that was almost designed to relieve them of their savings. Look it up, it was called the Mrs Watanabe effect and many of them lost a lot more than their blouses.

When you cut through the copy, it's pretty obvious that all the alleged democratisation of trading had achieved until very recently, is to bring a new breed of mark to the game and give rise to a booming industry that sucks capital out of the hands of the many, delivering it to the few. It was only ever a new casino cloaked in the garb of decentralisation, using all the right Internet lingo.

Despite the access that the Internet provides, most retail traders go through a gang of middlemen before their orders touch anything even vaguely resembling a real market (if they ever get there). They pay the highest fees and trade the widest spreads, they have the most inaccurate price feeds, the slowest execution and next to zero information about order flow. They play a video game version of trading with real money and nine point something out of ten of them sacrifice their account balances to the Gods of speculation every single day. Don't even get me started on Binary Options.

Crypto's second killer app

Then Satoshi came along and gave all us a little gift that we think might just change the world. What strikes me most about the cryptocurrency explosion is that, even though the promise of it becoming the Internet of money and replacing the extant banking system, or decentralising all the things from our car-sharing to our toilets, has yet to materialise, it has gone a hell of a long way to offering the kind of markets that traders have always dreamed of. I say this now, but I could've made the same argument last year, and the year before, and the year before that. It's been so for a while now.

Even in their nascent, wild-west state, crypto exchanges make other trading venues, retail or otherwise, seem like earlier versions of the game. In a crypto versus cash way. And that's just trading. What about investing? In Cryptoland, despite the premines and the scamcoins, many of you have actually had the experience of being an absolute nobody who bought into an idea early on, only to witness it becoming a buzzword on everyone's lips a couple of years later and having your early access to it being worth much more to other people now than it was to you then. Steemit is a perfect example of this 'cause it actually does something and works. Think about that too, 'cause unless your dad was a tech company's accountant or your godfather one of the founders, this was almost impossible a generation ago. That's what a lot of people are neglecting to mention when they draw parallels between what's happening now and the dotcom bubble of the 90s.

I've talked to experienced investors who are still watching the train go by because they can't even conceptualise an Internet that works without trust, it's weird. I've had people call me up a year or so after our first discussions asking me about this blockchain thing as if we never had the initial conversation. Now all they want to talk about is bitcoin, unable to comprehend the rest of the ecosystem that has evolved around it since we had those first chats. It's like they're only comfortable moving at the speed of the financial headlines. As I say, it's weird.

I've talked to experienced retail FX traders who can't even explain how market orders interact with limit orders and why the price changes. And who can blame them. To them the order book is a strange and mythical creature of trading folklore, discussed in hushed tones but rarely ever encountered. They're trading against a broker, not a market. The spread is just the difference between the price their broker is willing to buy/sell something to them while still maintaining a considerable edge. How do you explain that they're trading the wrong market when they've already internalised and accepted the scamminess of the situation and see it as a necessary evil, not even being able to imagine a possibility of things being different.

What I’m cackhandedly grasping at here, is that crypto’s second killer app is already here and it seems that hardly anyone has noticed. Crypto’s first killer app was digital cash. Crypto's second killer app was always gonna be the trading of said digital cash. Anyone who’s had the experience of shuttling their coins around from exchange to exchange in a matter of minutes, will recall that “whoa” moment when they first realised that this is, in fact, the future. If you've been following the explosion of crypto-related content on YouTube you'll have noticed that many channels formerly of a different shtick (from stock trading to the-end-is-nigh-buy-gold), have gradually started changing their respective tunes. I was amazed to recently hear a technical analyst who couldn't pronounce Ethereum a few weeks ago, having that “aha” moment when he realised how free and in-control traders of this stuff actually are.

Let's hear it for the crypto traders

Crypto traders are often derided as teenage ne'er-do-wells courting disaster and yet they are the lynch pins of a burgeoning economy. They've been at this since long before we even called them ICOs, long before Bloomberg and CNBC gave a toss, long before Vitalik earned himself provisional Elon Musk status, long before there were even handy UIs for you to buy in with. They've always carried out invaluable fundamental analysis, collecting and evaluating every iota of data, every scrap of hearsay surrounding a coin or token. And what about the troll boxes and forums? Those glorious, incongruous, foundations of FUD, where you’ll be greeted by much jawboning, wishful thinking, misinformation and downright delusion but will also probably hear about it first, whatever “it” happens to be. Ever wondered why traditional brokers don't offer a public chat facility? The last thing they need is for their “clients” to start talking to one another.

Crypto traders cut through the crap, separating the coins with promise from the copycats, the fads from the pump and dumps, albeit by sometimes falling for said fads and pump and dumps in the process. And even this is a service of sorts. They're responsible for maintaining price efficiency, liquidity and a collective memory of what happened, when and why.

Don't kid yourselves into thinking we'd get along just fine without them. They're not just an epiphenomenon. The whole ethos around what's desirable and undesirable in this space has kind of been co-created by them. They're the ones hounding the devs, they're the ones calling BS, they're the ones trying to figure out where this thing is going while moving their holdings around accordingly. And yes, many of them are teenage ne'er-do-wells and I frigging love that!

Also, don't forget that for there to even be an altcoin market, at some point in the past someone had to see Bitcoin as potentially one of many (back when maximalism was sort of the only option) and actually exchange their BTC for some other shite.

Preliminary props to the exchanges.

Were it not for the exchanges, we wouldn't be where we are today. They created the agora and beckoned the traders to come. Traditional retail brokerages are frozen in the headlights at the moment. The ones that are paying attention. They've seen crypto go from something they could just ignore and hope it would go away, to something that's eating into their business that they're not equipped in the slightest to jump on, even if there was a bandwagon in sight. I'm watching cryptocurrency exchanges slowly devouring that entire industry while it shakes its head and tells itself this crypto thing is never gonna catch on. The only thing they've managed to do to capitalise on the interest in cryptocurrencies is offer CFDs on them and then market them as being easier to trade 'cause you don't have to actually buy Bitcoin or faff around with wallets. I'll repeat that. The only response the traditional retail trading industry has been able to marshal to the thing that's gonna make it obsolete, is to offer derivatives on cryptocurrencies that don't actually involve their traders taking possession of any coins and selling this as an "easier" way of having access to this booming market. And our crypto media jumps on it any time a bucket shop announces it's adding Litecoin...

Why d'you think the Japan thing is so huge for Bitcoin? Do you really expect payment volumes to exceed trading volumes over there? Come on now. The retail trading industry is worth trillions and I don't hear all that much talk about how crypto is gonna revolutionise and disintermediate that. Maybe because it already has!

There are hurdles though. Especially if your investment in this space is ideological first and foremost. Cryptocurrency exchanges are still the unaccountable last bastions of centralisation in a supposedly decentralised space. This should concern us all. For all our big revolutionary ideals, the lion’s share of cryptocurrency liquidity is still made available to us through centralised points of potential failure. They are the glaring weak links in the crypto chain, making trust part and parcel of a supposedly trustless economy.

Hopefully these are just unavoidable growing pains that we must tolerate while one foot still has to tentatively tip-toe in the old world. For all the tenderness I feel for these nondescript little economic powerhouses that have single-handedly put the financial world to shame, I want to see them become obsolete rather than replicating the existing financial structure. It's inevitable though, as this thing continues to get bigger and bigger, we're going to see some of our beloved exchanges turning into crypto versions of the kind of retail trading outfits I described above.

Let's get our terms straight here. We call them cryptocurrency exchanges, right? Not brokerages. You take your coins there, temporarily relinquish control over them so that you can trade with others who have presumably also come to the same thing (ubiquitous bots notwithstanding). But many of these exchanges now also offer margin trading, which is, for all intents and purposes, a completely different business. And make no mistake, from the perspective of the exchange you're a completely different kind of customer depending on whether you pressed the “exchange” or “margin trading” tab on Poloniex, or whether you opted to change that “leverage” tab on Kraken from “none” to something more than none. Let me just put it this way; putting your money on an exchange still requires trust, we know this and we're working on it, but “borrowing” from an exchange in order to take leveraged positions on coins you don't truly own requires way, way, waaaay more trust. And the more money there is in this space, the more likely they are to break that trust, if they haven't already. Don't be surprised to observe a growing correlation between bugginess and lost trading opportunities or even worse stopped-out margin trades. It's one of the oldest tricks in the book.

In spite of my reservations, from Mt Gox and Cryptsy to Kraken and Coinbase, these centralised guarantors of the decentralised iterations that are hopefully soon to replace them, have made a kind of trading possible that we've always been sold but never provided. We all need to watch these gateways very closely and experiment with anything that could potentially disrupt them. If you're into this stuff and haven't shown decentralised exchanges like EtherDelta any love yet, what are you doing? Why aren't you on there buying and selling overpriced tokens on a market that moves at a snails pace? A market, incidentally, that can provide you with a wealth of trading education purely by virtue of how slow it still moves. If you've ever traded in a completely decentralised, trustless way, with no registration, no KYC or AML, just rocked up and got started while maintaining complete control of your coins at all times, then you're probably one of only a few thousand people in the history of humanity that has ever been able to do something like that. This is how game-changing what's taking place is. And because most people regard trading as some kind of walled garden of expertise they'll never be privy to, it's being largely ignored.

Let's bring it home

For me, the trading/investing infrastructure that underpins this space is the best gauge as to whether it has a hope in hell of succeeding in delivering that more peer-to-peer world we all seem to be after. If we're about to turn this into another slightly freer but still captured market, where level playing fields are just rhetorical devices spun by marketing interns, then I don't want to know. It wasn't money that brought me here, it was freedom first, so I'm not interested in devoting as much time as I do now to any project, no-matter how innovative, if it has even a smidgens smidge of a chance of being Zuckerbergerable a few years hence.

In a Nanex Research article from 2014 that provided evidence of stock market rigging by high frequency trading bots, the author makes the following statement: “Honestly, a free for all, no–holds–barred environment would be better than the current system of complicated rules which are partially enforced, but only against some participants.” Remind you of anything? That's kind of what we almost have going here, right? So let's make sure we keep it that way. And let’s hear it for the crypto traders. Once and for all. It’s a special type of psychosis that makes people want to engage in such a confounding practise.

Apologies for the length of the post. I'm awful, I know. I'll figure out how to rein myself in.

Thanks for reading.

Congratulations @failbetter! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!