In the event that you need to put resources into or exchange digital currency, an effective prescient device that is regularly neglected is the Ichimoku Kinko Hyo. The Ichimoku Kinko Hyo strategy starts from Japan and has been under-used by experts in the West because of the absence of interpretation and direction on the most proficient method to really utilize it, with most expelling it as an extraordinary pointer.

It is just in the previous decade or with the goal that Westerners have begun to comprehend the energy of Ichimoku Kinko Hyo.

This pointer works extremely well for BTC-USD and different cryptographic forms of money, and in addition working effectively for Asian brokers exchanging stocks, products, and prospects. Ichimoku Kinko Hyo converts into English as 'balance graph initially.'

You can take a speedy look at the graph and instantly discover the adjust point, or 'harmony zone' for the advantage being referred to. Designed by Goichi Hosoda, a writer, he discharged the Ichimoku framework to people in general in 1968 after he enlisted a gathering of understudies to run recreations by hand to test the framework for two decades.

The Ichimoku framework enables you to recognize breakouts and bounce on a continuous pattern. In addition, it can offer signs to enter exchanges and enables you to measure energy.

While the pointer is comprised of four parts, they all must be surveyed with respect to the market cost to comprehend what is happening in the market. Utilize the parts together to frame a coordinated entire picture of value activity that can be acknowledged by only a look.

At to begin with, utilizing this pointer can be overwhelming yet sooner or later, it turns out to be anything but difficult to utilize. You will then have a relatively moment comprehension of the quality of the present pattern and energy.

When utilizing the Ichimoku Kinko Hyo, think as far as harmony and disequilibrium. Since the market is a composite of all individual, human dealers, the market is an impression of gathering conduct. Similarly as you can't remain upbeat or irate everlastingly, we should come back to the mean, so does the market.

This conveys us to the Ichimoku cloud or 'Kumo'.

- The Ichimoku Cloud or the 'Kumo'

The main part that will be definite is the Ichimoku cloud (or 'Kumo') which speaks to the harmony zone after some time. In the event that the cost is inside the Kumo then we can state the market is in harmony;

Balance… the condition of a framework where there are two equivalent, restricting powers with the end goal that the framework is stationary. In this way, when the cost is inside the Kumo we should search for a breakout of this harmony as this will give an early section into the in all probability future heading.

Examination of the Kumo will likewise enable you to acknowledge two things; the general pattern and the value's relationship to that pattern. In addition, it gives a multi-dimensional perspective of help and protection. This is a change over the streamlined, straight perspective of customary help and protection at a specific level. Rather, in all actuality, the elements of the market causes to help or protection zones to grow and contract.

Kumo Breakout

On the off chance that the cost is inside the Kumo, the market is trendless. On the off chance that the cost is over the Kumo, at that point we have an uptrend while if the cost is underneath the Kumo we have a descending pattern. For instance, the diagram beneath demonstrates the 4-hour value activity for BTC-USD alongside the Ichimoku cloud/Kumo. In this case, we see that BTC-USD breaks over the Ichimoku cloud amid July 12, 2016, which is otherwise called a 'Kumo breakout'.

This gives a bullish flag and we could have gone into a purchase position once there was a 4-hour close over the Kumo. Be that as it may, a more intelligent system is to sit tight for the market to test the help zone gave by the Kumo. For the most part, if the cost is over the Kumo, at that point the Kumo will give a zone of help. Then again, if the cost is beneath the Kumo, at that point it will be a protection zone.

In the wake of breaking over the Kumo, the diagram underneath demonstrates that the market pushed down into the Ichimoku cloud. Be that as it may, this is an ideal opportunity to purchase as the connection between the cost and Kumo is flagging an uptrend and the Kumo presently offering help. Purchase positions would then be recommended. Following the push into the cloud, the market discovered help inside this zone and proceeded with upwards from ~$650 to a high close $685.

Purchase flag – Kumo breakout

Offer flag – Kumo breakout

Beneath you can see a similar thing yet for a breakout to the drawback.

Multi-dimensional Support/Resistance

So we have taken a gander at the signs the Kumo gives for recognizing the beginning of a pattern yet it likewise gives a multi-dimensional perspective of help and protection, as specified prior. For instance, consider the graph beneath. This was BTC-USD back in May 2016.

As should be obvious beneath, the profundity of the Ichimoku cloud differs generally finished the course of around two weeks. The profundity means that market instability and thus the degree of help or protection that will be found in this zone.

The thicker the Kumo, the more noteworthy help or protection it will give. The more slender the Kumo, the weaker the help or protection will be; this is shown beneath where a thin Ichimoku cloud was effectively broken by the market. Along these lines, we will probably observe the value change its association with the Kumo when the Kumo is generally thin.

In addition, pieces of information about the present and future patterns are given by the adjustment in the shade of the Ichimoku cloud. For instance, in the graph above when the Kumo abandoned green to red, this was cautioning us of the looming descending move that purchased BTC-USD as low as $435..png)

Subsequently, when the Kumo begins to change shading we ought to be prepared to take a position. Likewise, in the event that we detect a thin segment of the Ichimoku cloud which stands out, we ought to envision a break of the help or protection gave by the cloud. For example, a powerful case of how you can utilize the thin cloud is demonstrated as follows.

Prepare to take long position at an early stage August 17, as we expect frail protection from the cloud.

- Tenkan Sen or 'Base' line

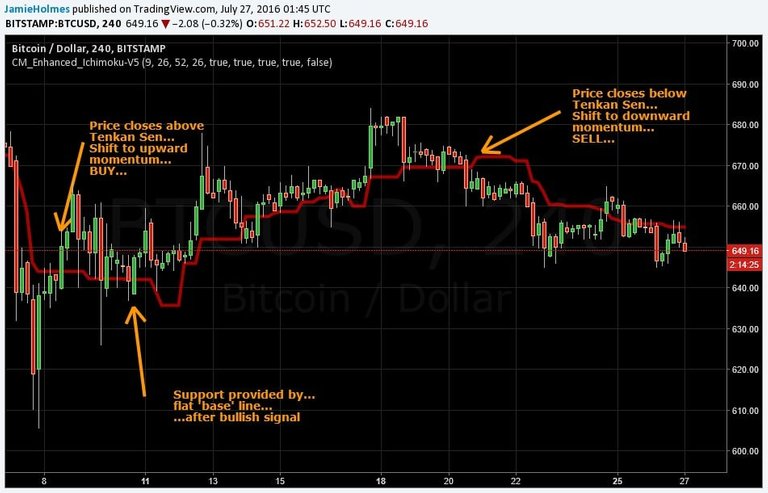

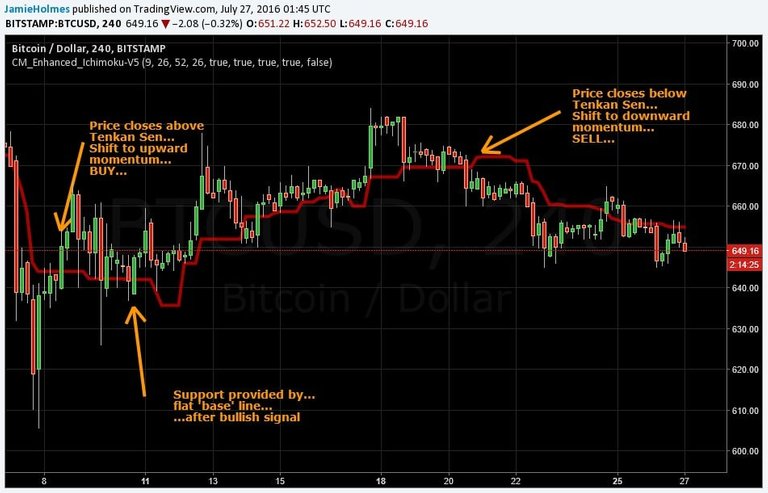

The Tenkan Sen is the normal of the most noteworthy high and least low finished the past 9 time frames and therefore better catches the market's balance and purposes of help/protection than a straightforward moving normal.

At the point when the Tenkan Sen is level, it demonstrates a trendless condition in the market in the course of the last 9 time frames. When it isn't level, the point demonstrates the relative force of the value activity over the past 9 time frames. On the off chance that the cost is over the Tenkan Sen it will go about as help. On the other hand, the Tenkan Sen gives protection when the value exchanges beneath it. However, given the fleeting idea of this segment, it isn't as solid as alternate flags in the framework. By the by, the value traverse the Tenkan Sen is generally a decent pointer of a move in energy.

For instance, if the value activity breaks over the Tenkan Sen this flags a move to upward energy. While if the value moves from above to beneath the 'base' line this demonstrates a higher probability of descending energy over the here and now. In any case, as with all Ichimoku signals, this ought to be assessed against the other three segments.

- Kijun Sen or 'Change' line

The third part is the Kijun Sen or 'change' line which is the most noteworthy high and least low found the middle value of over the past 26 time frames. The Kijun Sen basically works similarly as the Tenkan Sen yet since it covers a more drawn out era, it is more precise at deciding force and support/protection. Two fundamental signs are given by the transformation line.

This is outlined in the graph underneath which demonstrates that the transformation (blue) line gives a more tightly level of help and protection and a more exact portrayal of value balance. Likewise, see that when the transformation line is level, the value activity is pulled in to it and we encounter the 'elastic band' impact. The cost turns around this harmony level swinging without end at that point back towards the Kijun Sen. In this way, we can purchase/offer if the cost is altogether lower/higher than a level transformation line.

Another flag is the hybrid between the Tenkan Sen and Kijun Sen. The graph underneath shows how to utilize this methodology.

- Chikou Span or 'Slacking' line

The Chikou traverse or 'slacking' line is the present value time-moved back 26 periods. The primary flag given is drift affirmation. Once the Chikou traverse moves from above to underneath/beneath to over the Ichimoku cloud, this gives a flag. For instance, consider the graph underneath. The bolt features that the slacking line is moving over the Kumo, giving a purchase flag. This affirms the bullish Kumo breakout and unequivocally affirms an upward pattern is in progress.

In this manner, we utilize the slacking line to discover a help level, showed on the diagram with the yellow beam. We purchase BTC-USD when the cost touches this level, which it does following 12 hours or something like that. Subsequent to testing this help, we see that the upward pattern proceeds. To leave this exchange, we would likewise utilize the slacking line to decide a protection territory where the upward pattern may debilitate itself.

To do this, we zoom back and locate the latest pinnacles (or troughs in the event of a downtrend) and set our take benefit levels appropriately. This is shown underneath.

The Chikou traverse is whimsical in that it time-moves the present cost to contrast and the authentic value activity. On the off chance that the Chikou traverse is over the past value activity, at that point this is bullish. While if the Chikou traverse is underneath the past value activity then this focuses to more bearish activity to come.

An Integrated Picture

Utilize the greater part of the segments together to shape a coordinated picture. The diagram beneath demonstrates a hybrid of the Tenkan Sen and Kijun Sen which gives a hazardous however exceptionally beneficial purchase for BTC-USD.

This is additionally affirmed by the Chikou traverse when it moves over the Ichimoku cloud.

Likewise, now, the Chikou traverse is additionally over the past cost. Along these lines, the incorporated picture focuses to an upward pattern, so we should pause

Longer time periods are better, giving more dependable flags, for example, the month to month, week by week, day by day and 4-hour. Shorter time allotments produce excessively clamor and give not so much unwavering quality but rather more open doors for counterfeit signs. You may likewise need to do mutli-time span investigation, which will enable you to get to grasps with the Ichimoku system. For example, we can watch the 4-hour outline, take activities on the 15 moment or 5 minute diagram; if the 40hour graph inclines bullish, we can search for purchase motions on the lower time allotments and take these passages. .png)

The Ichimoku technique depends on probabilities, and back-testing can give you a superior sign of the hazard you are taking when following up on different signs. I for one jump at the chance to sit tight for affirmation and execute bring down hazard, bring down reward exchanges. Month to month and week after week closes give data on longer exchanging sessions and these Ichimoku signals are important. For example, consider beneath the basic powerless purchase flag given by XEM-BTC, which was a gigantically beneficial exchange for the principal half of 2017. The week after week close was higher than the transformation line, a frail purchase flag.

Beneath we see that the Ichimoku flag was turned out to be solid, with a long haul float toward the cloud, as the flag would recommend (a nearby over the transformation line by and large indicates an arrival to equilbrium, i.e., the Kumo).

Additionally, you can join this pointer with volume to create a wealthier viewpoint. One disservice is that the Ichimoku framework can be difficult to get your head around at first and takes some training. Likewise, a further detriment is that it doesn't unequivocally state where to put a stop misfortune so you need to likewise discover how much hazard you will take and regardless of whether that hazard is advocated.

Long and detailed post. Thanks for sharing. Proper formatting would have been more helpful.