Cryptocurrency arbitrage is another profitable trading strategy, which provides investors with a sustainable income. Cryptocurrency trading is just nascent; thus, a price discrepancy can be significant, which plays right into the traders’ hands. But certain risks shall be kept in mind.

Cryptocurrency arbitrage is the purchase with the immediate resale of a cryptocurrency on the markets to make a profit on a spread. Financial and fund markets have the type of trading activity as well, but it is much harder to use it since the prices are strictly held on the same levels. The significant potential of cryptocurrencies, unstable prices, substantial rate discrepancies make it attractive for arbitrage.

The major exchanges have a lot of regular customers and steady trading operations, which can influence the rest of the market. The minor exchanges comply with an overall trend.

If local exchanges delay changing the rate, it grants investors a chance to enjoy cryptocurrency arbitrage.

How does it work?

There are a few usable types of arbitrage, varying in terms of the automation level.

⚫ Manual. The investor is watching and tracking the prices by himself;

⚫ Monitoring via bots. There is a specially adjusted bot analyzing rates, who notices the trader of profitable pairs;

⚫ Automated system. The service makes deals automatically. The system’s script tracks the prices, creates orders, transfers the coins to the address, and sells them.A few kinds of arbitrage trading are available, regarding a strategy:

⚫ Basic.

It Is a price-difference-based trading on different platforms. Buying on one, selling on another;

⚫ Interexchange, triangular arbitrage.

The trader deposits a sum in USD, exchanges it for ETH, converts it into XRP, and then sells it again for the original USD. If the ratio and assessments are right, the trader gets a higher amount of USD than was deposited;

⚫ Static arbitrage.

It involves two deposits on different exchanges. Watching the spread, the trader is waiting for it to exceed the historical ratio. Once it does so, the trader sells the coins on one exchange, and buys them up on another.The later arbitrage is considered to be more flexible and has more in common with classical trading strategies, which are probability-oriented.

How does the service work?

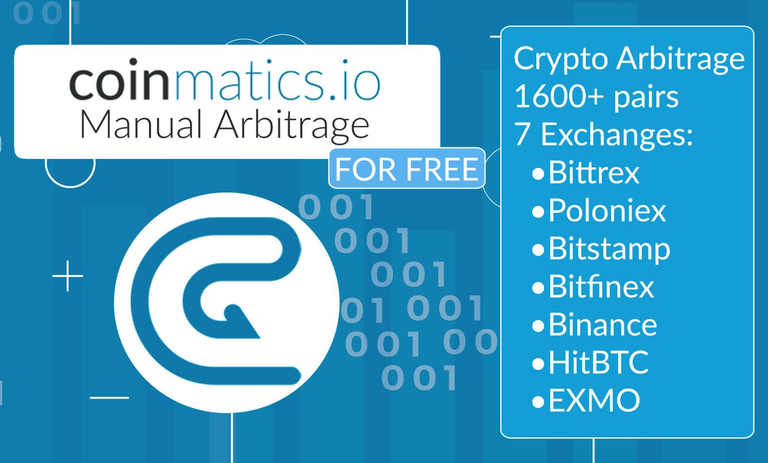

The registration on the algotrading website Coinmatics takes a couple of minutes.

Just your e-mail and the confirmation of it is required. Once you entered the service, you can pick one out of seven exchanges provided on the website.

Over time, the trader forms an investment portfolio, the data about which are stored on the platform. For the sake of convenience, there are detailed trading reports and trading history. The following information is available:

⚫ Trading reports;

⚫ Trading history;

⚫ Account balance chart.

Coinmatics offers a manual type of arbitrage matching with any possible strategy. Traders can easily adjust and manage their actions. The platform keeps statistics, which can help to monitor trading results and all figures.As an investment, crypto arbitrage looks more attractive on the developing markets than on the major exchanges, with the primitive trading strategies showing the results which are more sustainable than those of traditional currency market.

Using Coinmatics, the trader will be able to make good deals on a price difference and form a profitable investment portfolio.

only pro can do it with ease

Congratulations @cryptovanga! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!