At the start I want to make clear, that I am not talking about daily trading with savage lines in a chart when I talk about trading here. What I actually mean is the active trading over multiple days which, in contrary to the passive buy and hold strategy, makes it possible to react to the market more to buy in bad and sell in good times. The problem will be to catch the best time for buying and selling, of course. Generally, I have the opinion, that active trading - especially in the stock market – is not as lucrative as the passive investment in the same. For cryptocurrencies I have a different conception, which I will test with this experiment.

In the end the big difference to stocks is the following: While very good news are mostly already included in the price of stocks before the average consumer can react to them the flow of information in the area of Cryptocurrencies is very transparent and current so that you have a good chance even as a small investor to make some profit with good news. That at least is my feeling.

Appropriately I will try to analyze gained information as early as possible and sell or buy accordingly.

That the correlation between news and the rice and fall of the prices exists follows my personal analysis which I will explain in detail in the following:

My starting point was that I want to buy before the price increases and sell before it falls. Therefore, I looked at different projects and searched for the increase of prices in a short period of time. When I found some, I looked for News for that period of time. After some analysis I found some examples which definitely showed a connection. Here you can see two out of multiple examples:

Positive example: IOTA’s chart after release of some information about the Data Marketplace

Positive example: IOTA’s chart after release of some information about the Data Marketplace

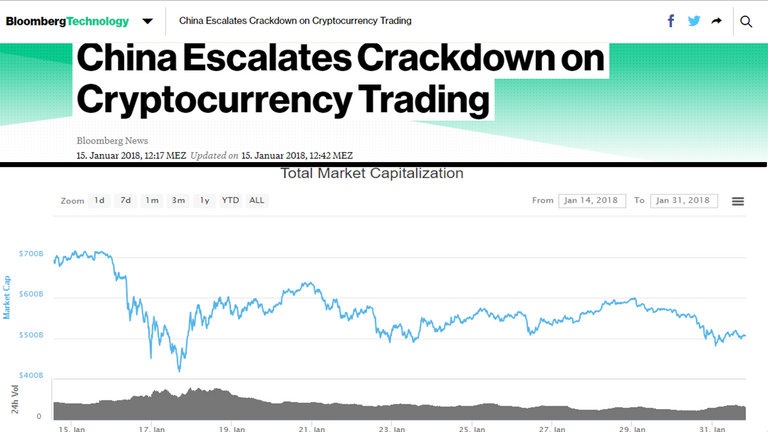

Negative example: all cryptocurrencies market capitalization after disclosure of possible bans of exchanges in China

Negative example: all cryptocurrencies market capitalization after disclosure of possible bans of exchanges in China

Consequently, the underlying assumption was confirmed. But as it is always the case: Following one problem is the next none. Or as in this case, a lot more:

1. What will be my currency for buying other currencies?

Beginning with the fact that I have to sell again and again, namely before the next big Information, I have to temporarily store my money. Due to a lot of negative press, Tether is too risky for that in my opinion. Nevertheless I don't want to store the money in Fiat for longer periods, while prices possibly rise. So I will decide on a solid currency like Ether, Bitcoin or even Litecoin to store my capital. That way I can act fast if there is an opportunity for a trade and let it gain value if times are calm. .

2. How to come by News?

The next problem is how to find hot news, preferably as soon as they come out. For well organized projects I have solved this problem with Slack, Telegram, Discord, different Blogs and especially Twitter. I soon realized though, that I cannot follow 1100 crypto projects with this quality. Here I get some help from the counterparty of the active trading: my analysis for the passive investment. Thus I will only include crypto-projects in this news-list that are all of the following three: No Scam, a bulging Roadmap that has not been executed far and the potential for big jumps in price.

3. Evaluating the news

One of the main problems will be to evaluate the gained information correctly. Meaning one has to recognize whether they are a bomb or rather a match. For this experience is obviously a fundamental which for me personally is only superficial in the trading area. However, thanks to my technical and financial knowledge, I think I possess a basic understanding that will help me. That is something to figure out and improve though.

4. Actually investing

Since I want to add multiple porjects in my news-trading-list, I will have to be able to act fast on multiple exchanges, which is a master stroke logistically because not every exchange lists every coin. If in great despair I will have to transfer between exchanges and that preferably not with Bitcoin (as of January 2018). All in all I should be present on the biggest exchanges so that I can always be able to act even with small projects. These big exchanges are Bittrex, which also includes exotic projects, as well as Binance and Bitfinex.

5. When to back out of a coin

There is no general solution to this problem. In my opinion one would have to decide this on a case to case basis. Nevertheless one should ride the wave longer until it breaks rather than stepping down from the surfboard to early. In other words: Rather be invested at the peak and leave afterwards instead of leaving to early and miss the biggest rise. The fall mostly is not that sudden, that you are back in the minus very fast. By contrast if you leave to early there is the danger to miss the biggest rise of the year if you leave to early. An example is Raiblocks (or Nano after the rebranding): If you left on December 14th of this year after a fivefold rise of the price in one week, you would have missed the second increase of the initial capital by five three weeks later. So, if you are invested and riding a wave: stay calm, analyze and especially important, listen to the mood of the community and evaluate it. Of course there are also negative news, like the example before shows. In a case like that it is better to leave all crypto currencies and coins as fast as possible (including the currency used for storing money between trades) and go back to Fiat. (This is in contrast to the buy-and-hold strategy where you stay invested until the painful ending.

6. News overlaps

Another problem are overlaps of good news for multiple crypto projects. In a case like that one has to analyze carefully and trade the better news.

7. Taxes and problems with accounting

I will talk about the problems with taxes and the trade history in a separate article. In the German article I will mention the details in Germany and in the article in English I will make an international overview which can be used to compare how different countries deal with this topic of taxes.

8. Mental strength

For the final point I want to write a bit about mental strength. Contrary to the passive investment, trading requires this mental strength, especially in case you miss a big rise although you could have traded it or if you didn't back out of a trade in time. You have to be able to deal with setbacks like that and cannot be pushed to emotional decision by them. Only who has the right amount of self-discipline should occupy himself with trading.

Of course there will additional problems coming up that I cannot foresee right now. These will have to be analyzed and cleared at the time of occurrence. At the moment though the basic plan is standing, so that in parallel to the analysis for the passive investment (Link) the analysis for the trading has priority until the beginning of March. Besides the mentioned article about taxes there will be another article for trading coming up in February, dealing with tools for trading and with price rises without big news. I am looking forward for any critique, ideas or suggestions you might have. Please feel free to provide them to me.

cryptoexperiment

Coins mentioned in post:

Congratulations @cryptoexperiment! You received a personal award!

Click here to view your Board

Congratulations @cryptoexperiment! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!