ICO Details

Symbol – BBT

Whitepaper – Link

When – October 11th 2017

How to Participate – ETH, BTC, LTC, and Fiat will be accepted in the sale.

Soft Cap – None

Hard Cap – Uncapped for 48 hours after selling 250 Million BBT, then closed.

Total Max Market Cap At ICO – ~175 Million USD (87 Million Circulating)

Exchange Rate: Variable Time Based:

Total Tokens in Circulation At ICO – 500 Million BBT

Overview

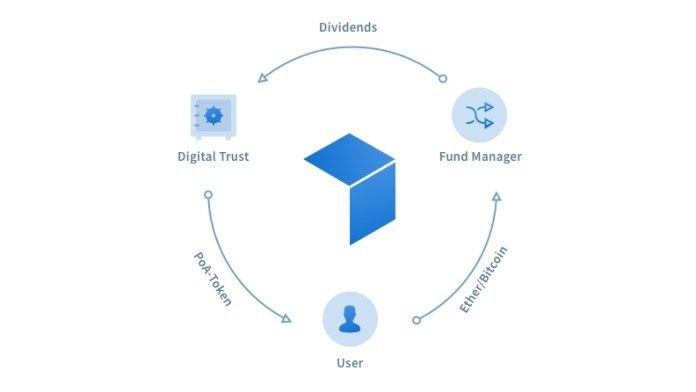

Brickblock is a cryptoasset that focuses primarily on the investing sector of financial markets. One of the innovations of Brickblock is that users of the platform are able to purchase real world stocks and securities while remaining inside of the “crypto” world through a clever little system of connected smart contracts and digital trust funds. While crypto trading can be extremely lucrative for some, for more risk-averse individuals it can often be a battle of finding that perfect alt coin or asset to buy that can grow over time (unlike a completely “safe” option such as Tether which will never grow in value) but without the added on risk. A portfolio combination of low volatility real-world stocks combined with the high potential gains of crypto equity can create a rock solid foundation with which to ease investor tensions and allow even further onboarding onto the system.

Cryptocurrency users in many parts of the world are either unbanked, unaccredited, or otherwise unable to purchase many of these real world ETFs or funds – with Brickblock, it becomes capable to micro-trade these assets within seconds without having to go through the added process of accreditation or geographic requirements. Brickblock represents not only stock traded investment opportunities, but also real estate assets with their tokens, whereupon a user who purchases a real estate asset with Brickblock will receive the corresponding unique Proof-of-Asset token in their chosen wallet. This gives the advantages of an immutable public record, the hallmark of the blockchain, combined with the benefits of real world investment.

One of the more interesting usecases of Brickblock (in my opinion) is the Coins Funds, which are essentially groups of several cryptocurrencies being tracked in similar fashion to an index fund. In a world with over 1’000 cryptocurrencies and many competing projects in the same space, it can be a tough task to try to divine who the “winner” of these projects will be and moreover, to profit from it. As an example, if you’re of the persuasion that healthcare will enjoy the many benefits of blockchain, you can’t simply invest in that sector. You would need to decide between projects such as Patientory, MediBond, Doc.AI, and others and try to suss out which of these is the best. If you instead decide to split your investment amongst these coins, you have the menial task of tracking all 3 in various wallets and prices. This can grow to astronomically high maintenaince times with certain sectors, such as Internet of Blockchain, where you would need to track over 10 cryptoassets at any one time.

Bancor was hinting at this idea, and Blackmoon Crypto also referenced being able to create these kind of index funds (similar to a stock market ETF), however Brickblock seems to be more focused on this concept and may prove to be the best chain for this kind of service (which funnily enough causes the same problem at the end of the day – do you invest in Bancor, BMC, Brickblock, or all three? Crypto is certainly strange in that sense.).

Brickblock enables users to invest in several traded assets irrespective of the size of their investment portfolio. It uses smart contracts to handle micro as well as big investments thus offering lower fees and better prices than traditional banks. Users get an asset-backed token with a unique denomination after each investment. The tokens are more easily tradable on cryptocurrency exchanges than on stock markets. Assets are also redeemable from the Digital Trust at any time.

Team

The Brickblock team is relatively new and untested, with a few great team leaders woven in. Overall I’d say that this team is on the weaker end of things, and while a project such as Brickblock isn’t the most complex thing we’ve seen in the space, time will tell whether this young and hungry motley crew of techies can bring the Brickblock vision to life.

Martin Mischke

Martin Mischke will be serving as the co-founder of the Brickblock team. He is by far the most important member on the team due to his experience with Bitwala, one of the first blockchain card and payment processing companies built for crypto enthusiasts. He has the proven record to bring Brickblock to the next level.

Positives

Brickblock’s primary strength is the novelty of their idea. There is clearly a large demand for their Coin Funds and the market will easily use any kind of service that simplifies the process of industry investing in blockchain. Trading ETF’s and and REF’s also open up the possibility for new investors who haven’t been able to dip their toes into these markets to give it a try, and I applaud any blockchain project that aims to have some real world utility.

Negatives

Brickblock’s first drawback is their competition. While their concept is relatively unique, they will face some competition – as an example, Melonport provides the capability for its users to create hedge funds for digital assets. This is essentially another version of Brickblock’s Coin Funds feature, and as such there will be fierce competition between these two projects. Another example is for their real estate ETF’s – a good example of this is Real Markets, who, while not directly related to real estate ETF’s will essentially function as one if you are a holder of the REAL tokens.

A second negative is the terms of the sale. Brickblock is looking to raise 87 million dollars in return for half of their tokens, making an obscene total market cap if 150 million dollars. It remains to be seen whether this goal will actually be hit or not, but the terms of the sale alone simply make this a questionable buy for any short term flipper or mid to long term holder. It’s likely that this is the kind of project that releases and begins to trade down the books over time, simply due to this large starting market cap.

Finally, the weak team members are some warning signs for this project. As a rule, you generally should not invest in teams that have a low amount of strong team members, as that will not inspire confidence in bringing fresh blood onto a given project. If one buys an ICO in the longterm, a weak team can also hurt the chances of the project actually achieving what it is that they set out to do. As a good example of this, look at the Aeternity crowdsale, which was relatively successful and yet was beleaguered with problems and hacks thereafter.

Conclusion

Brickblock is in an unfortunate spot, as they do have a generally solid plan with some great ideas backing their project. However, the weak team members, terms of token sale, as well as their future competition by stronger teams makes Brickblock an undesireable in the ICO space. Look for this project on the open exchanges after the ICO, however, as you may be able to get onboard this great idea at a better future entry.

AUTHOR: Khuongcute2503

Website: https://www.brickblock.io/index.html

Twitter: https://twitter.com/brickblock_io

My profile:

Bitcointalk Link: https://bitcointalk.org/index.php?action=profile;u=2080664

Bitcointalk Username: Khuongcute2503

Twitter: https://twitter.com/rinhill123

Hello! Good article! I'm interested in the them of ICO and crypto-currency, I'll subscribe to your channel. I hope you will also like my content and reviews of the most profitable bounties and ICO, subscribe to me @toni.crypto

There will be a lot of interesting!

ok