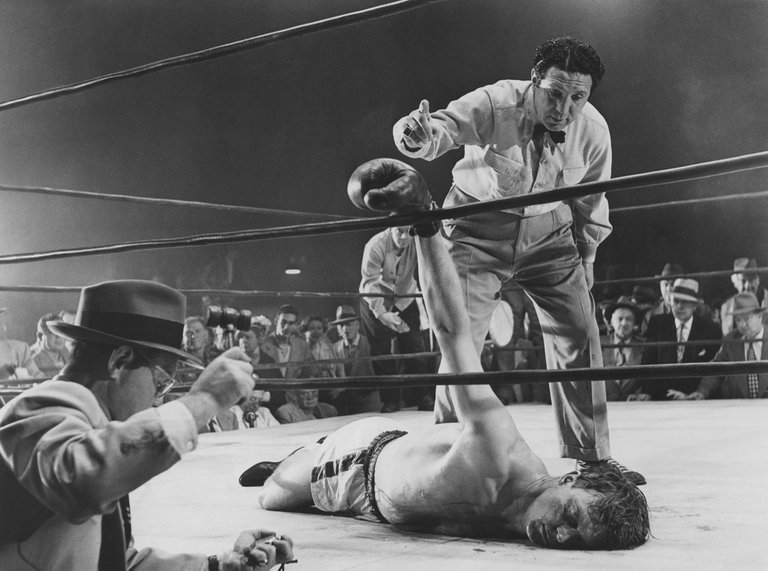

As legend has it, prize fighter Jake Lamotta returns to his corner at the end of round four of one of his early boxing matches with blood all over and his face was a mess. Trying his best, his trainer tells Jake, you’re doing great kid, they haven’t laid a glove on you. To which Lamotta replies, well you better keep an eye on the referee because somebody is beating the crap out of me.

Lately, those of us who have a passion for the world of cryptocurrencies are feeling that somebody is beating the crap out of us. Trouble is, it is hard to figure out why. Just as we are about to land a punch with the SEC declaring that bitcoin and Ethereum are not securities, ditto that for ICOs that do not convey an equity interest in the issuer, whamo prices drop to 2018 lows.

The Other Side Of The Coin

We read of the recent hack of a tiny South Korean crypto exchange and pundits blame this for helping to push prices lower. However, the market seemed to completely ignore this week’s progress in the Mt. Gox litigation. There is actually a decent prospect that investors that held $450 million in bitcoin at 2014 prices will be compensated in nitcoin. If my arithmetic is working right, this is good news considering the 2014 Blbitcoin price was less than $2.00.

Institutionalizing Crypto

While most eyes last week were fixated on falling prices, exchange giant Coinbase let it be known that it was preparing a crypto custody service. This may appear as a boring administrative step but that is hardly the case. This move is being heralded as the final step in opening crypto to institutional buyers.

Before Coinbase’s solution the problem has been that, despite the highly secure nature of bitcoin and other cryptocurrencies, the wallets where they are stored are a regular target for hackers.

For investors, making cryptos more accessible to institutional investors is every bit as important as adding retail merchants that accept crypto for goods and services.

Finding Crypto Support From Unexpected Places

Last Friday various media outlets point out how The U.S. Supreme Court mentioned bitcoin and cryptocurrency while issuing a ruling on a seemingly unrelated case. Here is what the U.S. Supreme Court had to say on June 21st in the case of Wisconsin Central LTD v. United States:

“What we view as money has changed over time. Cowrie shells once were such a medium but no longer are, our currency originally included gold coins and bullion, but, after 1934, gold could not be used as a medium of exchange, perhaps one day employees will be paid in Bitcoin or some other type of cryptocurrency.”

In spite of the current oversupply of naysayers, the legacy of crypto is increasing daily. Now even the Federal Reserve Bank of St. Louis is collecting and publishing prices of bitcoin, bitcoin cash, Ethereum and Litecoin. A year ago at this time, such a notion would have been absurd.

Suspension Of Efficient Market Thinking

For those who have been kind to follow these ramblings know that I am a big believer in the theory of efficient markets. The key to this theory is that people have all the available information about a particular investment asset and act upon is rationally. Of course, this is not to say that everybody reads the information in the same way. That is what makes for buyers and sellers.

Lately, there has been a complete suspension of an efficient market for crypto. All coins and tokens have been dumped without regard for fundamentally positive events, some of which we mentioned above. Since the vast majority of crypto is owned by individuals, the wisdom of the crowd (or in this case mob) psychology prevails. The last time this was the case it was bitcoin alone that lost some 80% of it’s value starting late in 2013. But that took more than a year to play out. Since the infamous $19,000+ peak, bitcoin has lost 68% so history is getting close to repeating itself.

It may also be a sign that a bottom in prices may be getting closer. The values are clearly there to be had. Now if only those of us who have a longer term view can find other who share a similar view.