ecently, it has become much less profitable for newcomers to hand over their business cards. No matter how many copies of his printed business card are missing, he meets people without visiting them at all. Of course, it is not just the end of the term.

It's not even a business card. It is because it is sufficient to send my digital card, which has been stored by e-mail, e-mail, and instant messaging. You can store your contacts in this letter or email, so you can say, " Good and good. "

Of course, the printers won't be fine at all. Still, the majority of them carry their printed business cards full of pocket cards. Exchange civilities and exchange business cards Most of the business cards given to others will be discarded through the process of contact. Maybe it is just abandonment.

Why do you still exchange business cards?

Why can't we end this inefficient act? Why is it possible to send a business card to a clearer and more efficient way of acquiring a digital card with a hand-held device?

There is no explanation for the repetition and habit of repeating behaviors that come from the past. Also, if you ignore the process and process the process later, it is the most obvious and convenient way to communicate and finish. Maybe it's similar why we still exchange cash.

In fact, the fate is more precarious than the business card. It seems that the future of the coins is more volatile than the printers of the Chungmu-ro. According to figures a few years ago, the cash we spend is only 3 to 5 percent of the total amount. Most of the money is already digitalized and exists only in numbers and numbers on books. Job managers, such as " payroll logs, " and " logged out to the credit card company, " are not just joking.

And now the remaining cash is doomed to disappear into the coffers of the collectors ' collectors ' collections of collectors ' collectors and criminals. In fact, the development of technology has long ceased to require cash use. However, due to the sheer convenience of habit and immediate convenience, the total waste was delayed.

Q : What is the development of technology that renders cash unavailable? The key point is that the financial regulator, such as the Internet, allows financial institutions to immediately reflect and seal the agreement or agreement on transactions by the financial regulator.

Initially, money transactions were the key to payment of payments and payment details. In other words, it was not the first time that cash and money were exchanged. If the transaction details of the agreement were recorded accurately in the records, there was no reason to use cash to carry out the risk of theft, damage and loss.

The existence of cash, ranging from shell shells to notes on paper bills, has been based on technical limitations that are difficult to trust in the field of exchange. As soon as it is difficult to fill the books immediately, it is only a matter of time before they can get rid of the transaction, and it is not as though it is more fundamental than usual.

Reasons for Cash Abscondence

Through the era of the Internet, the digital chemistry of financial institutions was completed. And as the mobile wave entered the mobile revolution, traders had one of the devices connected to the network. The desperate reason for the loss of cash is disappearing, and now it is time to leave the account in the book, which is now managed by financial institutions, without paying cash to cash in.

Namely, the development of the transaction cost has resulted in the exchange of transactions, exchanges of agreed data, and the exchange of agreed data on transactions. So, what role chain and block chain based on this nature will play in the process of returning to this nature?

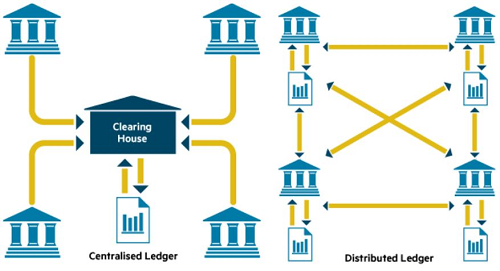

Comparison of centralized transaction records (left) vs. block chain transaction records

Comparison of centralized transaction records (left) vs. block chain transaction records

The " Block Chain " is defined as a distributed book technology, which is now gaining popularity regardless of BitTon's underlying technology, such as bigging coins. In short, data about transactions between the parties, which are the essence of transactions discussed above, are distributed discriminately without the intermediaries of financial institutions, without redundancy and redundancy.

The transaction parties carry out transactions with each other, and the transaction details are automatically entered by the public as they are automatically entered by the network, and the transaction details are confirmed by the public.

Individually, the transaction details of transactions without cash can be confirmed immediately, but it is now the core of innovation that can easily be done on the Internet without intermediaries such as intermediaries. Cash and brokerage agencies, and the elimination of these two factors deteriorate a significant reduction in the cost of transactions.

Only the boundaries of the nation's financial institutions, which have the confidence of financial institutions, will surpass the boundaries of the nation. Without cash, non-blocking society, instead of eliminating cash, instead of eliminating cash, the non-partisan risk of managing financial institutions will be relegated to the anti-participation risks. On the other hand, a cable-free society that adds up to a block of cash makes it clear that it is truly possible to make transactions between the parties, which eliminate both cost factors.

Transform new ways of dealing with new methods

Block chains and virtual currency are not content to reduce the cost of reducing costs. This guarantees real innovation in making transactions that could not be done in traditional ways. It is a matter of microfilament payments.

The settlement between the two countries was impossible to cash in. The transaction is basically the most expensive, but the problem is that the transaction itself has become much larger than the boat, resulting in a huge amount of money.

For example, there is no way for Southeast Asian fans to pay 50 won and 100 won for K-pop fans. Furthermore, the smart platform, consumers ’ bank account agreement as deoriu that micropayments are possible for this has to work with international. Since last year, the Spanish Santander Bank has been doing this experiment on this planet.

Without cash, a society without cash will develop into a financial transaction without human intervention. Not only cash and brokerage agencies, but also humans, who are subject to payment. Machine to Machine Baching. Convergence of M2M, artificial intelligence, and autonomous driving technologies result in the emergence of M2M financial transactions.

This will inevitably lead to losses, and the existing methods of managing the books will also be lost, as the agency will not be able to handle the book. The position of the block chain technology, particularly smart contract functions, will serve as a central function.

The absence of cash, which is currently being discussed, is only about removing change, keeping the underground economy alive, keeping the efficiency of the underground economy alive, but without cash, a cash-free society, a cash cow, and a person without a cash cow. One will only intervene to identify and agree to the basis of the underlying algorithms that are based on the basis of the transaction.

The newly minted coin, called " AppCoin, " or " Cryptopolis, " is expected to be more detailed in a more granular sphere and thus is expected to pull the tide in tighter divisions. For example, the ' eo geo ' and ' Gnosis ', issued above this platform, are both a platform and a platform for predicting the predictive market theory.

Coin, called ' Steam ', has the wrong idea of what content on the web is all about free, and the aim of correcting the first button of the wrong content industry. Already on the steam platform, many independent content producers receive a small amount of money from the world and collect millions of won per essay.

Although we believe that the new behavior creates new payments, in reality, the history of new payments has been established to enable new settlement techniques. Like block chains and virtual currency.

Let's talk about a more realistic version of the discussion, and let's talk more realistically. Currently, the Korean bank is experimenting with plastic cards such as T-Money. Thinking about the digital divide is a thoughtful approach.

Without a device like a smartphone, one can save money digitally, so we have no barriers to anyone. However, it remains to be feared that the card will lose money or damage to the card instead of cash.

Apart from the Bank of Korea's approach, the bold business development of various projects is also sprucing up a cash-free society. However, it is necessary to point out whether it is the best in terms of efficiency and convenience.

I would like to urge myself to think about the bundling of Block Chain technology right now if I consider myself to be a distant future of Korea, whether it is a Korean bank or a private business.

If the Scandinavian countries are willing to move beyond the cash, they will also need to move forward with the middleman attitude of eliminating the middleman, and eliminating the need to deal with the rapidly changing trading practices. Right now, there seems to be the most realistic answer to the block chain and virtual currency.

Good post. You Should check out my new article. Cheers!

https://steemit.com/artificialintelligence/@michaelbisbell/who-will-you-be-with-the-technological-revolution-has-concluded

Resteemed by @resteembot! Good Luck!

The resteem was payed by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.