Every trading platform offers access to a vast number of Forex indicators to use when trading. The MetaTrader4 platform, for instance, not only gives access to many trend indicators and oscillators, but traders can also import custom ones.

As always, when it comes to trading, the best Forex indicators are the ones that produce results. Many of these indicators exist for decades. Thus, they don’t show something new or unheard of so far.

By the time that traders open the platform for the first time, all indicators have the same, default settings. What it actually means is that all traders have the same start.

With indicators and settings the same, the difference is made by the traders. As human beings, each one of us differs and sees things from a different perspective. This is why the best trading indicators are the ones modified to suit a trader’s needs.

For instance, the RSI or Relative Strength Index exists since the late 1970s. The currency market was only on its incipient phases, but the RSI was useful enough for a technical trader to use when charting the stock market.

Since then, the indicator suffered no changes. To this day, the RSI’s formula remained the same, as it was calculated by J. Welles Wilder Jr. and presented in his book called “New Concepts in Technical Trading Systems.”

The same is valid for all famous technical indicators. Their formula remained the same, only now traders use them on new markets, like the currency one.

However, it doesn’t mean the technical indicators have no use. They do! But traders need to find and create their unique trading system based on the standard interpretation of such free Forex indicators.

Top Forex Indicators to Use in Technical Analysis

In this article, we want to present to you the most relevant Forex indicators to use in your analysis. For each indicator introduced here, we’ll show the standard interpretation but also a trading strategy derived from using the indicators.

In some cases, we’ll show a scalping strategy using indicators on lower timeframes, but we’ll also show what makes the best Forex indicator combination.

Trading with the Bollinger Bands Indicator

Listed as a trend indicator by most trading platforms, the Bollinger Bands indicator bears the name of its developer, John Bollinger. It uses three lines that follow the price:

- UBB – Upper Bollinger Band

- MBB – Middle Bollinger Band

- LBB – Lower Bollinger Band

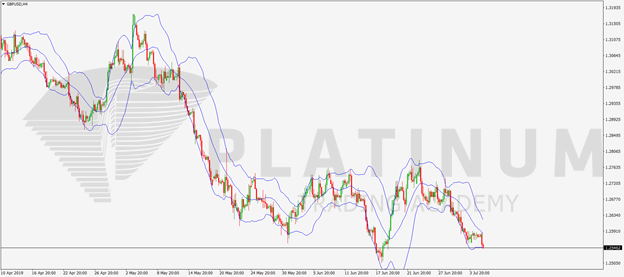

Here it is, applied to the recent GBPUSD 4h chart. The three lines are easy to identify.

An interesting thing about the Bollinger Bands indicator is that the price remains between the extreme bands over ninety percent of the time. It makes it easier to build trend trading strategies, making the Bollinger Bands one of the best scalping indicators if used on lower timeframes.

The default setting uses the twenty periods of the MBB. And, usually, the MBB is an SMA (Simple Moving Average).

However, some traders use an EMA (Exponential Moving Average) to take advantage of the fact that the EMA eliminates part of the lag between the price action and the actual moving average turning point.

Bollinger Bands – The Standard Interpretation

The standard interpretation of this indicator is to ride trends. This is why such Forex indicators are placed in the trend indicators category.

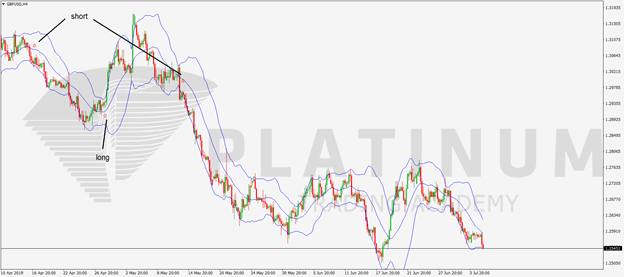

The idea is to sell short the pair when the price evolves between the LBB and MBB. And, to go long when it travels between MBB and UBB.

Here’s an example using the same GBPUSD 4h timeframe:

But this approach works only then trading conditions exist. However, used on lower timeframes, like the standard interpretation gives excellent results as a 5-minute scalping strategy or even a 1-minute scalping strategy.

Bollinger Bands as a Volatility Indicator

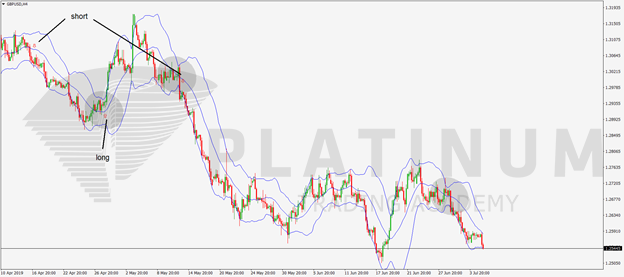

Another essential characteristic of the Bollinger Bands indicator offers clues about the emergence of new trends. Acting as a volatility indicator, the bands show when a breakout is about to start.

The thing to watch is the distance between the UBB and LBB. The wider the distance between the two, the greater the volatility. The narrower interval suggests low volatility levels, and the market prepares for a breakout.

The circles on the chart below show the three instances when the Bollinger Bands narrowed, suggesting an imminent break.

Used like a volatility indicator on the lower timeframes, the Bollinger Bands indicator setup provides a powerful 1 min scalping system.

Moving Averages – One of the Best Forex Indicators

Another trend indicator, the Moving Average is of multiple types. As a rule of thumb, all trend indicators appear attached to the actual chart, in comparison with oscillators that appear in a separate window, typically at the bottom of the main window.

A Moving Average or MA does exactly what the name suggests. It averages past prices and plots a new value on the chart.

Multiple types exist, the SMA we already mentioned, the EMA, the DMA (Displaced Moving Average). The only difference between multiple MA types is that the calculation formula changes.

One thing all MAs have in common is that they became flat, the more periods consider. The MA(200), considered the “mother of all MAs,” is the MA that uses the most periods, without the Moving Average indicator to lose its significance.

The Standard Interpretation when Trading with Moving Averages

Moving Averages are great indicators to ride trends. Basically, a Moving Average splits the screen into two parts: a bullish and a bearish part.

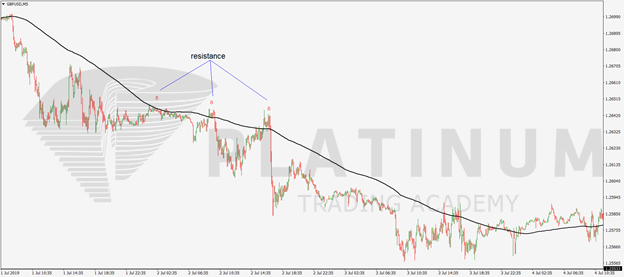

The standard interpretation says that the market is bullish while staying above the MA. Thus, any move into the MA is considered as reaching support.

Or, the market is bearish while trading below the MA. Any spike into the MA means the price reaches a possible resistance.

Obviously, the more periods the MA considers, the stronger the support and resistance are. Trading support and resistance levels with the MA is a profitable Forex scalping strategy if used on the one-minute, five-minute, and up to the hourly chart.

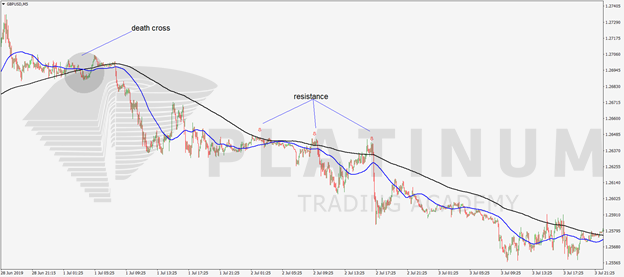

Golden and Death Crosses with Moving Averages

Another way to use Moving Averages as profitable Forex indicators is to combine two or more MAs on the same chart. The combination between the MA(200) and MA(50) and their crossing is closely watched as one of the best Forex scalping signals in technical analysis.

More precisely, when the faster MA crosses above, the slower one, it is said that the market forms a golden cross. This is bullish, and it is time to buy.

Conversely, when it moves below, the market forms a death cross. Traders interested in Forex scalping will look to sell the currency pair.

Relative Strength Index – One of the Best Forex Indicators for Scalping

So far, we’ve covered two important trend Forex indicators: the Bollinger Bands and the Moving Average. Time has come to consider the RSI, an oscillator, that often acts as the best scalping strategy indicator available to retail traders.

We already introduced the RSI at the start of this article. It has become the most popular oscillator for the retail trader and the trading professional alike.

The default setting of the RSI considers fourteen periods. This is how its developer intended to use it and, to this day, remains the best setup for the RSI.

It means that the oscillator interprets the last fourteen candlesticks on a candlesticks chart before plotting a new value on a separate window.

The RSI Standard Interpretation

The RSI is an oscillator that travels only in positive territory. With values moving from 0 to 100, it has an overbought and oversold area.

When the RSI exceeds 70, it means that it reached the overbought territory. Traders prepare to sell or go short.

On the other hand, moves below the 30 level mark an oversold area, and traders that scalp Forex prepares to go long or buy the currency pair.

Have a look at the chart below. It shows the EURGBP pair on the hourly timeframe having the RSI(14) attached to it. As it reaches overbought and oversold levels (above 70 and below 30), it is a great Forex scalping indicator.

However, such a simple Forex scalping strategy works with one condition only: that the market moves in a range. When trending conditions exist, the market may stay in overbought and oversold areas more than the trader remains solvent. Trading divergences with the RSI solves this problem.

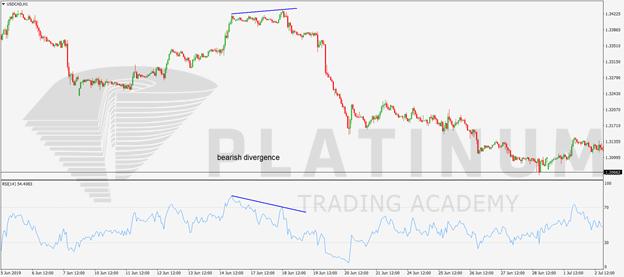

Trading Divergences with the RSI – An Easy Scalping Technique

A divergence appears when the price of a currency pair differs from what the oscillator shows. As a rule of thumb, a bullish divergence always forms in oversold territory. And, a bearish one appears in overbought territory.

Divergences work on all timeframes. And, the principles described here for divergence with the RSI work with all oscillators.

The best time frame for scalping Forex using RSI divergences is up to the hourly chart. A bigger time frame implies that the trader won’t scalp anymore, but most likely, the trading style changes to swing trading or even investing.

Because the RSI (and any other oscillator as a matter of fact) uses previous periods to plot a value, traders rely on the information provided more than on the actual price. That means that a divergence shows a discrepancy between the oscillator’s values and the actual price. The trader always stays with what the oscillator shows.

Bullish and Bearish Divergences with the RSI

Here’s an example of a bearish divergence between the price and the RSI. This is the EURGBP hourly timeframe.

Let’s walk through the setup together. First, the price makes a new high when compared with the previous high.

The RSI confirms the new high, as it stretches beyond the overbought level. During this trip, the RSI also makes a new higher high. Therefore, the two (price and oscillator) move in a correlated manner.

Next, the price continues higher. It makes a new higher high.

However, the RSI fails to make a new higher high. In fact, it prints a lower value, diverging from the bullish move the price made.

This is called a bearish divergence and traders go short by the time the RSI moves below the overbought level. The opposite happens when a bullish divergence forms: the price makes two lower lows, but the RSI doesn’t confirm the second one. By the time the RSI moves above the oversold level, traders go on the long side.

Conclusion

The Forex indicators presented here show how easy it is for traders to use them in various ways. Because each trader has a different tolerance level, as well as a different trading strategy to scalp Forex, the methods to interpret them may vary.

However, as mentioned at the beginning of this article, the best trading indicators are the ones that produce profitable setups. But a trading strategy is worth nothing without a proper money management system.

Money management helps the bottom line in the sense that it keeps the trader disciplined. And, more importantly, it builds confidence that no matter what happens, it was planned to happen.

This is, in fact, the beauty of trading with indicators. Technical analysis is the art of interpreting previous levels and forecasting them on the right side of the chart.

Because what’s on the left side of a chart is free information, the name of the trading game is to interpret the information and forecast future prices. Traders that manage to do that and combine a scalping strategy with money management have better chances to survive in the long run.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.platinumtradingacademy.com/best-forex-indicators/

Congratulations @platinumfx! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!