Most traders start out absorbing information from anywhere they can. This information will come in the form of stock picks, books, seminars, trading coaches, gurus, and blog posts like this one. Your personal beliefs, background and personality traits will then take that information and digest it and mould the base for your trading.

Next you will take all this new information into the markets. This can be exciting and a bit daunting at the same time. If you are lucky you will put on a few trades and things will go according to plan. The money will just flow. If you are unlucky, you will quickly realize why 90%+ of traders fail within the first few years of taking up the charge.

No matter how you start out you inevitably will face a loss that will hit you in the gut. This loss will resemble the first time a girl broke your heart, or the disbelief you had when you heard at school that the tooth fairy didn’t exist after your parents have been encouraging you to hide your teeth under your pillow for years.

You will feel a sense of utter disparity as your trading world unravels much quicker than the time you have spent to build it up.

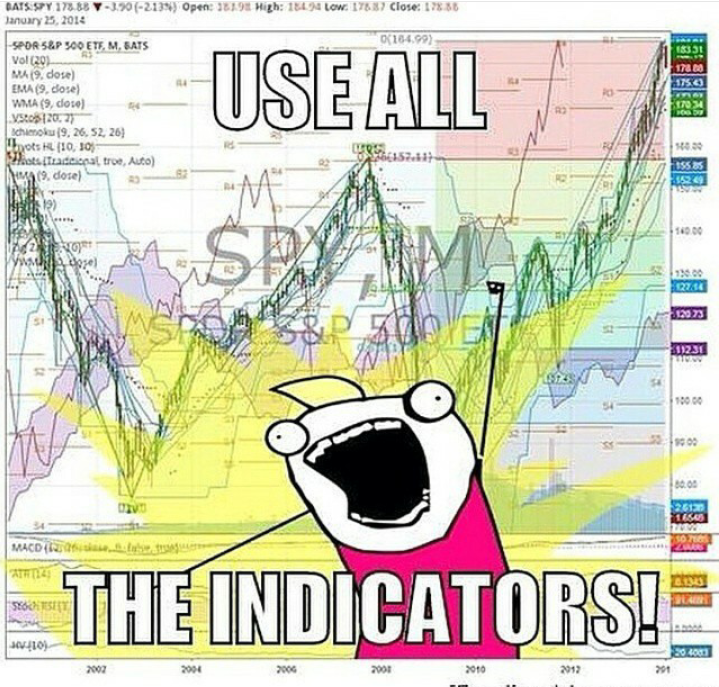

This is where a lot of traders, in an attempt to improve dump all their current knowledge of trading onto their charts and smother them with indicator upon indicator, believing this will somehow make their analysis more accurate, however the exact opposite happens, they become confused by their own charts, things have become cloudy and their charts lack clarity which then leads to more losses.

Indicators can be useful however it is important not to rely on them too much let alone overload your charts with them, I would suggest a maximum of four indicators on your charts however some would suggest even less than that, some may even suggest not using any indicators at all, however I do like to stress that you must find the style of trading that suits you, your personality and your lifestyle.