Hello fellow Steemians. Without further ado I present Part 3 of 'Coinjar experience from a novice', and this one will show you how you can easily use Coinjar to increase your purchasing power in a BTC bull market. There's no 'trick' to it, it's still 'buy low sell high', but Coinjar offers a way that's simple enough for novices to use, particularly with regard to liquidity between fiat currency and Bitcoin. Because their explanations aren't always the clearest, I thought I'd make this quick guide, using a real life example.

For those new to this concept, please refer to the first 2 blog posts in the series, here:

https://steemit.com/teamaustralia/@truthdoesntpay/coinjar-experience-from-a-novice-part-1-setting-up-account-and-coinjar-swipe

https://steemit.com/teamaustralia/@truthdoesntpay/coinjar-experience-from-a-novice-part-2-coinjar-swipe

How I went about obtaining a positive result using Coinjar is as follows:

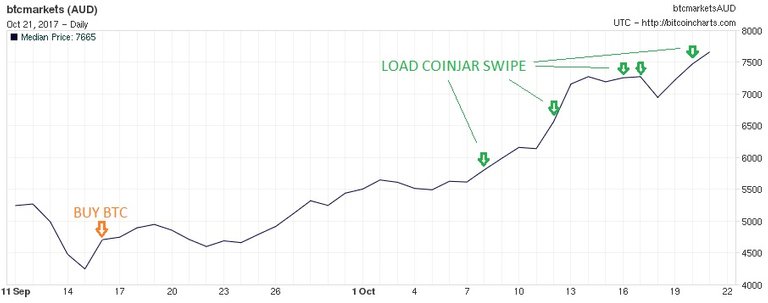

In mid September, when the price of Bitcoin was faltering (trading at around $4,900 AUD), I bought $1,000 AUD worth.

16/09/17:

BUY 0.20148334 BTC for $1,000 AUD + fees $20.92 AUD (2.09%) = COST BASE $1,020.92 AUD

Note that due to the fees, while I put in $1,000 AUD, I only received $979.08 worth of BTC.

In the following month, October, the price of Bitcoin started to rally. I loaded BTC onto my Coinjar Swipe card (thereby trading BTC for AUD at the time of transfer), in a number of transactions (see graph above).

Note that Coinjar tells you on their website that you can only load up to $999 AUD of value onto Coinjar Swipe in one go. I first thought this meant that you could keep loading more value onto the card, just as long as each individual addition was below $999 AUD. Not so. It means that you can only store an amount up to $999 AUD on the card at any one time. Hence why I loaded it numerous times (during this time I was also spending the value).

Also note that transaction fees are only charged on buying or selling BTC, NOT loading value onto your card, so if you want to add $100 AUD onto your card, that will be the amount you end up with.

8/10/17:

LOAD 0.10000000 BTC / $567.63 AUD onto card

12/10/17:

LOAD 0.06880985 BTC / $450.00 AUD onto card

15/10/17:

LOAD 0.01107928 BTC / $80.00 AUD onto card

16/10/17:

LOAD 0.01415347 BTC / 100.00 AUD onto card

20/10/17:

LOAD 0.00744074 BTC / $53.50 AUD onto card

Increased purchasing power, or return is summed up as follows: $567.63 + $450.00 + $80.00 + $100.00 + 53.50 = $1,251.13

Given that the cost base, calculated above, is $1,020.92, the return on investment (ROI) can be calculated as:

(($1,251.13 - $1,020.92) / $1,020.92) * 100 = 22.55% (earned in just over 1 month)

Great for buying groceries and fuel, or anywhere that accepts EFTPOS and you aren't buying high value items.

You can of course buy a greater amount of BTC, and keep loading the card up as you wish, as long as the card holds no more than $999 AUD at any one time. While useful, this limitation does unfortunately limit the potential to make a big gain on a day when the price of BTC peaks. Your other option would, of course, be to sell the BTC to Coinjar for AUD, although this would attract transaction fees.

Another method is to use Coinjar's hedge account (not sure about limits, but would certainly be higher than $999 AUD). You would do this by buying BTC low, then at a peak in value down the track, hedge the amount (against the value in AUD). One would do this if the value of BTC was expected to drop in the future, or as a way to forego potential future gains in exchange for the security of locking in the value as it stands at the time.

I hope this has helped somebody out there, feel free to share this link with your friends who might be still 'sitting on the fence' about getting into Bitcoin!

Congratulations @truthdoesntpay! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!