Let's learn what a 1989 bumper sticker can teach us about a possible downturn. The RBA yesterday left rates unchanged for the 12th consecutive month while July end figures show 820,000 Australian households are now in “mortgage stress”.

Good morning Steemit. Please find below my article written today for www.ainsliebullion.com.au. See this post for context. Content hosted at

https://www.ainsliebullion.com.au/BullionNews.aspx

The notable news feature since my last article was the RBA’s decision to keep rates at 1.5% yesterday following an 11% rise in the Australian currency this year.

Bloomberg’s Michael Heath penned an article with a title that sums up nicely the impact of the elevated AUD on the minds of the RBA board: “Aussie Dollar Turns Into a Villain for Central Bank”.

The RBA started its easing cycle nearly six years ago now in an attempt to mitigate the impact of the decline in the mining driven component of the economy and has continued this trend citing concern over the now ongoing issues of stagnant wage growth and headline inflation that now seems almost unarguably resistant to classical stimulation techniques.

Of course more recently the issue of the higher Australian Dollar has comprised another figurative thorn in the RBA’s side as we have been covering lately.

RBA governor Philip Lowe in his statement yesterday remarked that “the higher exchange rate is expected to contribute to subdued price pressures in the economy” and further noted that “it is also weighing on the outlook for output and employment. An appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast.”

Interesting too was the collective yawn from the trading community evident in the almost unchanged AUD price, sitting above 80c before and after the announcement but since retreating to 0.79661 as pictured below. Note that times are in UTC and hence 10 hours behind local.

Indeed interest rate settings are arguably becoming an ineffective tool for the control of currency strength; a point well illustrated by the following Bloomberg comparison of cash rates versus the AUD over the past 3 years.

In the eternal search for inflation, Philip Lowe said that “the board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.” Traders are currently pricing in a 50 percent chance of a rate increase in July.

In bringing these articles to you, we attempt to go a little beyond the sound bites and to do so today we explore the problem plaguing not only the RBA but the Australian population in general; the impact of low rates on property.

While a stimulative rate setting tends to entice construction and consequentially the hiring of labour, it simultaneously tends to entice speculative purchasing due partly to the tax benefits currently available.

While this is a large topic and one well beyond the scope of this article, it is reasonable to say that the Sydney and Melbourne housing markets have displayed bubble characteristics in recent years. In fact according to Bloomberg, July property prices in Melbourne and Sydney rose 3.1% and 1.4% respectively despite moves by regulators to strengthen lending standards and depress demand for interest-only loans.

The result?

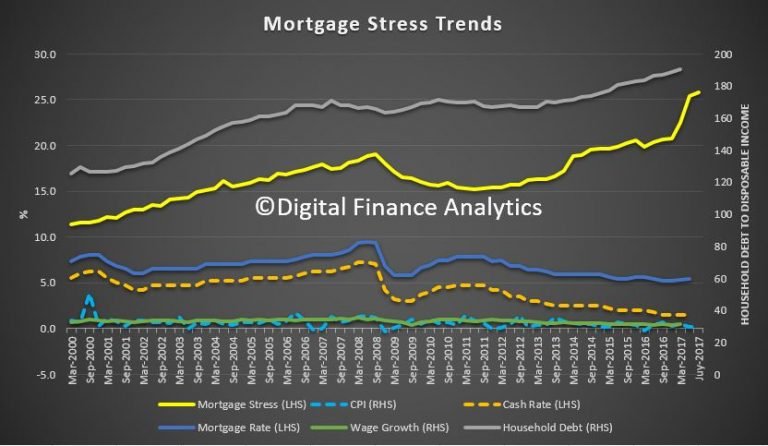

According to Digital Finance Analytics research to the end of July 2017, greater than 820,000 households are now considered to be in mortgage stress. This figure represents a staggering 25.8% of households and an increase of 0.4% from last month’s figure. Furthermore, Martin North in the Digital Finance Analytics Blog goes on to state that “we also estimate that nearly 53,000 households risk default in the next 12 months”.

This trend is pictured below courtesy of Digital Finance Analytics. Observe in particular the combination of increasing debt illustrated (ironically) by the silver line and stagnant wage growth illustrated by the green line.

Martin continues by saying that “the number under pressure have been rising each month. The RBA cash rate cuts have provided some relief, especially directly after the GFC, but now mortgage rates appear to be more disconnected from the cash rate as banks seek to rebuild their margins. The main drivers of stress are rising mortgage rates and living costs whilst real incomes continue to fall and underemployment is on the rise. This is a deadly combination and is touching households across the country.”

It is certainly counter intuitive to observe elevated levels of mortgage stress in an environment of record low interest rates; something we’ve discussed at the start of last month. As always we recommend a balanced approach to investing which is a topic that will be addressed at the NUU Understanding Money Conference scheduled for Saturday 26th August.

Today we conclude by borrowing a comment posted yesterday by Macro Business contributor David Collyer in relation to the broader topic of mortgage stress:

“Please, for you own sake, diversify. Even modest steps can significantly alter your risk profile. In the 1989 downturn, a bumper sticker said: ‘I am not participating in this recession.’ Choose now to be among those not participating in the coming severe downturn. Create these options for yourself.”

I went to Ainsliebullion last week and bought 40 oz's of silver, and I want to get more. But back to the topic. Remember its the central banks that manipulate the market. As the US stock market is a bubble, it seems lately the FED Reserve has gone from a hawkish view to a dovish view. And now the Australian dollar has gone up. It seems they don't want to be the ones that started the world depression again, so they are trying to pop the Australian housing bubble. So they can blame Australia instead of trump as everything is falling apart over there since the collapse of the democrat governed state of Illinois.

And it's not just here. Some of the Canadian cities are also at nosebleed levels and the insanity in Silicon Valley is, well, insane!

I suspect Trump will be on the receiving end of the blame too. He's a convenient fall-guy.

NOM

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by nolnocluap from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.