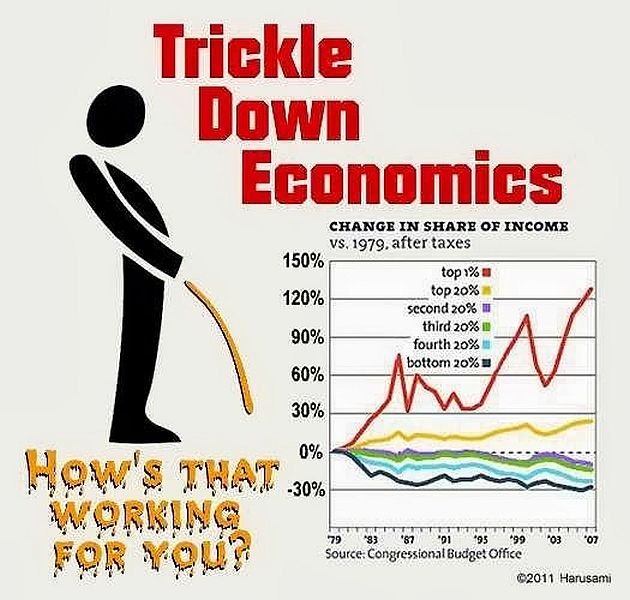

With the US passing some sweeping tax reforms, and us Aussies trying to get some Corporate Tax cuts passed, the realistic outcomes all just seem like a big fancy dream.

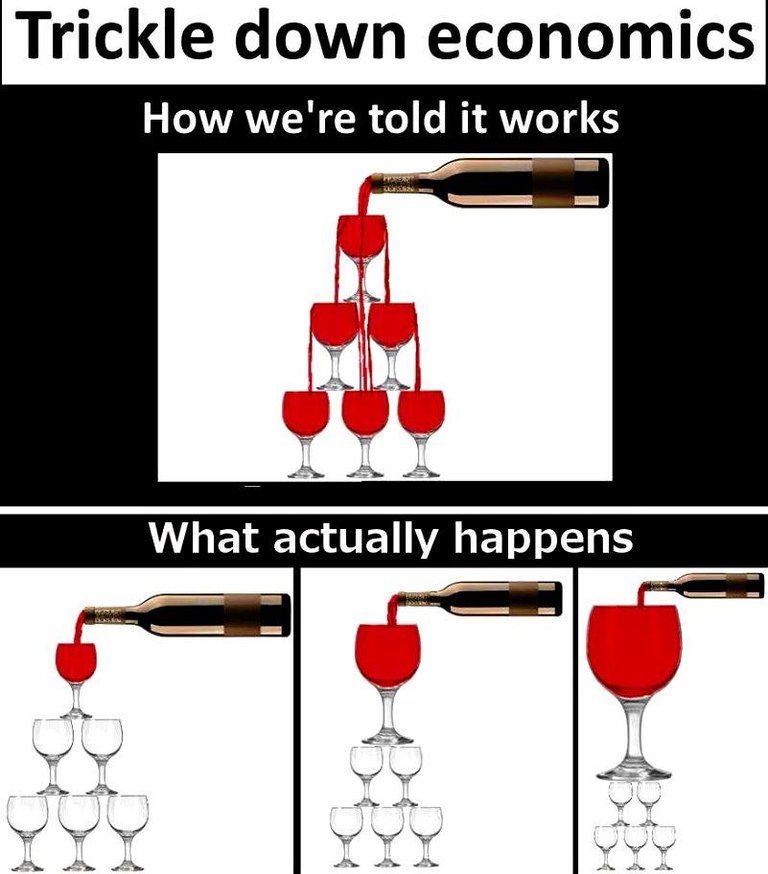

So the idea is, that we cut tax that big business has to pay and they will in turn increase investment. This increased investment leads to economic growth. We should note, that payrises are actually an investment by the company.

But is this actually going to happen? Of course not, the problem with big business is that it has shareholders and investors who want their cut. Then there is the new machinery and R&D work, then lastly comes employee investment. But by then its not worth anything so the companies dont bother.

The best system to equalise the tax system and make it fairer for everyone is to move away from an effort based system where you are penalised for putting in additional effort, and move to a consumption based tax system.

How would this work you may ask? Well its pretty simple, earnings are taxed at a greatly reduced rate, lets just say 15% across the board. If you work overtime, or study hard and get a new job you're not penalised for putting in the extra effort.

But at the same time, the GST moves up to a higher rate, lets just say 15% again. So now, you're only paying tax really on the money you spend. This gives the citizens the option on how much tax they want to pay. It also gives the citizens much more disposable cash to purchase more items, thus paying more tax.

So instead of big business tax cuts hoping for trickle down economy, governments need to look at base income tax cuts and work from the bottom up. The more money in my pocket, the more likely that I'm going to go to that local business and buy that doo-dad both giving more growth to that business plus paying more GST.

All images sourced from Google Images

it true it doesnt trickle down , the rich get richer and the poor gets poorer, the rest is just falacy

The picture you posted with your article sums up the whole situation. It is even worst here in the third world countries where finding a job is like flying in a space rocket.

Nah, the market forces of demand and supply for services (wages) in a growing free market, with low taxes and regulation, never lifted hundreds of millions out of poverty.

Everybody with a brain knows this.Reagan started this BS almost 40 years ago and during these years the middle-class just kept declining,yet morons still believe in this .Mostly because of the media successfully brainwashed a big chunk of the population.

Hey at least you have a glass!

A lot of older people i talk to say there use to be a middle class.... now there is just 2 classes :(

I wish they took a bottom up approach more often, makes you wonder if they have some different goals.

thank you for up vote me.

I thought this theory was long since discredited. I'm always surprised that every few years it pops up again under a different name. In general, it makes some sense (as much as any economic theory). However, in practice, economic systems aren't that simple, cause and effect are tangled, diluted and just plain non linear....

As far as I understand, in Australia, profits have been rising and wages have been stagnant. The company tax cuts are supposed to fix that? Well, it has already been shown that cutting tax doesn't lead to increased wages.

If I was in charge (I'm not, so this only guessing)

To be honest, if you have been undervaluing your workers up to this point, I really don't think increasing their wage now will change their view of your company!

Taxing that way would certainly make more sense. However, that would equalise the population. Have you heard the theory that having a bigger divide makes for an easier to control population, the poor part of which demands more taxes be paid by the bigger earners? It makes you think, especially as the government throws enough money around to end all poverty in the country.

Trickle down economics is just a pile of horse shit that rich people tried to sell to poor people so they can make themselves richer and the poor poorer.

You said "the problem with big business is that it has shareholders and investors who want their cut. Then there is the new machinery and R&D work."

Can you clarify what the shareholders and investors then do with their cut? Likewise, can you also explain who builds the new machinery and performs the R&D work and how they are compensated and what they then do with that money?