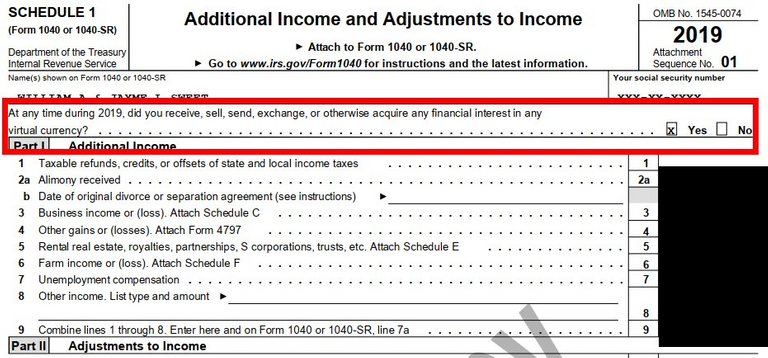

On the new 2019 tax forms the IRS specifically asks if you have crypto with the following question:

At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in virtual currency?

Never before has the IRS directly asked this question and it now creates a legal document where you directly have to confirm if you have or don't have crypto. This will likely give the IRS more power to prosecute those who deny having crypto much less fail to report.

It is well known the IRS is aggressively pursuing technology to track crypto transactions and identify owners.

Earlier in 2019 the IRS sent over 10,000 letters educating tax payers on their responsibility to report crypto gains.

The IRS has an official documentation on cryptocurrency document available online.

Image Sources: 1

I'm no tax lawyer, but I'd argue Steem Power is a crypto asset, rather than a crypto currency.

Steem Power can be interpreted both ways as technically steem power is vests and vests are not tradable or sellable. In fact, they are not a token at all. Steem power doesn’t exist, it is just a human readable symbol for vests.

If its not liquid, how can it be a currency? I've yet to hear any advice/guidance on crypto-assets.

I don't accept taxes. I haven't even filed in 20 years regardless of who owed who.

Geesh, I can't believe they haven't contacted you yet.

Maybe he doesn't have a permanent address. Being constantly on the move and going from state to state might explain it.

I do live in a school bus but I have several mailing addresses.

Even if they do I won't pay them. I don't accept their contract. It's illegal IMO.

If you don't earn above a certain threshold you don't have to file.

They can't content themselves to stealing Federal Reserve Notes alone. Bastards.

Does it matter?

People exchange their crypto into those federal reserve notes anyways.

This doesn't ask that, though, even if that mattered.

I'm saying, they aren't stealing crypto.

They want your notes equivalent of crypto. Minus a few states that actually accept crypto directly for tax purposes.

Bittrex now prompts US customers for their SSN, and has a Jan 14th compliance date.

If you never agree to follow their rules they have no more authority to tell you what to do than i do.

You and me can't vote ourselves power over others, legitimately.

Ask them to prove that you voluntarily, knowing full well the ramifications, agreed to follow their rules.

(A prerequisite to a valid contract.)

And then there is this:

https://www.thelawthatneverwas.com/

Steem rewards would presumably be considered income valued at the price of the coins on the day in which the rewards were paid out.

What is interesting, is that in comparison to the values of everything else, the crypto market is absolutely tiny.

But of course... there is no future in crypto. Crypto is Ded. It will never be mass adopted.

Uncle Sam doesn't like it when people owe him money. No matter how small.

He'll find a way to make it into a bigger problem.

Yes, by inflating the value the best he can

I'm happy that the Netherlands has an easy tax rule for crypto. Just a percentage on the total at the end of the year, like any other asset. None of this crazy capital gains on every single transaction...

Austria is even better, you don't pay taxes at all if you hold crypto for more than a year :)

Holy moly! That is really great!

I am so jealous. It's a disaster in the US.

I hear it... It would be an absolute nightmare to do it for each transaction, and then with which accounting system? Have they even given definitive guidance yet?

How does that work?

You declare your holding in euro's at the change of financial year, then you are liable for 1.2% or something like that. Just like other assets like property.

So, capital gains tax does not apply to crypto at all? Instead, you pay a percentage of the total in euros at the end of the tax year. Interesting. Could be tricky because if the value of your holdings peaks at the end of the year, you have to sell immediately because you might end up owing more than you have. I prefer capital gains tax.

Steem is earned income.

No capital gains, which means a single once per year accounting rather than the continuous tracking of capital gains on every single buy/sell transaction with no clear idea of which method of tracking (FIFO or otherwise...) is actually correct.

Yes, the price could peak just before the 1st of January, but even if it peaked across the board by 10% then that would make for 1.21% of holdings... Then if it crashed afterwards, it would still not be than much different. To make it to roughly 2% of original holdings, you would need to peak by around 66% and then crash immediately after accounting by around 40%...that's not really likely from size and timing (and that is only to make it 2% from 1.2%!).

On the other if it parked across the board by 10 million percent then immediately crashed by a similar or greater amount, then it would be noticeable.

However, I much prefer the simplicity of a single accounting point compared to potentially millions in a year!

Well, here where I live people are completely uneducated regarding crypto. Thankfully so is our government...yet. Complete ignorance

Of the 90 or so people I've asked that question to so far this year, 2 have said yes.

Interesting times.

P.S. Keep your crypto corporate

is it too late or should I move everything under my company moving forward? I tease it out on taxes but I verified on bittrex as a human not a company....

The key would be getting corporate accounts on exchanges if you are going to use them.

Even if a taxpayer bought and didn't sell, the box is still required to be checked YES!

Technically if a taxpayer made no direct intentional transactions but involuntarily received a fork/airdrop, the box is still checked YES!

At least they acknowledge the existence of cryptocurrencies, but fail to name it correctly (virtual currency) 😂

I just dont cash out yet, so they don’t need to know about anything. When I do decide to cash out, it won’t be in a bank that is in the US. They aren’t getting their greedy hands on anything.

Let the fun begin! Need to make sure I mention this to my accountant.

They’ll have to pry my private keys from my cold, dead fingers.

Virtual Currency? Like the tokens they use for camgirls? Cuz my crypto ain't virtual. :P