How to pay tax on cryptocurrency assets in India

Investment in cryptocurrencies exchanged for real money

Investment in cryptocurrencies exchanged for real money

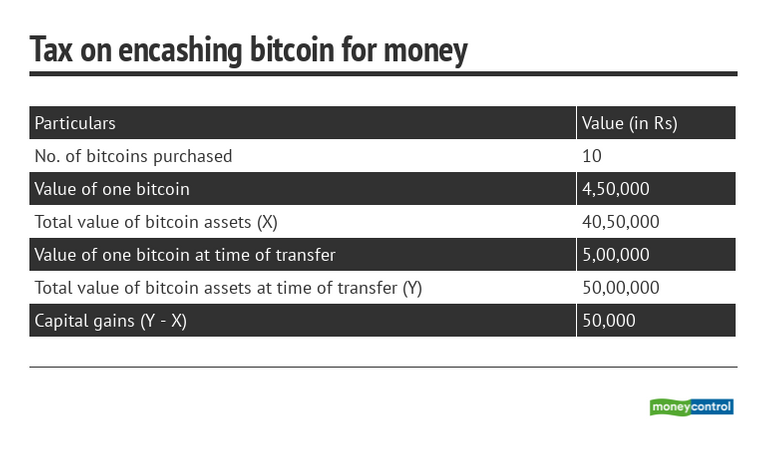

If money held in the form of cryptocurrencies is transferred in return for real money, the same rules applicable to income from capital assets, such as long term capital gains tax, will be applicable. Long term gains will be taxed at a flat rate of 20 percent, while those accrued over a shorter term will be taxed according to the slab.

For example, in the above case, the capital gained is Rs 50,000. If this was accumulated over the long-term, it will be taxed at 20 percent. The I-T department could make use of an ambiguity in the statute book to classify such transactions as “income from other sources” rather than as capital assets. This can be beneficial since income above Rs 10 lakh will be liable to be taxed at 30 percent, as opposed to the flat 20 percent for long-term capital assets.