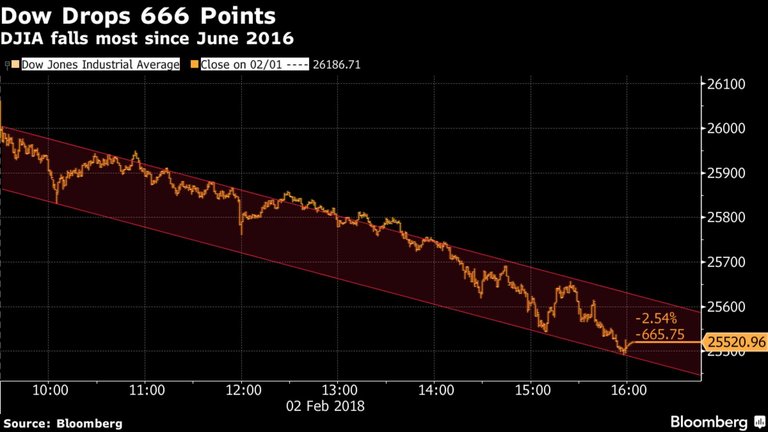

The market fell. And then it fell some more. Eventually the DOW dropped 666 points. The average investor simply didn’t think it was possible. But these are market forces at work. Sometimes there are corrections. It happens. Those who are investing with margin, were really punished in the incident today. Are you prepared for more volatility?

LOOK THROUGH MY BOOKS!: http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

BITCOIN: 1MbAUXsHa8XRFMHjGurd7L5nRDYJYMQQmq

ETHEREUM: 0xece0Dd6D0b4617A8D94cff634C64155bb1cD8C2C

LITECOIN: LWh6fji4WrJT7FAbFvFSZ9jVNCgVM3dHod

DASH: Xj9RXrvhXbaL3prMDvdzAxM8gDB2vDiZrh

MONERO:47q5qDPkDBLRadwcSXDsri3PNniYRYY1HYAhidXWAg8xXHFFZHFi7i9GwwmZN9J5CJd8exT4WARpg2asCzkuoTmd3dfcXr6

STEEMIT: https://steemit.com/@themoneygps

DTUBE:

T-SHIRTS: http://themoneygps.com/store

Sources Used in This Video:

https://goo.gl/UpprQe

1600x-1.png (1600×900)

Dow plummets 665 points, capping worst week in 2 years

https://www.cnbc.com/2018/02/02/us-futures-move-lower-as-investors-worry-about-rising-yields.html

Effective Federal Funds Rate | FRED | St. Louis Fed

https://fred.stlouisfed.org/series/FEDFUNDS

Dow Plunges 666 Points as Rate Angst Sinks Bonds: Markets Wrap - Bloomberg

https://www.bloomberg.com/news/articles/2018-02-01/asia-stocks-to-slide-as-tech-stumbles-bonds-drop-markets-wrap

1600x-1.png (1600×900)

![]()

2018-02-02_10-42-38.jpg (890×472)

2018-02-02_10-35-14.jpg (500×264)

▶️ DTube

▶️ IPFS

S & P should hit 2700 before a slight bounce. At least that is what the technical analysis says.

We'll see!

In your opinion, what kind of impact will interest rates have on the stock market?

Sir, I believe you are absolutely right. Companies are using free money form central banks to buy their own stocks and rise the price in the process. Once they run out of free money, there will be blood. And I mean it literally, I see millions of people in the streets protesting the governments, across USA and western Europe especially

It will have to happen unfortunately. All major cities will burn.

Central bankers make their policy according to prof. Knut Wicksell's theory about interest rate - for us it is "pump and dump" model od economy:

https://mises.org/library/value-capital-and-rent-0

Of course, interest rates will demolish the economy, but they are a lagging indicator. Interest rates are only going up in response to inflation and a weak dollar. Thus why gold usually does well during rising interest rate cycles. People are buying gold as a hedge against the dollar, interest rate rises are just playing catch up.

It seems that dollar and US treasuries are waiting to go up because of giant sell off:

Thank you for the chart.