Even though stocks and Bitcoin are a different form of asset and each of them has its advantages and disadvantages, they are similar in a few ways. A survey made in the United States towards Bitcoin has found a little over half of the sample either owned the digital currency or were considering an investment. And, of those polled most trusted the stock market more than Bitcoin, but not by a huge margin.

Capped at 2 000 responses from people from Alaska to Wyoming across the North-East of the United States (22.78%/457 respondees), the South (34.65%/695), West (21.04%, 416), Mid/West (21.54%/432), Toluna´s survey revealed that more than 57% trust the stock market as against almost 43% in Bitcoin. Most bulk of responses came from the states of California, New York, Florida, Pennsylvania, Texas, Illinois, and Michigan.

In response to the question: Which of the following technological advances are you familiar with? 44.87% (900) of the sample stated Bitcoin versus just over half 51.15% iPhoneX, 52.04% and 55.88% Smart Watches. Out of 900 responses to date, while 26.33% indicated that they own an amount of Bitcoin, almost a quarter of respondees 24.89% indicated that although they do not currently own any of the cryptocurrencies, they were thinking about investing. 42.33% revealed that they neither owned any Bitcoin and do not plan to purchase.

Although only slightly over a quarter of the sample cap responded to a question on which attributes they felt make the cryptocurrency an attractive investment, the fact that its digital 68.02%, second highest is digitality with 63.97%, third is anonymity with 56.26% and last ease of transfer/use with 42.2%. In a related question and as to attributes that those polled worries about when considering Bitcoin, the anonymous nature of the currency 45.56% and that it “can be easily deleted or somehow” 44.32% were the two top concerns.

This was followed closely by it not being regulated at 44.32% and a little further back by unclear taxes on just under a third 30.44% of those canvassed to the question from 519 responses. On the appetite for investment, of those answering a question on how much they would be willing to invest in Bitcoin, 42% responded by indicating $0 to $1 000, almost 21% with $1 001 to $5 000, 10.02% in the range of $10 001 to $50 000 and 8.29% indicating over $100 000.

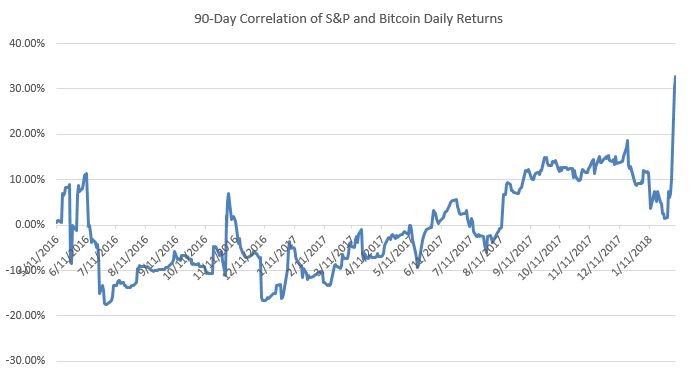

Bitcoin´s ties to the performance of American stocks appears to be increasing. On a 90-day basis, the correlation between the daily percent returns of the cryptocurrency and the S&P 500 is 33 percent, the highest since the cryptocurrency started gaining public attention in January 2016. Normally, the correlation is from 10% to -10% most of the time, but in early 2018 correlation jumped to 30%. From this it is clear, that it is only a temporary spike in a correlation and soon it will get back to normal.

sources:

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

yes, you are right.

https://steemit.com/mridang/@janinet/watch-mridang-2018-hdrip-full-hindi-movie-watch-online-free-download-hd-print