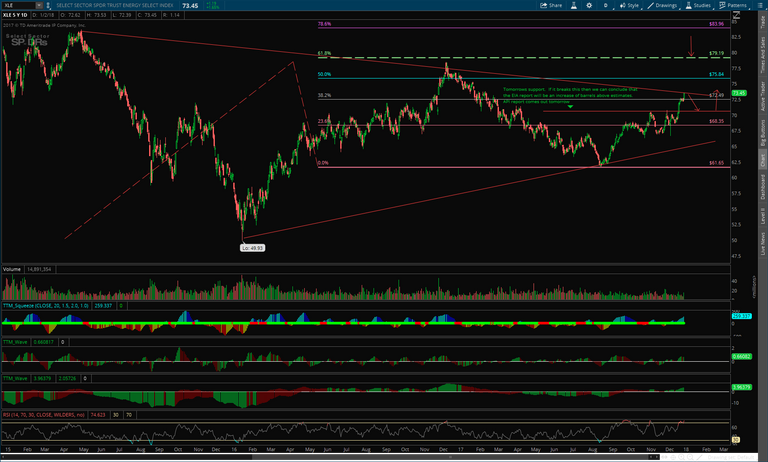

As you can see we have a neutral wedge set up on the Daily chart in the XLE. After a little fibonacci work we can see a nice green filled candle passing through the 38 coefficient. Which also happens to be the 78 coefficient using the begin point and the end point as the same point for the retracement. This shows that there is enough strength in the upward momentum to carry the price action above the 50 coefficient and into the golden number, the 618.

However, since the RSI is in an overbought condition, there needs to be a pull back to propel the Price Action higher. This is where the support line is drawn on the chart for tomorrow.

If Sector Spyders Energy ETF (XLE) breaks the line in the sand (or the red line on my chart) then we can conclude that the EIA report will have an increase in inventory.

Why would I believe that charts dictate the future you may ask, as opposed to fundamentals driving the price action? Well despite what everyone and anyone tells you... There is insider trading happening EVERY DAY. Someone always knows something and they have a tendency to spread the word. It's human nature. We all do it, Mark Twain has a quote about it...

"tis better to keep ones mouth closed and seem a fool, rather than open it to remove all doubt." Or something to that effect. I digress...

This is a more than likely scenario rather than gospel, but you'd be surprised how many times price action leads fundamentals, earnings or the news of certain tickers.

This is what I am watching tomorrow. For those that want a heads up before Thursday's EIA report, check this after 5PM tomorrow.

https://ca.investing.com/economic-calendar/api-weekly-crude-stock-656

Thusly I will be updating this with opening contracts either tomorrow at the close, or I may wait until the open on Thursday. I haven't decided yet. Either way when I open positions I'll post them here:) GL y'all happy trading!!!

I didn't take this trade. Another gift was dropped into my lap. Goes by the ticker IYR I will post the trade exit and my entry I make at the close of trading yesterday